Together with Public

Hi Everyone,

We’re hosting a FREE webinar tomorrow called Fast Track to Financial Clarity (In 30 Days)! We’ll be joined by the team at Sequence to talk through our Rich Habits Money Maps. These help you visualize your money flow and have better control of your entire financial situation.

CLICK HERE TO SIGN UP FOR TOMORROW’S FREE WEBINAR. If you sign up, you will receive a recording of the event as well.

A quick breakdown — in case you don’t have the time.

⭐ Energy could benefit from the biggest winners beginning to lose steam.

⭐ We made a podcast episode about approaching market volatility in 2026.

⭐ Retail investors are aggressively buying the dip — especially in software.

⭐ Crypto is seeing its largest outflows since the 2022 bear market.

⭐ Carvana stock plummets -20% after vague 2026 outlook.

Members of the Rich Habits Network have had the opportunity to invest in the following companies over the last several months:

Ongoing opportunities are updated every week!

Congrats to those that joined us by investing in Apptronik! Here’s a link to last week’s CNBC article about their round of funding.

It has come to our attention that many of you may not fully understand what it means to invest alongside Robert and Austin in startups and pre-IPO companies.

Over the last 18 months, we’ve provided opportunities for hundreds of accredited investors invest millions of dollars into over a dozen companies (including the ones shown above).

Market Overview

As of market open, 2/19/26

ETF Winners & Losers

Chart of the Week

Energy could benefit from the biggest winners beginning to lose steam.

This Goldman Sachs chart tracks two things over the last 100 years: how big the largest stock is relative to the 75th percentile stock, and how much weight the top 10 names carry in the S&P 500 index. Both are at levels we've only seen during the Great Depression, the Nifty Fifty era of the early 1970s, and the peak of the Dot Com bubble.

Right now, the largest stocks in the S&P 500 are more dominant than at any point since the Great Depression. Every single time concentration has gotten this extreme, it eventually unwound — not because the top companies were bad businesses, but because when positioning is this one-sided, it doesn't take much to trigger rotation.

The million dollar question isn’t “When is this rotation going to happen?” it’s “Where does the capital flow to next?”

According to the latest BofA Global Fund Manager Survey, institutional investors are still massively underweight energy stocks. Net positioning in global energy is sitting near multi-year lows — even as the sector is quietly breaking out. Exxon's (XOM) recent move looks less like a one-off and more like the start of something broader. We’ve also seen Occidental Petroleum (OXY) begin to breakout after smashing their earning report this morning.

When regime shifts like this happen, capital doesn't disappear — it rotates. And the sectors that are under-owned and structurally mispriced tend to be the biggest beneficiaries.

Energy and emerging markets — these are the areas where the crowd hasn't shown up yet. And if history is any guide, that's exactly where the opportunity is.

If you’re inside the Rich Habits Network, you’ll know that Austin has already built a mid-five figure position in energy — as of this writing his position is up about +8% while the S&P 500 and Nasdaq-100 are down -0.6% and -1.9%, respectively.

