Hi Everyone,

Today is a day filled with a lot of emotion.

Yesterday, Charlie Kirk was tragically assassinated in broad daylight while hosting one of his discussion-based events on a college campus in Utah. Charlie was a man driven by faith, family, passion for intellectual debate, and love of country. The Rich Habits Team mourns his loss and prays for his family that will now move forward without a husband and a father. Violence is never the answer.

And now today, we also honor the nearly 3,000 people that lost their lives during the terrorist attacks of September 11th, 2001. There has been no darker time on American soil, and millions of people are still dealing with the losses of that horrendous morning in New York City. If you’ve never heard the story of Welles Crowther — “The Man in The Red Bandana” — we highly encourage you to do so. He was a hero that chose to lead others to safety that day instead of just looking after himself.

The reality of 9/11 is that there are thousands of individuals who also chose to help others instead of seek their own safety. Many of them did not make it through the day, but that doesn’t mean we can’t take this opportunity to honor them and their ultimate sacrifices.

Each and every day, we are very proud to be Americans. But on this day — we are supremely encouraged by the resolve that was shown during that morning from hell. We encourage each of you to understand the importance of never forgetting what took place that day, and how much was lost from so many people. America is ultimately an experiment — one which has yet to even amass 250 years of history. 9/11 was a crimson stain in that history, but also was filled with countless acts of selflessness and patriotism. Today — we honor those that were lost, those that were impacted, and those that spend each and every day defending us.

As one final note — there will not be a “Rich Habits Radar” Friday Episode of the podcast this week. Austin is traveling to his father’s memorial this weekend. We appreciate you understanding.

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show. We want you to get notified when each new episode is released.

Now let’s jump into things.

A quick breakdown — in case you don’t have the time.

⭐ The Fed’s balance sheet just hit its lowest level since April 2020.

⭐ We sat down with the CEO of Fundrise for a podcast episode.

⭐ Global liquidity is surging to all-time highs.

⭐ Retail investors are cashing in — while institutions keep buying.

⭐ Oracle’s AI cloud infrastructure blowout stunned as stock soared

Market Overview

As of market open, 9/11/25

Chart of the Week

The Fed’s balance sheet just hit its lowest level since April 2020.

In August, the Federal Reserve trimmed its balance sheet by -$39 billion to $6.60 trillion. That marks a nearly five-year low, taking total assets back to early-pandemic levels.

Since the April 2022 peak, the Fed has reduced its holdings by -$2.36 trillion (-26.4%), effectively unwinding 49.2% of the $4.81 trillion in pandemic-era stimulus.

On a relative basis, Fed assets are now 21.8% of U.S. GDP — the lowest since Q1 2020 and roughly in line with 2013 levels.

But here’s the kicker: the balance sheet still sits $2.45 trillion (+59%) above pre-pandemic levels. Despite aggressive tightening, the Fed is far from fully unwinding its COVID-era interventions.

Translation: liquidity is tighter, but the system is still running on more Fed support than before the pandemic. The Fed’s moves regarding rate cuts and the words coming from Jerome Powell have never been more important.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more — it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert sat down with the CEO of Fundrise to answer your questions about the real estate industry, and their unique approach.

Ben has been democratizing real estate investing for over a decade, building Fundrise into a platform that manages billions in assets across real estate, private credit, and venture. With the Fed’s recent policy pivot out of Jackson Hole, this was the perfect time to get his perspective on what it all means for everyday investors.

Here’s what they covered…

Fundrise’s “Buy Box” — Ben broke down how Fundrise identifies and acquires real estate, and why having a clear “buy box” matters for investors looking to grow wealth steadily over time.

The Fed’s Policy Flip — Jerome Powell’s shift from fighting inflation to prioritizing employment signals rate cuts ahead. Ben explained how this pivot impacts real estate and why it could create opportunities for Fundrise investors.

Shareholder Letters & Market Transparency — Ben discussed why he started writing quarterly letters to Fundrise investors, what he’s been reporting lately (including AI trends), and why clear communication matters in volatile markets.

Beyond Real Estate — Fundrise has expanded into private credit and venture capital. Ben shared what drove that decision, how the hot IPO market is shaping their venture bets, and which areas of real estate still excite him the most today.

As always, we aim to bring you conversations with leaders shaping the future of money and investing. Ben’s insights offered a rare behind-the-scenes look at where real estate and his company are both headed.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, YouTube, and wherever else you get your content!

