Together with Sequence

Hi Everyone,

We’ve got a jam-packed newsletter for you today!

Before you read on — make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ The Supreme Court just became a real macro variable for markets.

⭐ We broke down the three mindset traps that can keep you broke in 2026.

⭐ The AI boom has now caught the attention of policymakers.

⭐ Institutional investors are entering 2026 in full risk-on mode.

⭐ Trump signed an EO for the U.S. to collect 25% proceeds from chip exports.

Members of the Rich Habits Network have had the opportunity to invest in the following companies over the last several months:

Ongoing opportunities include:

More to be announced in next two weeks

It’s come to our attention that many of you may not fully understand what it means to invest alongside Robert and Austin in startups and pre-IPO companies. Over the last 18 months, we’ve helped hundreds of accredited investors invest millions of dollars into over a dozen companies (including the ones shown above).

Going forward, we’ll be breaking this down weekly — highlighting the caliber of these companies and why access to these opportunities is one of the biggest perks of being part of the Rich Habits Network.

Market Overview

As of market open, 1/15/26

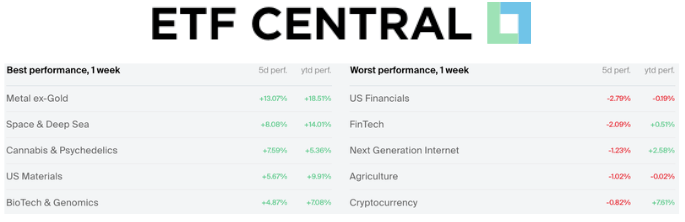

ETF Winners & Losers

Chart of the Week

The Supreme Court just became a real macro variable for markets.

The next major source of potential volatility isn’t inflation or earnings — it’s whether the Supreme Court rules that President Trump’s tariffs are legal. If the Court ultimately strikes them down, estimates suggest the U.S. Treasury could be forced to refund as much as $150 billion in customs duties.

Tariffs directly impact corporate margins, consumer prices, and federal revenue — meaning a legal reversal would ripple through earnings, inflation, and fiscal policy all at once.

Yesterday, the Court declined to rule and pushed the decision further out — extending the uncertainty. For markets, that means tariff policy remains a live macro risk rather than a settled input into forecasts.

According to Polymarket, there’s a 32% chance the Supreme Court ultimately rules that the Trump-era tariffs were authorized under IEEPA — down from a high of 59% in September. With trade policy, inflation, and earnings all intertwined, legal outcomes are now emerging alongside the Fed as a key driver of market volatility heading into 2026.

Today’s Rich Habits Newsletter is brought to you by Sequence — the platform that turns good money habits into automatic systems.

Rich Habits teaches you what to do with your money. Sequence makes sure it actually happens — automatically.

Together, we built the Rich Habits Money Map, a plug-and-play setup for personal and business finances that helps you save, invest, and make your money work for you without relying on willpower.

With Sequence, you can:

Automatically save first and invest consistently every time you get paid

Route money for taxes, debt repayment, and goals using simple rules

Manage personal and business finances in one clean, automated system

Get expert help to tailor your Money Map to your specific situation

If you want your Rich Habits to run on autopilot, check out the Rich Habits Money Map at getsequence.io/richhabitspodcast.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert broke down the three mindset traps that quietly keep people broke year after year, even as their income grows.

These aren’t “skip Starbucks” tips. They’re deeply rooted beliefs that sabotage wealth long before money ever hits your bank account.

Here’s what they covered…

Mindset Trap #1: “I’m Just Bad With Money” — Nobody is born good with money. Treating it like a fixed trait shuts down learning and progress. Replacing it with “I’m learning money” reframes money as a skill you can improve over time.

Mindset Trap #2: “A Good Job Will Fix My Money Problems” — High income doesn’t guarantee financial security. A job is a tool — not the solution. Wealth is built when paychecks fund assets, not lifestyle inflation.

Mindset Trap #3: “I Need to Look Successful to Be Successful” — Trying to look rich is expensive. Real wealth is built quietly by prioritizing ownership, investing, and long-term freedom over appearances.

You’re not broke because of your job or the economy — you’re broke because of what you believe about money. Change the belief and the behavior… and eventually the bank account follows.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

The AI boom has now caught the attention of policymakers.