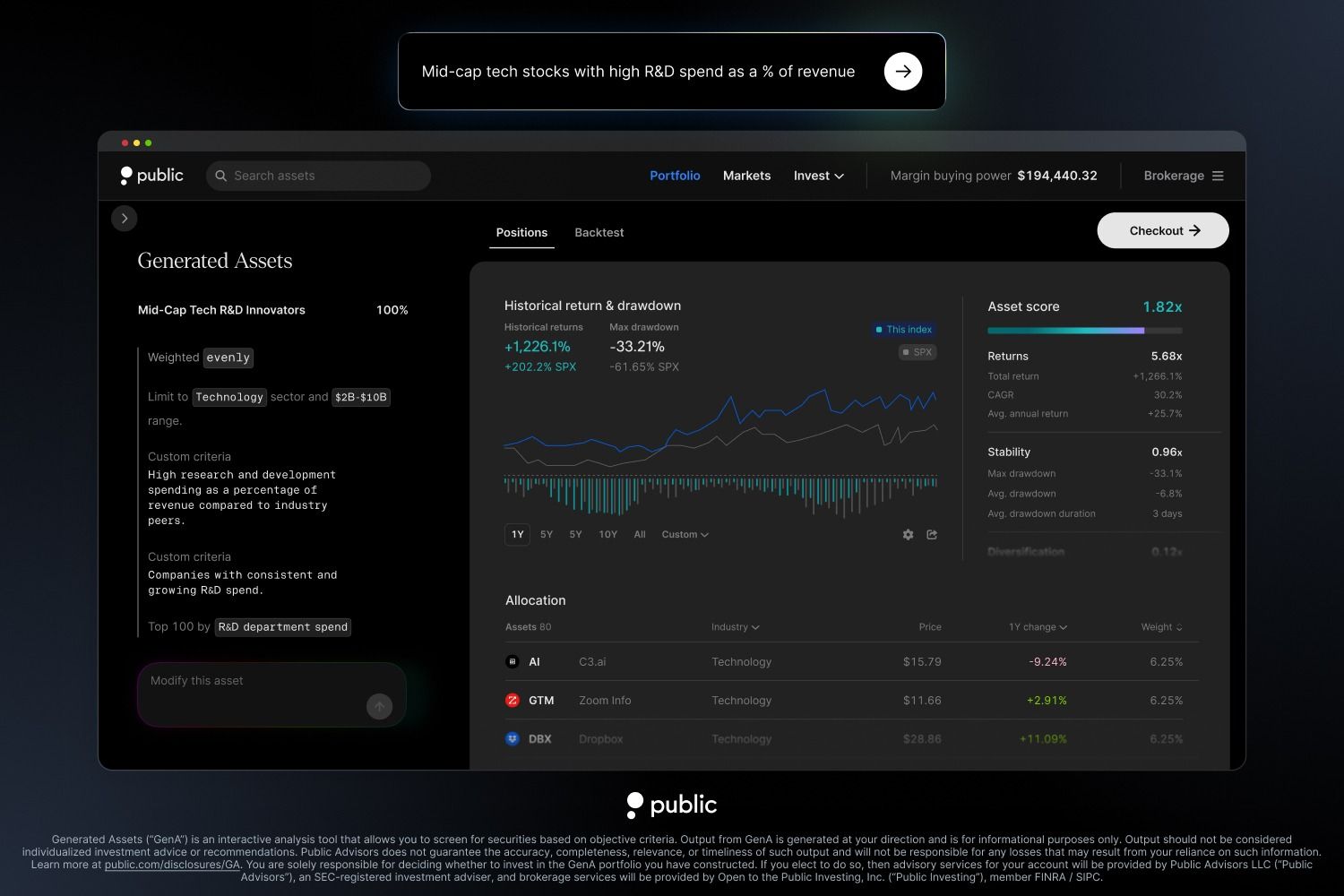

Today's Rich Habits newsletter is brought to you by Public, the investing platform that recently launched Generated Assets. Now, you can turn any idea into an investable index with AI.

Seriously. You can type in anything, from “AI-powered supply-chain companies with positive free cash flow” to “defense tech companies growing revenue over 25% year-over-year.” Generated Assets then builds a one-of-a-kind index you can backtest, refine, and add directly to your portfolio.

Gone are the days of one-size-fits-all ETFs. On Public, you can bring your own investment ideas to life. Plus, earn an uncapped 1% cash match when you transfer your portfolio.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — break down how they’re preparing for volatility in 2026… and why smart investors are learning to monetize it instead of fearing it.

With markets swinging daily, leadership rotating, and policy uncertainty driving headlines, this episode focuses on building a portfolio that’s diversified not just up and down — but side-to-side across risk levels, asset classes, and income outcomes.

Here’s what they covered…

Volatility Isn’t the Enemy, It’s an Asset — Garrett Paolella and Troy Cates of NEOS explain how elevated volatility can increase options premium and improve income potential. If the market is going to move anyway, the goal is simple: structure your portfolio to get paid for it.

