Hi Everyone,

Happy Thursday! We hope everyone had a wonderful Labor Day Weekend.

Additionally, thank you for all of the incredible feedback we’ve received on our “Rich Habits Radar” Friday Episodes — we’ve had a blast filming them!

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ The last two weeks of September are the worst on the calendar.

⭐ How to diversify your portfolio to build generational wealth.

⭐ Gold hits all-time highs while the US dollar weakens.

⭐ There’s a 91.3% chance the S&P 500 climbs higher before year-end.

⭐ Figma’s first earnings call disappointed investors.

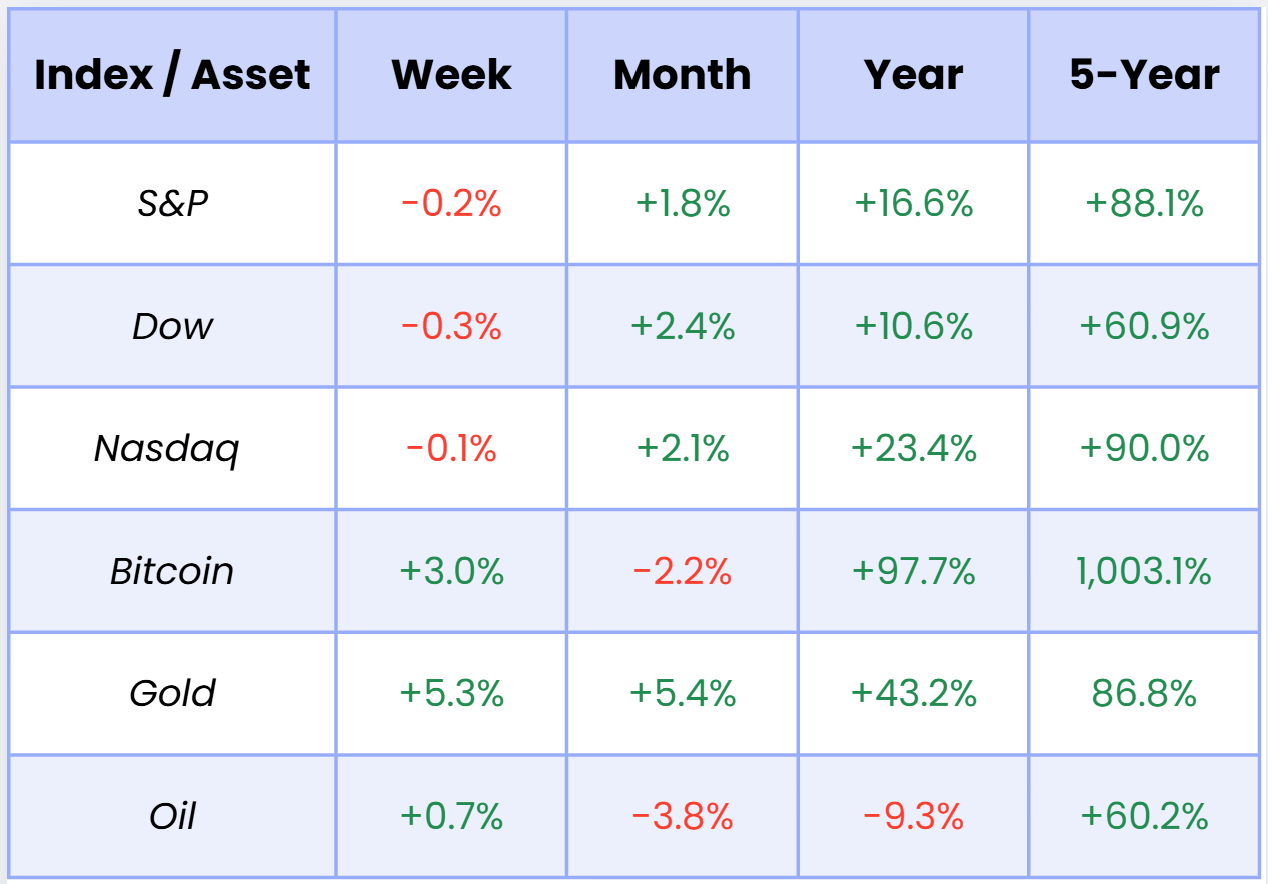

Market Overview

Chart of the Week

The last two weeks of September are the worst on the calendar.