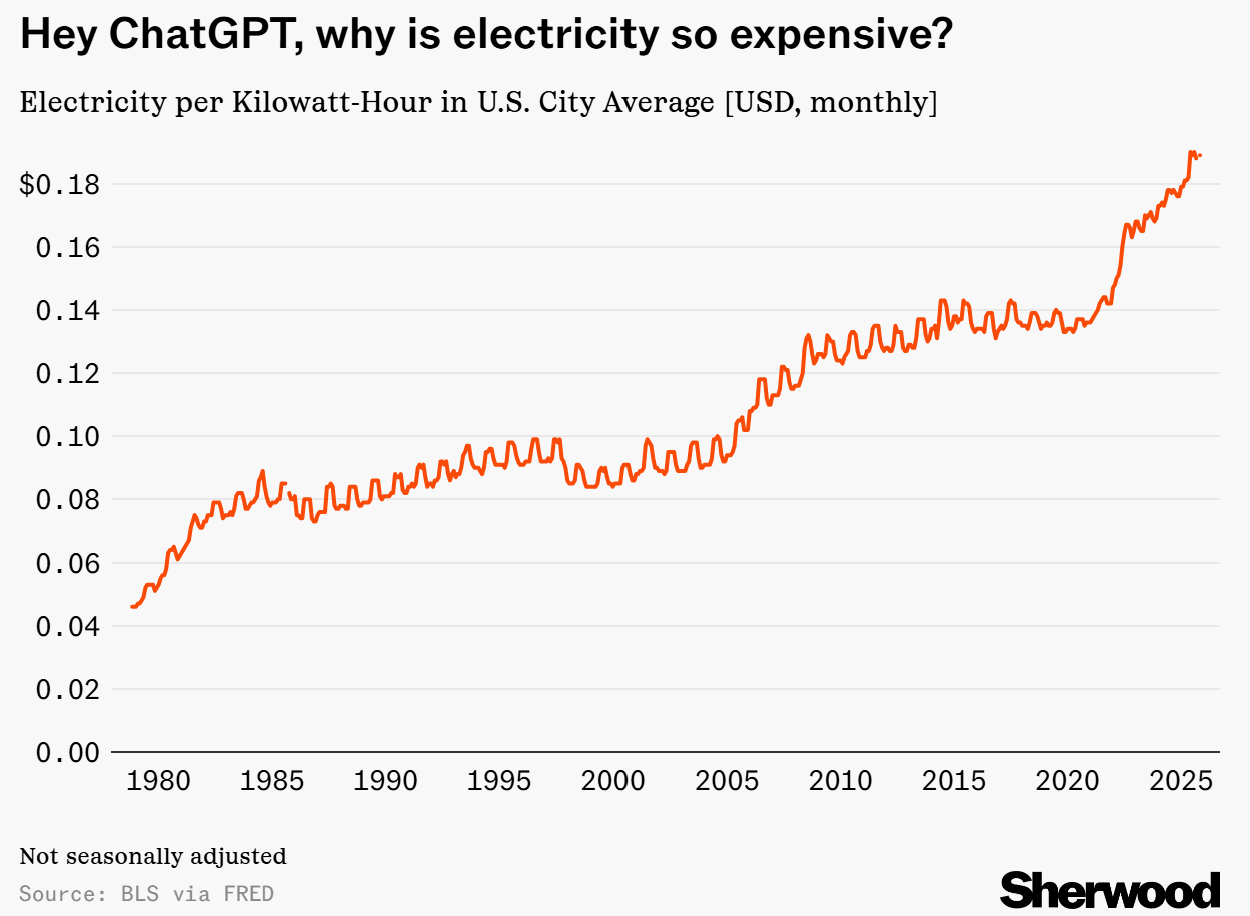

The explosive growth in AI data centers is now colliding with electricity prices and politics. President Trump warned this week that the AI build-out must “never” cause Americans to pay more for power, pressuring companies like Microsoft to ensure households don’t “pick up the tab” for massive data center energy demand.

Electricity prices are already up roughly +40% since early 2021 (compared to “inflation” rising +25% during that same period of time), and Big Tech hyperscalers are racing to secure power fast enough to support their AI ambitions. Microsoft’s own leadership has admitted the main bottleneck isn’t chips — it’s access to power, with servers ready but nowhere to plug them in.

Tech giants are responding by locking up energy supply directly. Meta’s nuclear power deals and new generation projects are designed to add net power to the grid rather than strain it — a sign the industry knows affordability is becoming a political and economic constraint.

AI growth is now inseparable from energy infrastructure. The companies and regions that can bring new power online — whether nuclear, gas, or grid-scale renewables — are becoming just as critical to the AI trade as chips and cloud capacity.

This is why we’re seeing names like Bloom Energy (BE) experience such positive price action over the last six month. Certainly an investment theme to keep an eye on.

Robert’s Callout

Institutional investors are entering 2026 in full risk-on mode.

S&P Global’s Investment Manager Index shows expectations for near-term U.S. stock market returns are now the most optimistic since the survey began more than five years ago. The Risk Appetite Index has climbed to +41%, its highest reading since April 2021, with nearly 60% of institutional managers expecting stocks to rise over the coming month.

Fund managers now see both the U.S. and global economies as positive drivers of stock market returns to a degree not seen in years, while lower interest rates are also viewed as positive since sitting at levels not seen in 2021.

That combination has pushed expectations for dividends, earnings, and shareholder returns to their strongest levels in over a year. At the same time, concerns around valuations and geopolitics — while still present — have eased meaningfully compared to late 2025.

For markets, this matters because institutional capital sets the tone. When large managers move into a risk-on posture at this scale, it tends to reinforce momentum rather than fade it — especially when the macro backdrop is improving alongside it.

Austin has been talking about this for several weeks now inside the Rich Habits Network — despite high-beta names like Robinhood (HOOD) and Palantir (PLTR) not putting in new all-time highs in months, the indices (especially the Russell 2000) seem well positioned to climb higher in 2026.

The Rich Habits Radar

👉 Trump signed an EO for the U.S. to collect 25% proceeds from chip exports.

👉 OpenAI made multi-billion $ deal w/ Cerebras to buy 750MW of AI compute.

👉 The Trump administration’s first Venezuelan oil sale was valued at $500M.

👉 Oracle sued by bondholders over losses tied to AI buildout.

👉 JPMorgan beat earnings, trading & net interest income topped expectations.

👉 Delta Air Lines topped earnings, travel demand stayed resilient to end 2025.

👉 Producer prices were hotter than expected, w/ inflation pressures still sticky.

👉 Consumer inflation was softer than expected, boosting hopes for Fed cuts.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.3% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Timeshare Exit — Exit an unwanted timeshare

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.’

Sequence Disclosure: Sequence is a financial technology company and is not an FDIC-insured bank. Banking services provided by Thread Bank, Member FDIC.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.