Diversification “Side-to-Side” — Beyond a basic stock/bond split, NEOS offers hedged ETFs, core income funds, alternatives, enhanced fixed income, and boosted exposure. Blending strategies like SPYI, QQQI, XSPI, XQQI, and XBCI allows investors to match risk tolerance while keeping capital productive.

Turning Income Into Weekly Cash Flow — NEOS’s new distribution calendar spreads payouts across different weeks of the month. Instead of one lump-sum payment, investors can potentially build a more consistent weekly income stream.

Energy as a Diversified Income Play — MLPI adds energy infrastructure exposure that’s less correlated to traditional equities. In uncertain markets, differentiated cash-flow streams can strengthen overall portfolio resilience.

The bigger message: volatility isn’t a signal to retreat — it’s a signal to get strategic. With the right structure, investors can stay invested, manage risk, and generate income regardless of the market cycle.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

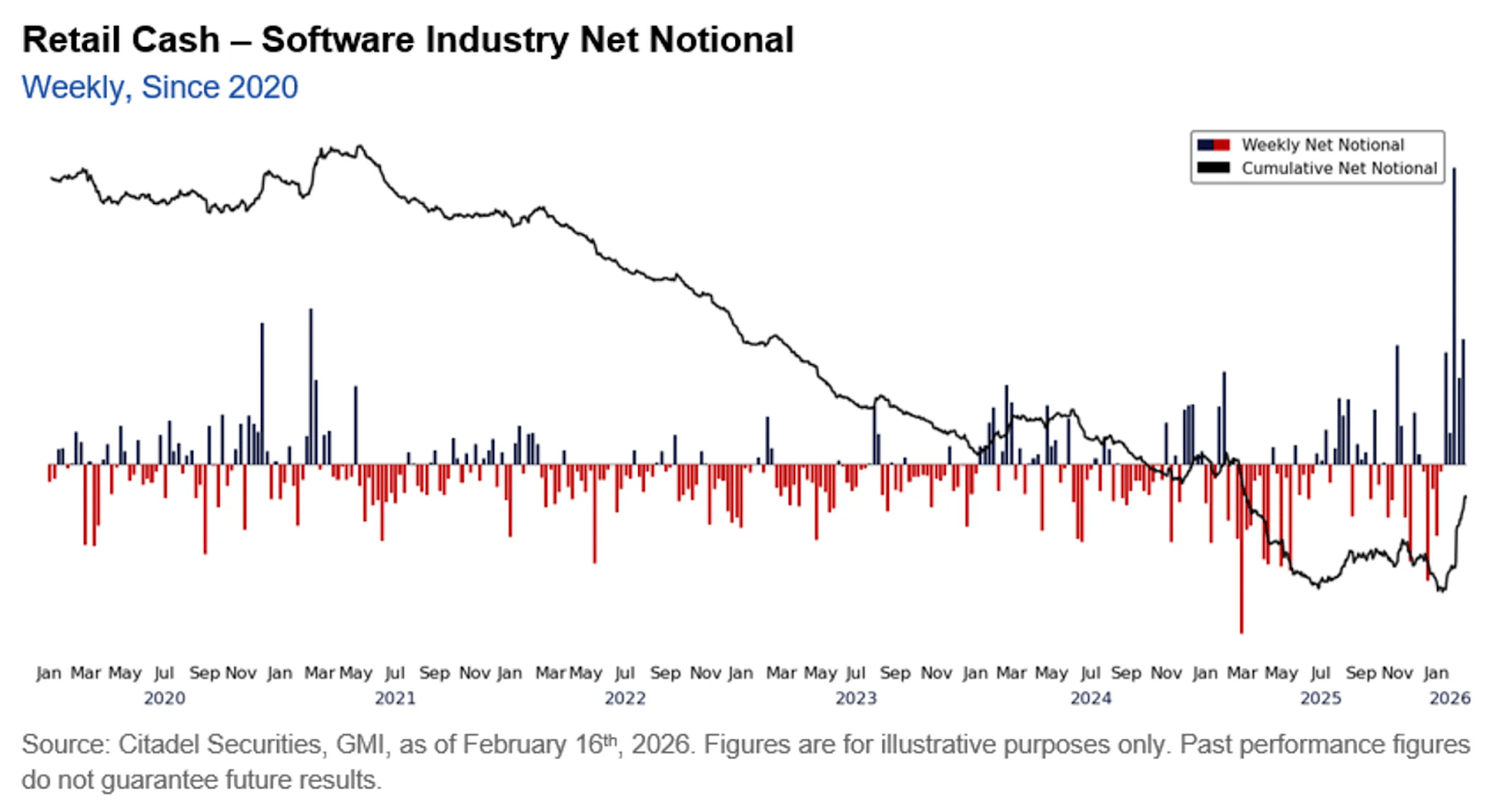

Retail investors are aggressively buying the dip — especially in software.

February equity flows have remained unusually strong. Participation has stayed elevated into mid-month, with retail investors leaning hard into recent weakness in software names.

As the group has come under pressure, retail buyers have stepped in aggressively, pushing inflows to historically high levels. In fact, recent buying already amounts to roughly two-thirds of the total net flow seen across all of 2025 — despite that year ultimately ending with retail as a net seller of the sector.

This tells us two things. First, retail conviction remains high. Second, recent price stability in parts of the market has been supported by concentrated dip-buying in some of the most volatile names.

Software-as-a-Service names, as those in the IGV ETF, have been destroyed year-to-date because of AI. As we shared inside of the Rich Habits Network livestream earlier this week, I believe a fair amount of these software names are doomed. However, names like Crowdstrike, Cloudflare, and Palo Alto Networks will be just fine in the long-term. Do your own research to understand how AI could potentially disrupt the software names in your own portfolio.

Robert’s Callout

Crypto is seeing its largest outflows since the 2022 bear market.

Digital asset funds just recorded their biggest wave of outflows in years, with capital leaving at one of the fastest rates since the last major bear market. Bitcoin and Ethereum positions are shrinking, and stablecoin growth — often a proxy for fresh buying power — has largely stalled.