It’s that time of the year again — the September slump. Historically speaking, September is the worst month for US stocks. Dating back to 1928, the S&P 500 is green only 44% of the time with an average loss of -1.17%.

8 of the last 15 Septembers have been negative for an average return of -0.94% — again, the worst month over the last 15 years.

Below is an incredibly interesting chart — illustrating the total performance of the S&P 500 from January 2021 through August 2025. The dark blue line is the actual performance of the index, and the light blue line is hypothetical performance of the index assuming no exposure during the months of September (sitting in cash).

In the above-shared example, cutting September (negative) returns out of a portfolio between January 2021 and August 2025 would have increased total performance by +18%.

Does this mean we should all sit in cash during the month of September?

Well, no.

Despite the “September slump” being one of the most predicted and common themes in the stock market — it still only happen 56% of the time. The other 44% of the time, the S&P 500 delivers positive returns. By sitting in cash heading into September, you’re essentially flipping a coin to determine if you’ll avoid losses or miss out on gains.

No one can predict what the stock market will do — have a plan to dollar cost average and stick to it.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more — it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert walk through how to diversify your portfolio to build generational wealth.

Here’s what they covered…

Core/Satellite Framework — A well-diversified portfolio should follow the core/satellite approach, with 65–85% allocated to stable core holdings (index funds like VOO, QQQ, VTI, etc.) and 15–35% allocated to satellite holdings. This structure works regardless of portfolio size—whether $100K or $5M.

Satellite Opportunities — The satellite allocation can include real estate, pre-IPO companies, crypto, precious metals, thematic ETFs, or single stocks like Nvidia. This diversification provides exposure to trends and asset classes that can outperform over time while balancing volatility.

Rebalancing Discipline — Twice a year, investors should rebalance to their target allocations since satellite investments may outperform and grow beyond their intended share. Regular rebalancing ensures the portfolio remains aligned with the original strategy and risk tolerance.

Remember, investing isn’t always sexy. The “Core” section of a portfolio is supposed to seem boring! Do the boring things over and over again — eventually, wealth will be built.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

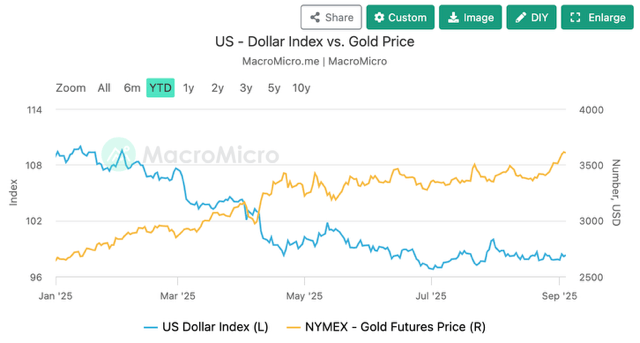

Gold hits all-time highs while the US Dollar weakens.

Gold has been an exceptional performer this year, delivering a +34% return year-to-date — far outpacing equities like the S&P 500 (+10.5%). This rally isn't just noise: it's driven by genuine shifts in investor behavior and policy stances.

Weakness in the U.S. dollar, rising inflation expectations, and geopolitical stress —particularly pressure on Federal Reserve independence — have all boosted gold’s appeal as a true safe haven. Even more compelling is the mega-trend of central banks diversifying their reserves: gold now holds more weight than U.S. Treasuries globally.

This environment reinforces the logic behind dollar-cost averaging (DCA) into gold or other precious metals.