Robert’s Callout

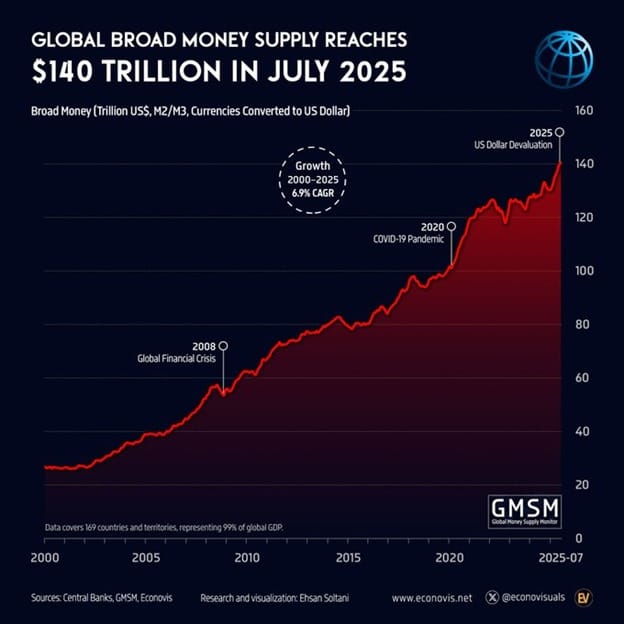

Global liquidity is surging to all-time highs.

In July, broad money supply climbed +9.3% year-over-year, reaching a record $140 trillion. This measure spans 169 countries and territories, covering 99% of global GDP.

Since the start of 2025, global money in U.S. dollars has jumped by +$10 trillion, and since the 2020 pandemic, total money supply has soared +$40 trillion — a 7.0% compounded annual growth rate.

This massive expansion underscores the ongoing flood of liquidity worldwide. On the positive side, it supports economic growth, fuels markets, and provides investors with ample opportunities. On the flip side, too much liquidity can stoke inflation, create asset bubbles, and amplify market volatility.

The key takeaway: global money is abundant, but positioning and discipline remain crucial for navigating both the upside and the risks. With this much liquidity in the market, I wouldn’t be surprised by massive rips and massive dips as we head toward Q4.

Austin’s Callout

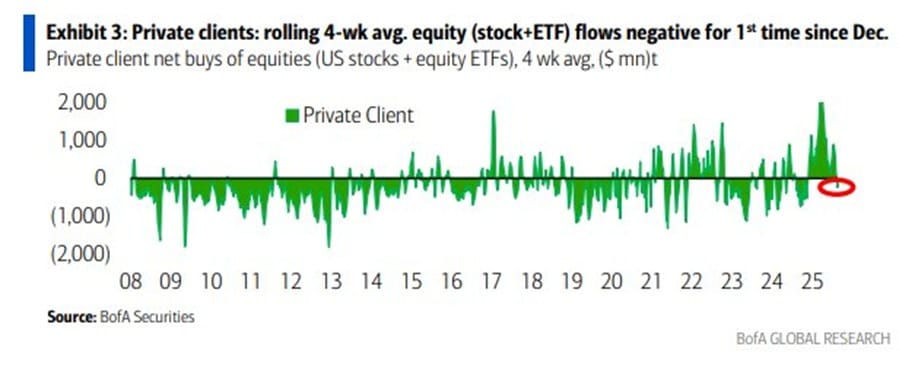

Retail investors are cashing in — while institutions keep buying.

Last week, individual investors sold $700 million of U.S. equities, marking their second weekly sale in the last three weeks after nearly 36 straight weeks of buying. This pushed the 4-week average of retail selling to $200 million, signaling a notable shift in sentiment.

Meanwhile, institutional investors snapped up +$1.1 billion, their 6th consecutive weekly purchase, the longest streak since the 2022 bear market. Prior to this streak, institutions had sold -$19 billion over 12 weeks, but their 4-week average of purchases now sits at +$1.7 billion, highlighting growing confidence among professional investors.

Wall Street is buying while Main Street is selling, a classic example of the sentiment divergence between retail and institutional players. Historically, these periods of retail selling and institutional buying can create attractive entry points for disciplined investors who are willing to go against the crowd.

Stay patient, stick to your strategy, and remember that understanding market behavior — not emotions — often separates long-term success from short-term frustration.

The Rich Habits Radar

👉 Oracle’s AI cloud infrastructure blowout stunned as stock soared

👉 Hims announced plans to roll out new men’s testosterone treatment in 2026

👉 Klarna jumped in NYSE debut, valuing the company at $17.5B

👉 Producer prices slipped in August, hinting firms may be absorbing tariffs

👉 US added -911K fewer jobs than previously reported in largest revision ever

👉 GameStop topped earnings and disclosed $500M worth of bitcoin holdings

👉 Apple’s ‘Awe Dropping” event unveiled the iiPhone 17 and iPhone Air

👉 Amazon's Zoox launched in Las Vegas as robotaxi race heats up

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.1% on your savings

Public — Trade stocks, options, and crypto

Roi — Use code “Habits” and start tracking your net worth

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.