Together with Acorns

Good morning,

A quick breakdown — in case you just don’t have the time.

⭐ YouTube’s ad revenue compared to Amazon, Google, & Meta.

⭐ This week’s podcast episode will help you save thousands.

⭐ It’s been two years since the crypto market bottomed.

⭐ A quick breakdown of stock buybacks and blackout periods.

⭐ You can’t buy ZYN nicotine pouches online anymore.

⭐ Optimize your portfolio & get the best research w/ Seeking Alpha.

Market Overview

As of market close 6/18/2024

Chart of the Week

This one is simply a beauty — showing what the tech giants are able to rake in from advertising. If there’s one thing we’re taking away from it — it’s that Alphabet (Google + YouTube) has garnered nearly $214B of advertising revenue over the last 12 months. That’s insane!

When compared to the $140B that the Meta family of apps has done (Facebook, Facebook Messenger, Instagram, WhatsApp) — it shows the ridiculous amount of advertising power of Google.

Another cool callout is that Q4s seem to be consistently strong across the board. Let’s check back after the holiday season this year and see if these numbers trend higher over time!

Big Tech companies are addicted to growth. When they don’t grow, analysts and investors sound the alarms. We’ll see if they’re able to establish some more consistent “up and to the right” trends with these advertising metrics.

One things for certain — get used to seeing more and more ads…

As we turn the page to the summer months, we’ve partnered up with Acorns!

If you set up your account using the link below + pay your first subscription fee (which start at $3 / month) — you’ll get a $35 bonus!

More importantly, this $35 bonus can be used to kick-off building your base — allowing you to become financially free over time. With over 13 million customers and $20B invested, we’re thrilled to partner with Acorns to present this special offer to you all.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin touched on the following:

Capital Gains Taxes — these are the taxes you pay on your investment profits. Depending if you held the investment for less than or more than one year, you’ll owe short-term or long-term capital gains taxes. Short-term is taxes as ordinary income, whereas long-term is much more favorable.

Tax-Loss Harvesting — by selling our unprofitable investments, we’re able to utilize those losses to offset gains made elsewhere in our portfolio. You must wait 30 days before you can add the stock back to your portfolio and still claim it as a loss.

Direct Indexing — instead of buying shares of VOO, you’re buying the individual components of the S&P 500 (all 500 companies) in their market capitalization weighted fashion. This allows you to track the total performance of the index, just as owning VOO would.

Below is a screenshot of our $20,000 Rich Habits portfolio inside of Frec — putting our money where our mouth is! As you can see, by direct indexing the S&P 500 we’re up +2.5% while automatically having tax loss harvested $36.17.

Over time, that $36 will grow to $3,600 — offering us over $1,500 in savings on our taxes at a later date. This happens automatically and behind the scenes — we didn’t do anything beside deposit the funds.

This one was an absolute banger. Some of the best questions were about having a mountain of student loan debt, financial considerations with a significant other, and having a ton of one single stock.

This week’s Q&A episode (posted this morning) had questions from — Sophia G, Jerry, Daniel H, Yi H, Vihn T, Matt, and Mauv.

We prioritize questions via Instagram DMs — if you’re not yet following us, be sure to follow here! Thanks for keeping all of the great Qs rolling in!

Robert’s Callout

The cryptocurrency market bottomed two years ago.

Given the recent inaction of the cryptocurrency market (Bitcoin is the same price it was three months ago in March), it’s important to reflect upon where things were only two short years ago.

Despair was everywhere — FTX had just gone under, BlockFi was filing for bankruptcy, and Bitcoin was trading below $17,000 per coin. Some “experts” were calling for Bitcoin to crash to $0 entirely — but we know that would never happen.

Today, the price of Bitcoin is up +287% since the December 2022 lows and there’s a lot to be excited about — especially ETFs. This is your reminder that we like to always be dollar cost averaging into these types of investments as you never know what tomorrow might bring.

We could be the same price as we were three months ago, or up +20% in a week — prepare yourself! There’s a lot to be excited about over the coming 12-18 months.

Austin’s Callout

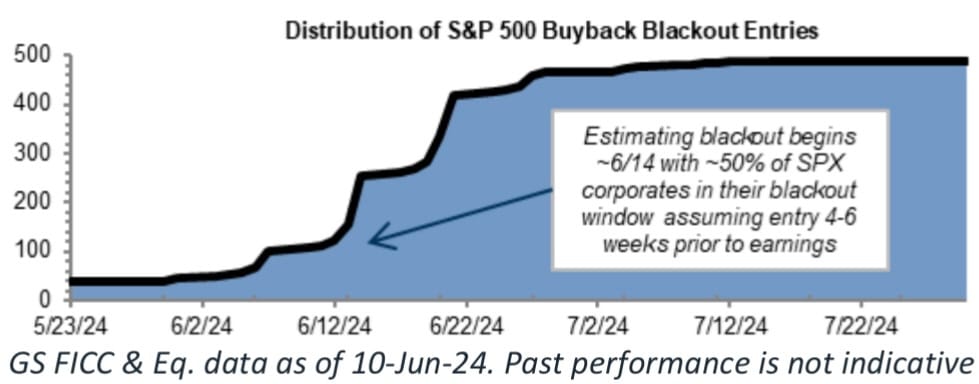

The buyback blackout period has begun.

As you all might know, once a company becomes extraordinarily large they begin allocating a portion of their profits toward buying back their own stock — artificially inflating their EPS (earnings per share).

Apple recently announced a $110 billion stock buyback program just the other week — the largest stock buyback authorization in history. However, these companies aren’t allowed to buyback their stock whenever they want — they must only do it during specific times of the year as not to “insider trade” their earnings data.

These “blackout” periods happen every 3-months, and we’re in one right now. Goldman Sachs estimates that the upcoming blackout period will run from June 14 through July 19. Companies enter their blackout periods 4-6 weeks ahead of earnings and exit blackout 1-2 days post earnings.

Historically, this has caused volatility in the markets as tens of billions of dollars that were previously used to “prop up” stock prices has suddenly disappeared. If we experience volatility, don’t panic! Keep calm and dollar cost average.

The Rich Habits Radar

👉 Nvidia became the most valuable company in the world this week.

👉 Warren Buffett’s Berkshire Hathaway upped its OXY stake to 29%.

👉 “Netflix Houses” were announced, with locations in PA & TX.

👉 Apple just ended its “buy now, pay later” offering.

👉 Philip Morris halted online sales of popular ZYN nicotine pouches.

👉 McDonald’s ended its AI drive-thru partnership with IBM.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to automatically tax-loss harvest

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.