Together with Public

Good morning,

A quick breakdown — in case you just don’t have the time.

⭐ This might be the most headline-filled couple of weeks in all of 2024.

⭐ We broke down how to go from “zero to one” when buying a business.

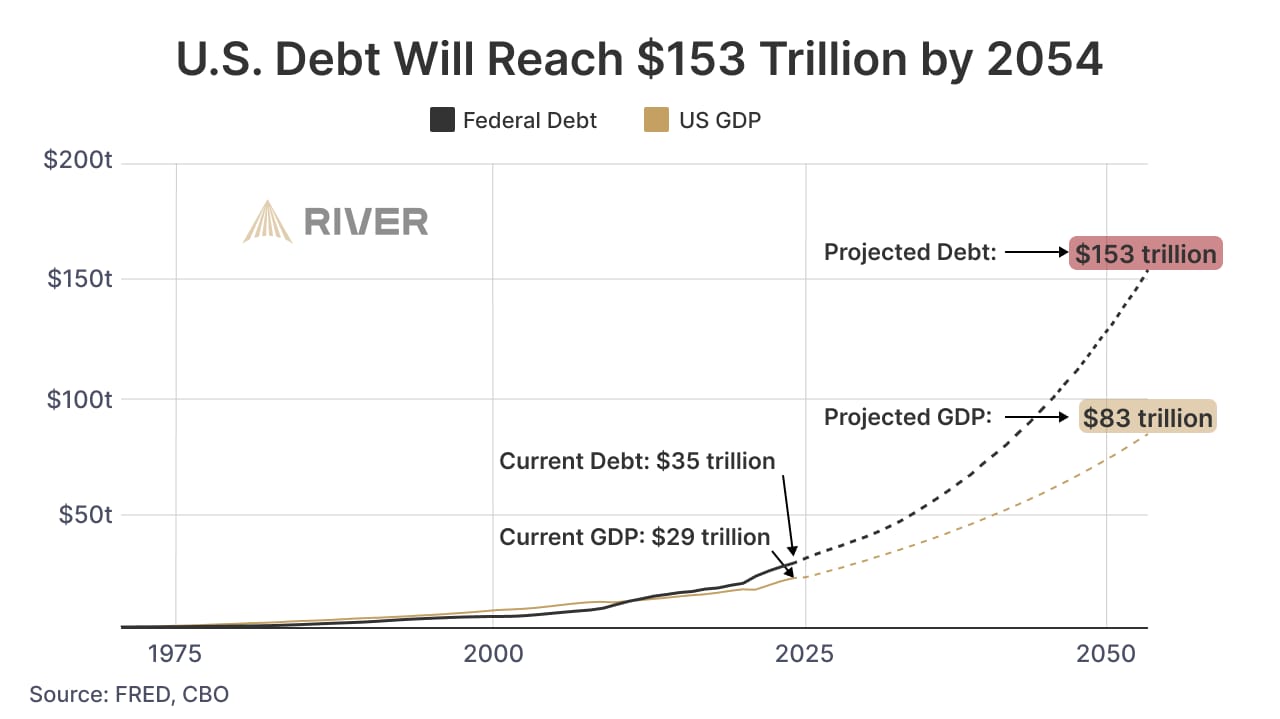

⭐ We’re on track for (at least) $153 trillion of national debt by 2054.

⭐ Stock market concentration has reached 50-year-highs.

⭐ Spirit Airlines soared +81% in five days after securing time to address debt.