In short, new capital isn’t aggressively entering the space right now.

Crypto has always been highly flow-sensitive, and periods of rapid inflows are often followed by sharp cooling phases as leverage resets and speculative excess gets worked off. We’ve also seen open interest decline, suggesting much of the froth has already been flushed from the system.

For long-term investors, this looks more like a consolidation phase than a collapse. Capital flows may be negative in the short term, but adoption, institutional rails, and regulatory clarity continue to build beneath the surface. In crypto, sentiment tends to swing faster than fundamentals.

The Rich Habits Radar

👉 Federal Reserve minutes reveal potential interest rate hikes in 2026.

👉 MSG Sports is considering spinning off the Knicks and Rangers.

👉 Carvana stock plummets -20% after vague 2026 outlook.

👉 Meta agrees to deploy millions of Nvidia chips over the coming years.

👉 Nelson Peltz is considering a takeover of Wendy’s.

👉 Bitcoin ETFs bled -$133M in outflows on Wednesday.

👉 Coinbase expands crypto lending beyond BTC and ETH.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.3% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Timeshare Exit — Exit an unwanted timeshare

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: Paid endorsement. Brokerage services provided by Open to the Public Investing Inc, member FINRA & SIPC. Investing involves risk. Not investment advice. Generated Assets is an interactive analysis tool by Public Advisors. Output is for informational purposes only and is not an investment recommendation or advice. See disclosures at public.com/disclosures/ga. Past performance does not guarantee future results, and investment values may rise or fall. See terms of match program at https://public.com/disclosures/matchprogram. Matched funds must remain in your account for at least 5 years. Match rate and other terms are subject to change at any time.

Disclosure: This content is sponsored by NEOS Investments. The creator is compensated by NEOS to discuss NEOS ETFs. This content is for informational purposes only, and is not personalized investment, tax, or legal advice, and does not constitute an offer to buy or sell any security. Investing involves risk, including possible loss of principal. Before investing, carefully review the NEOS ETFs prospectus at neosfunds.com.