Together with Public

Good morning,

A quick breakdown — in case you don’t have the time.

⭐ The S&P 500 is a wealth building machine over the long-term.

⭐ We discussed how to approach your financial fears in 2025.

⭐ The U.S. job market might be weaker than expected.

⭐ The U.S. budget deficit has reached unprecedented levels.

⭐ Project “Stargate” - a $500B AI infrastructure deal - boosted tech stocks.

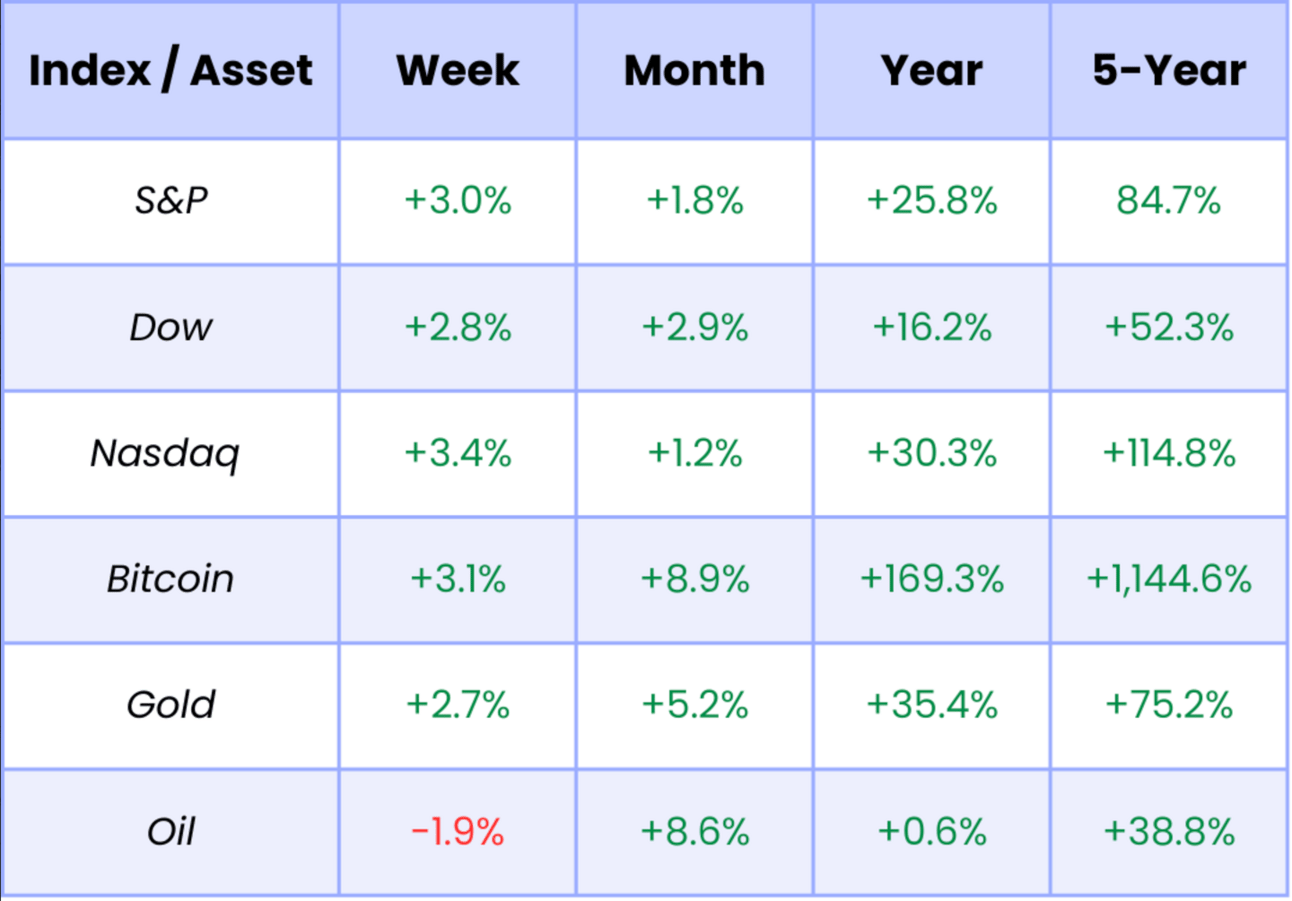

Market Overview

As of market open, 01/23/2025

Chart of the Week

The S&P 500 makes wealth-building inevitable over the long-term.