Market Overview

As of market open, 10/24/2024

Chart of the Week

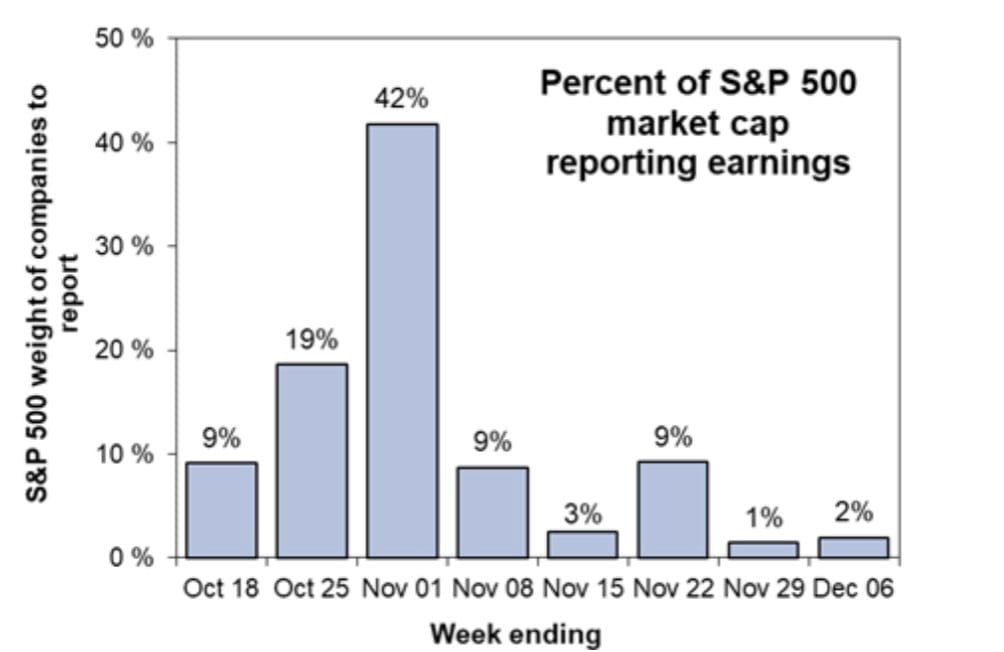

79% of the S&P 500 will have reported their Q3 earnings by November 8th.

Election Day is in less than two weeks, economic numbers are mixed, the Middle East is unstable, Russia & Ukraine continue to be a mess, China is becoming more threatening toward Taiwan, and on top of all of that…. 79% of S&P 500 companies are reporting earnings by November 8th.

Over the next few weeks, we’re going to find out how the majority of America’s largest companies are performing — as well as how that performance has been impacting their income statement.

As we head into the next few weeks, we want to remind you to keep calm and don’t have any knee-jerk reactions. As you begin to analyze the Q3 earnings reports of the companies inside of your portfolio, keep the following in mind…

Did their revenue grow year-over-year?

Did their operating income growth outpace their revenue growth?

Are their gross margins trending higher?

Did they report positive free cash flow? Is it growing year-over-year?

As a final reminder, don’t be afraid to sell a losing stock. If a company’s earnings are not trending higher and this is now the second or third quarter in a row of disappointing earnings — consider selling the stock!

If you’re someone looking to ride of the volatility with monthly income, don’t forget about the NEOS Investment ETFs! Austin just purchased $100K of SPYI the other week, and announced on Tuesday’s livestream that he’s re-allocating $50K of that to their newest ETF, BTCI.

The best way, in our opinions, to ride out unpredictable earnings volatility is to add predictable monthly income to your portfolio via the NEOS ETFs.

Together with Public

Public launches the Bond Account, offering a 6.79%* yield.

You may know Public as the all-in-one investing platform where you can build a multi-asset portfolio of stocks, options, bonds, and more. Now, Public has taken another step in making fixed-income investing more accessible with the launch of its Bond Account.

At a time when bond yields are at their highest levels in years, the Bond Account allows you to lock in a 6.79%* yield. In just a few clicks, you can now invest in a diversified portfolio of ten investment-grade and high-yield bonds that generate 20 interest payments annually.

With the Fed preparing for what many expect to be a series of rate cuts, the Bond Account offers a timely opportunity to lock in today’s historically high bond yields.

Lock in your 6.79% yield at Public.com/richhabits.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin discussed shared their four-step-process of finding and acquiring businesses.

Here’s what they walked everyone through:

Determining Your “Buy Box” — It’s important to narrow down what aligns well with both your passions and your skillset. You want to make sure that you have some familiarity with the industry, especially if you’re a first-time buyer. The last thing you want to do is buy a business you know nothing about.

How to Find Them — Loopnet, BizBuySell, and Crexi are some websites that Robert has used in the past to find small businesses. They can be thought of as “Facebook Marketplaces” for small businesses — just be wary of scams. There’s also nothing wrong with driving around your town, talking to nearby business owners, or looking at local websites.

