Together with Moby

Good morning,

A quick breakdown — in case you just don’t have the time.

⭐ Households have 48% of their financial assets in stocks.

⭐ The President of Shopify spoke w/ us about entrepreneurship.

⭐ Insider stock purchases of S&P 500 execs are around a 13-year low.

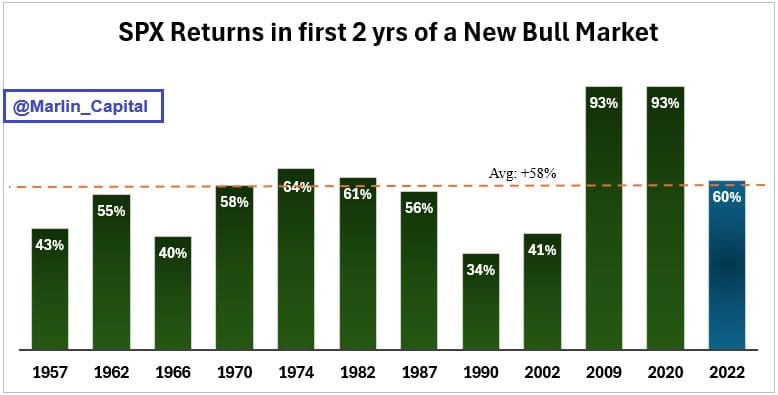

⭐ The bull market over the last 24-months has returned +60%.

Market Overview

As of mid-market 10/16/2024

Chart of the Week

U.S. households now hold 48% of their assets in equities (stocks).

That’s right. According to the Federal Reserve and Goldman Sachs, U.S. households now have 48% of their financial assets in equities, and only just 15% towards cash.

You could look at this chart in a few different ways. The first way is “holy smokes… a crash is a certainty!” But, the other way is to be a bit more realistic.

Will there be drawbacks and red days? Certainly. However — earnings season is upon us. If companies continue to show that their operating profits, free cash flow, and forward-looking guidance are improving — it’s hard for anyone to argue for a major crash.

If you want to look at it from a different angle, it could be reinforcing the broad-based strength of the U.S. stock market. As we’ll cover in a different section, we’ve officially crossed the 2-year mark of this most recent bull market — and the returns are par for the course.

Until we see wide-spread economic deterioration (a rising unemployment rate, lower retail sales, lower manufacturing output, rising inflation, etc.) we remain bullish investors in the S&P 500 and are positioned accordingly.

Modern strategies for the modern investor in you, only with Moby.

The best-in-class app for concise investment insights and stock picks designed for busy professionals seeking smart financial decisions.

If any of these have crossed your mind, at one point:

How can I stay more updated on financial markets? Where can I see the latest good stock ideas? How can I avoid my inbox being spammed with meaningless updates?

Then, Moby is custom made for you.

The Moby app provides busy professionals with a filtered view on the most important financial news of the day with latest research on profitable trends in the stock market — all done via notifications straight to your phone that only take 3-5 minutes to read.

Moby's insights are driven by the team's experience at Morgan Stanley, Bank of America, and Goldman Sachs — making what used to be complex financial information into easy, profitable, and concise stock recommendations for you.

Examples of Moby latest trends in the market below…

Check out Moby today and gain a competitive edge with how you can make even smarter investment decisions.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin were joined by the President of Shopify, Harley Finkelstein.

They discussed the following:

Increasing A Businesses’ Chances of Success — One of the ways that Shopify empowers entrepreneurs to be successful is by doing the heavy-lifting when it comes to distribution. Shopify has become the second largest “check-out point” on the internet in the United States. Other value-adds include Shopify Capital for funding, Shopify Markets for expansion, or Shopify Audiences for finding look-alike audiences across social media.

The Future of Retail — Shopify President Harley Finkelstein stated that in the future, retail won’t be online or offline — it’s going to be everywhere. He gave an example about augmented reality (AR) being sparsely used in commerce back in 2018, but now it’s built into all of our phones and used by many major retailers. Shopify is determined to stay ahead of the curve when it comes to where and how people purchase online.

The Mindset of an Entrepreneur — The cornerstone of entrepreneurship is optimism. If you’re not a positive thinker, it’s much less likely to work out. Other key traits include having a desire for experimentation (instead of fearing it) and becoming a good storyteller.

This was easily one of our favorite Rich Habits episodes ever. Learning directly from an incredible business leader like Harley is hopefully something you all enjoy! Shoutout to Harley and his team for coordinating with us — and give him a follow on Instagram!

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from the following people: Amirreza, Anna, Christian, Lisa, Olivia, and Omar. The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content.

Robert’s Callout

S&P 500 Executives aren’t buying their own stock.

According to Sentiment Trader, corporate executives among S&P 500 firms have some of the least open market purchases in 13 years.

While the market rallies, I’m curious to see if insiders are really being the “smart money” here. Lack of insider buying can often mean there’s a lack of confidence in future performance — so I felt a need to bring this up.

Something else to consider is the fact that after a +60% total return in the S&P 500 over the last 24-months, these executives are likely already “over-allocated” in the stocks of their own companies. Just because you aren’t buying up more of your own company’s shares does not necessarily mean that you are bearish.

As we’ve seen with companies like Apple, BlackRock, Delta, Lululemon and countless others — there’s been PLENTY of stock buybacks this year and plenty of executives that have bought more of their own stock.

Remember, company insiders SELL their stocks for any reason — they BUY their stocks for only one… they believe the price will go up.

Austin’s Callout

Believe it or not — this bull market has actually been very normal so far.

You’ve heard us talk about how the S&P 500 is currently having its best year since 2000 — and from a year-to-date perspective, this is true.

However, this bull market (which started in October of 2022) is now celebrating its second birthday. Since inception, the S&P 500 has increased by +60%. When compared to the +58% average of S&P 500 bull markets in their first two years — that really doesn’t seem that crazy!

I share this to give you perspective. Stocks have been ripping, and the natural reaction from many retail investors is to assume that they will come right back down. Maybe they will, but at the moment this bull market continues to experience broad-based strength.

Bull markets are all vastly different, and making investment decisions entirely based off of history is never smart. You should not view the market today and think that this is an incredibly rare moment in time — as history tells us these returns are normal!

Yes, people make money in bear markets by buying low — but the REAL money is made in bull markets when stocks rip higher. Let’s enjoy the ride!

The Rich Habits Radar

👉 Sphere will build its second location in Abu Dhabi, capital of the U.A.E.

👉 ASML had a disappointing earnings leak, leading to a semiconductor sell-off.

👉 Amazon & Google made dueling nuclear investments to power data centers.

👉 A random biotech stock rose over +3,000% in five days. Meme madness?

👉 Walgreens will close 1,200+ of its U.S. storefronts (14% of total).

👉 Boeing will raise up to $25B via shares or debt to improve balance sheet.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.