But that doesn’t mean it’s always “up and to the right.”

The incredible chart above illustrates the annual returns of the S&P 500 for the last 151 years. Here are a few observations for you to consider:

There are 3X more positive years than negative years.

There are 3X more years of 20%+ gains than 20%+ losses.

Macro bullish trends typically last longer than macro bearish trends.

We feel all of this is important to share because many of you have likely only been investing for a few years. Recently history has shown you: a massive Covid crash, an even bigger Covid bubble, a bear market in 2022, and an AI-driven frenzy.

No one could have predicted that, which is why dollar cost averaging is so important. There’s no way for you to know the future, but history tells us that participating in the stock market — over a long period of time — is a wise thing to do.

We remain bullish for now, even if we do believe that this market is due for some volatility in the near future. Instead of trying to time the “market top” — we instead look forward to adding our favorite, cash-flowing companies throughout a volatile 2025.

See the quotes below to help refine your investing mindset!

“Though tempting, trying to time the market is a loser’s game. $10,000 continuously invested in the market over the past 20 years grew to $63,636. If you missed just the best 30 days, your investment was reduced to $11,484”

“A -10% decline in the market is fairly common — it happens about once a year. Investors who realize this are less likely to sell in a panic, and more likely to remain invested, benefitting from the wealth building power of stocks.”

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.”

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform trusted by millions. On Public, you can build a multi-asset investment portfolio of stocks, options, bonds, crypto, and more.

You can even put your cash to work at an industry-leading 4.10% APY*.

Public is a US-based company and member of FINRA with an award-winning customer support team. Plus, only Public has Alpha, an AI-powered investment research assistant that can answer any question about any stock.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Robert and Austin shared their thoughts on the most common financial fears our podcast listeners face.

Here’s what they shared:

Struggling to Get Ahead with Money — Many people feel stuck, unable to save or invest because they’re living paycheck-to-paycheck. The solution starts with an honest budget audit to identify spending leaks, like “ankle biters” — small, frequent expenses (i.e. Uber Eats or impulsive Amazon purchases) that add up quickly. Cutting these can free up hundreds of dollars annually to invest and build wealth. Remember, it’s not just about how much you make — it’s about how much you keep.

Overcoming Analysis Paralysis — Fear of making the wrong move often leads people to do nothing at all. Investing is risky in the short term but nearly risk-free in the long term, especially with diversified index funds like the S&P 500. Start simply: contribute to a 401(k) up to the match, open a Roth IRA, and invest in ETFs like VOO or VTI. For those afraid of past losses, remember what we shared at the beginning of the newsletter… markets average 10% annual returns over time, unrealized losses aren’t actual losses, and no investor gets it right every time.

Addressing Retirement Fears — Calculating your future retirement savings can provide clarity and direction. By using a retirement calculator, you can project your “nest egg” based on current savings, contributions, and expected returns. If the numbers fall short of expectations, small adjustments — such as slightly increasing monthly contributions — can have a massive impact. For example, contributing $600/month instead of $500/month could grow an inflation-adjusted portfolio from $1M to $1.2M. Every little bit adds up. Here’s a great retirement calculator for you to try out!

By breaking each of these fears into actionable steps, you can take charge of your finances and feel confident about your financial future.

We want 2025 to be the year that you conquer your financial fears and become more at peace in your relationship with money!

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from: Sakura, Manuel R, Matt B, Anna S, JP, Brad K, Henry C, and Jimmy W.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

The U.S. job market might be weaker than advertised.