Evaluating the Deal — Having correct information about the business is the most important part of this entire process. Once you are certain that all of the data is accurate — it’s critical to determine the business’ operating income. Review things like current / former employees, rent / mortgage payments, property taxes, equipment, and who’s making the after-tax money at the end of the day.

Negotiating the Price & Executing the Hand-Off — Understanding the situation of the seller will help with determining how hard you can negotiate. Is foreclosure involved? Are they moving cities? Did they have a change in their family dynamic? Start by figuring out the seller’s current state and timeline. Also knowing if there are other offers is helpful.

We’re really inspired by how many Rich Habits listeners are active in the small business world. We hope this episode is helpful to many of you — either now or in the future!

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from the following people: Jon B, Brandi S, Kiy S, Lesley K, Andrew G, and Jake B.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content.

Robert’s Callout

The Congressional Budget Office (CBO) is predicting $153 trillion of national debt by 2054.

This isn’t some meme chart — this is the unfortunate momentum the United States deficit has endured over the last several decades. Since 1970, the federal debt has grown 78X — outpacing economic growth by +300%.

Also keep in mind that these are merely projections from the Congressional Budget Office. They don’t include more wars, more pandemics, or any other things that could happen between now and then. When I see this graphic, I honestly believe the $153 trillion number to be a minimum approximation.

I sure hope that either party that gets in the White House or gets control of Congress actually tries to slow down this runaway train.

Are they going to though? Probably not.

For that reason — I remain invested for the long-term. Simply put, inflation and the devaluation of our currency around the world is crushing our wallets. I truly believe that the only way to beat it and remain comfortable is for me to dollar cost average across my portfolio, consistently.

The more I see our government acting in such inefficient ways — the more bullish I am on crypto over the long-term. Like Austin, I just added the NEOS High Income Bitcoin ETF (BTCI) to my portfolio and you already know that I’m still holding the Bitcoin bags I’ve been carrying for years.

Crypto is unpredictable, but I have a strong belief that some bright days are coming.

In the meantime — clean your act up, government people!

Austin’s Callout

Stock market concentration has reached 50-year-highs.

Today, the Top 10 U.S. companies make up a staggering 18% of the entire global stock market’s value. This intensity of concentration not seen since the early 1970s. We’re talking Apple, Nvidia, Microsoft, Google, Amazon, Meta, and all of their mega-cap friends.

This concentration has tripled over the past 15 years, underscoring the unreal growth of the world’s largest companies. Even during the height of the Dot-Com bubble in 2000 — the top 10 companies only accounted for 14% of global market value, -4% lower than current levels.

Additionally, the Top 5 U.S. companies now represent 15% of the global stock market’s total value — the level of concentration on record (dating back to the 1970s). Whether we like it or not, a small group of major U.S. companies have an overwhelming impact of the global stock market.

You’ve heard me say it before and I’ll say it again — the bullish trend of the stock market is strong, but it remains very dependent on the market continuing to broaden. I continue to believe that this broadening is taking place, and the upcoming earnings reports will reaffirm that as well.

Here’s a video breaking down three ways that I’m diversifying in 2025.

For the real estate callout in the video — here’s my exposure:

1) Publicly-traded REITs: VICI and O

2) ETFs: ITB and VNQ

3) Private real estate deals: Fundrise Flagship Fund

The Rich Habits Radar

👉 McDonald’s shares fell nearly -10% after CDC E. coli accusations.

👉 Starbucks revealed that its same-store sales slid for a 3rd straight quarter.

👉 Spirit Airlines soared +81% in five days after securing time to address debt.

👉 Arm Holdings is canceling a chip design license deal with Qualcomm.

👉 Paul Tudor Jones says that the U.S. is going broke quickly, likes Gold & BTC.

👉 Peloton will now sell discounted bikes via Costco, both online and in-stores.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.6% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves risk. Brokerage services for US listed securities, options and bonds in a self-directed brokerage account are offered by Public Investing, member FINRA & SIPC. Not investment advice.

*This yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees, as of 10/23/2024. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults.

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The 6.79% yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees, as of 10/23/2024. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more

While corporate bond yields should fall in reaction to a Federal Reserve rate cut, we cannot know whether that will be true of the bonds in the Bond Account, how quickly bond yields will respond, or how much they will decline.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.