Whether you’re a long-term holder or adding for diversification, the 2024–2025 period has underscored gold’s role in hedge efficiency.

Analysts at institutions like Goldman Sachs, State Street, and Janus predict this bullish trend could continue — forecasting gold to potentially reach $4,000 by mid‑2026 and even $5,000 in aggressive scenarios.

Austin’s Callout

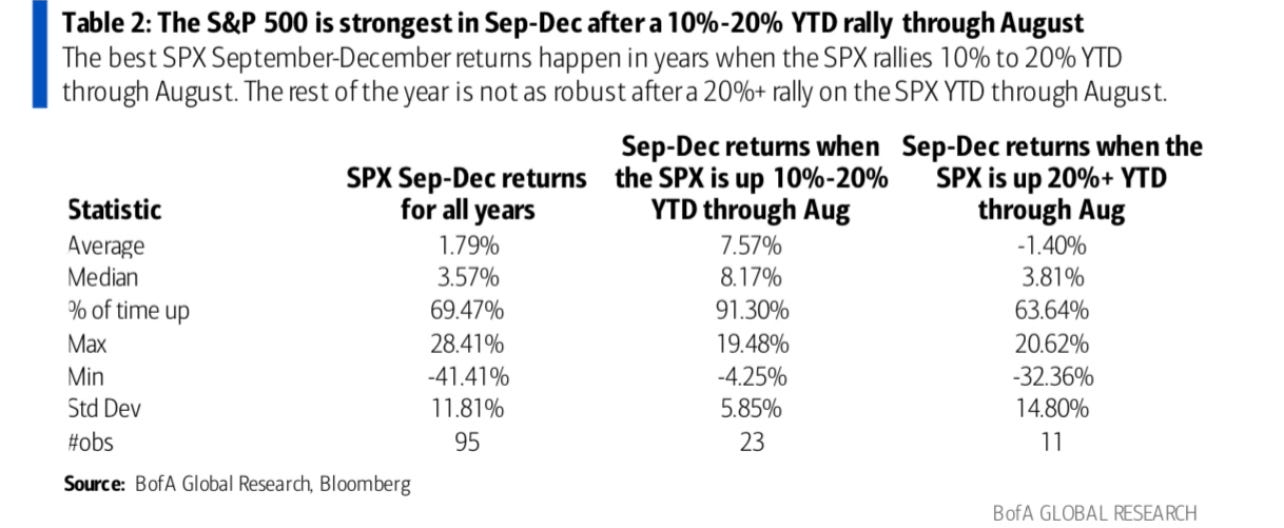

There’s a 91.3% chance the S&P 500 climbs higher before year-end.

The S&P 500 is now up +10.1% year-to-date through August. Historically, this has often boded well for the remainder of the year (September through December). Over the last 100 years, there have been 23 instances where the S&P 500 delivered year-to-date returns of +10% to +20% through August — and in 21 of those 23 cases the index climbed higher over the following four months, with an average gain of +7.5%.

2025 is shaping up to be the 24th instance of a +10% to +20% gain through August — and if history repeats, the S&P 500 could deliver another +7.5% from September through December, despite the so-called “September slump.”

If we do see a “September slump,” I’ll be treating it as a buying opportunity — particularly in small- and mid-cap names.

Keep in mind, the Federal Reserve is expected to begin cutting interest rates this month. Historically, that has been especially bullish for small-caps, as reflected in the Russell 2000 Index.

The Rich Habits Radar

👉 Figma’s first earnings call disappointed investors.

👉 American Eagle stock surged 25% after Sydney Sweeney’s viral campaign.

👉 Apple confirmed plans for an AI-powered search to bolster Siri.

👉 Alphabet will not be forced to sell Chrome.

👉 Anthropic secured $13B in fresh funding at a $183B valuation.

👉 American Bitcoin trading was halted four times.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.1% on your savings

Public — Trade stocks, options, and crypto

Roi — Use code “Habits” and start tracking your net worth

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC. As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.