In November 2024, U.S. job openings surged by +259,000 to reach 8.1 million — the highest level since May. Coupled with October’s increase of +467,000, this marks a two-month jump of +726,000 — the largest gain since March 2022.

On the surface, this might suggest a booming job market.

However… hiring data is telling a different story. The number of hires fell to 5.3 million, bringing the hiring rate down to just 3.3%. This is the lowest level since the heart of the pandemic in 2020.

Additionally, the percentage of workers voluntarily quitting their jobs dropped to 1.9%, also the weakest rate since 2020 — a potential sign of declining confidence among employed workers.

Compounding the confusion, the survey response rate for the job openings data has plummeted to near-record lows at 33%. This raises the likelihood of significant data revisions in the future, further clouding the picture.

The reason we keep such a close eye on this economic data is because of the chart above — the average S&P 500 returns following the initiation of rate cuts by the Fed. Remember, the Fed initiated rate cuts just four months ago in September.

History tells us if we avoid an economic recession, returns this year could be well into the double-digits. If we fall into an economic recession, expect a double-digit contraction in the markets.

At the moment, we remain optimistic about the economy’s ability to dodge a recession in 2025 — but only time will tell!

P.S. Our Rich Habits Network subscribers saw this chart during our Tuesday livestream with them — if you like this type of info, consider joining! Click here.

Austin’s Callout

The U.S. budget deficit has reached unprecedented levels.

In Q4 alone, the federal government borrowed an astonishing $711 billion — a +39% increase compared to the same period last year! This marks the largest cumulative deficit ever recorded in the fourth quarter of any fiscal year.

To put this into perspective, the rapid pace of borrowing is not just a historical anomaly — but it also has us en route to having the worst yearly contribution to our federal budget deficit in history. Rising deficits are rapidly pushing the country into uncharted territory.

“We are spending like drunken sailors… Don’t forget pre-Covid — the federal government was 20% of GDP in spending. Now it’s 25% of GDP… My father told me ‘if you’re in a hole, stop digging Stan.’”

We are at a serious inflection point as the Trump Administration takes office. They are determined to cut government spending and drive down costs. However, they’re also optimistic about cutting taxes — decreasing the “revenue” of the U.S. government.

When government spending goes parabolic, inflation often comes as result — but that doesn’t mean that your equity positions are destined to go down. Going back to Robert’s commentary above, it means that economic data can fluctuate greatly — something that ultimately fuels volatility over anything else.

I highly recommend researching how to US Government inflated their way out of a massive deficit after World War Two.

The Rich Habits Radar

👉 Bitcoin hit ATH of $109K, fueled by optimism of President Trump’s new term.

👉 S&P 500 nears record highs as Trump begins his new term.

👉 Project “Stargate” - a $500B AI infrastructure deal - boosted tech stocks.

👉 Amazon invested $11B in AI cloud infrastructure and data centers.

👉 Tesla to produce 600 Optimus robots weekly by the end of 2025.

👉 Netflix hit record subscriber growth, adding +18.9M in Q4.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures:

*Rate as of 1/23/25. APY is variable and subject to change.

**Terms and Conditions apply.

Paid endorsement for Open to the Public Investing, Inc., member FINRA & SIPC. All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Public Investing offers a High-Yield Cash Account where funds from this account are automatically deposited into partner banks where they earn interest and are eligible for FDIC insurance; Public Investing is not a bank. Cryptocurrency trading services are offered by Bakkt Crypto Solutions, LLC (NMLS ID 1828849), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative, involves a high degree of risk, and has the potential for loss of the entire amount of an investment. Cryptocurrency holdings are not protected by the FDIC or SIPC.

Alpha is an AI research tool powered by GPT-4. Alpha is experimental and may generate inaccurate responses. Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. Public makes no warranties about its accuracy, completeness, quality, or timeliness of any Alpha out. Please independently evaluate and verify any such output for your own use case.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.