Together with Public

Good morning,

A quick breakdown — in case you don’t have the time.

⭐ Government spending is out of control.

⭐ We discussed the five types of wealth with Sahil Bloom.

⭐ Crypto adoption is clearly growing in 2025.

⭐ February is typically the worst month of the post-election year.

⭐ Palantir shares rose +33% to $107 after Q4 earnings (congrats to Robert).

Quick Callout

If you’re a listener of the show, you know we love passive income.

The passive income-loving folks at NEOS Investments just launched their own podcast and the first episode is live on YouTube! They’re going to get on Spotify, Apple Podcasts, and everywhere else too — but for now throw them a subscription on YouTube!

Market Overview

As of market open, 2/6/2025

Chart of the Week

Government spending is out of control.

As Stanley Druckenmiller famously said — our government spends like drunken sailors. Since his inauguration, President Trump has put Elon Musk in charge of the Department of Government Efficiency (DOGE) with the mission of mitigating government waste. According to Elon, DOGE is trending toward saving the American taxpayer $1B per day throughout 2025 — that’s potentially $365B in savings.

But reeling in government spending is only one side of the equation — we must also increase government income.

Historically speaking, there are two ways to do this — raise federal income tax rates on the American people and / or tariff the important of goods. As you’ve likely seen this week, President Trump announced his intention to implement tariffs on goods imported from both Mexico and Canada.

At the moment, we’re in a “wait and see” point of this supposed “Trade War.” So let’s use this time to reflect upon the Trade War we experienced under Trump’s previous Administration — January 2018 through June 2019.

Below is a (blurry) chart that illustrates the operating margin of the S&P 500 between 2012 and 2024 — with a white box outlining our previous Trade War. As you can see, the operating margins of the 500 largest and most profitable companies in the United States, on average, decreased by about -1.5%.

In the grand scheme of things, a -1.5% decline in operating margins isn’t a big deal — with that being said, if we see something similar happen in 2025 / 2026 it’s not unreasonable to expect a “re-rating” of their valuations.

Remember, the stock market is forward looking — the reason we experienced such a violent sell-off earlier this week is because analysts were trying to answer the question “If history repeats itself and margins compress by -1.5%, how many billions of dollars in profits are these companies now going to lose… and how will that discount back to current valuations?”

Regardless of what happens, we firmly believe it has never been more important to own equity in profitable billion-dollar companies. We will see more volatility — including multiple double-digit pullbacks in the blue chip stocks and index funds we know and love.

That doesn’t mean these companies are operating any less efficiently — the analysts on Wall Street trying to make sense of it all simply can’t. We encourage everyone to continue to dollar cost average throughout this year and be net-buyers of assets.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform trusted by millions. On Public, you can build a multi-asset investment portfolio of stocks, options, bonds, crypto, and more.

You can even put your cash to work at an industry-leading 4.10% APY*.

Public is a US-based company and member of FINRA with an award-winning customer support team. Plus, only Public has Alpha, an AI-powered investment research assistant that can answer any question about any stock.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Robert and Austin interview Sahil Bloom. He’s on a mission to redefine what it means to live a wealthy life.

Here’s what they talked about:

Time Wealth — the freedom to choose how to spend your time, whom to spend it with, and when to trade it for something else.

Social Wealth — the connection to others in your personal and professional worlds. It is the network you can rely on for love and friendship, as well as help in times of need.

Mental Wealth — the connection to a higher-order purpose and meaning that provides motivation and guides your short- and long-term decision making.

Physical Wealth — your health, fitness, and vitality. Focusing on the controllable actions around movement, nutrition, and recovery.

Financial Wealth — growing income, managing expenses, and investing the difference in long-term assets that compound meaningfully over time, while simultaneously keeping your expectations in check.

Don’t forget to order his new book, The 5 Types of Wealth! It’s a page-turner and includes some incredible stories, anecdotes, instructions, and motivation.

If you’ve not yet listened to this episode, you need to. As the interviewers, we learned a lot. A few of our favorite quotes from the episode include “Anything above zero compounds,” and “You’ll achieve much more in life by being consistently reliable than being occasionally extraordinary.”

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from: Aquiles V, Trey D, Brendan O, Keiko T, Brady B, Benjamin F, Austin M, and Mr. F.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

Crypto adoption is clearly growing in 2025.

Three massive things are going on in government right now that are bullish for the crypto world. While many are calling for a top in the market, I believe we have a ways to go.

#1 — Trump signed an executive order establishing a sovereign wealth fund (SWF) for the United States. If you’re not familiar with this term — it’s a state-owned investment fund that invests in real and financial assets like stocks, bonds, precious metals, alternative assets, and more. Taxpayer dollars are being spent, but taxpayers can also theoretically reap the rewards of a SWF that grows its value over time because it’s good for the U.S. “balance sheet.”

The U.S. SWF will be led by Howard Lutnick and Scott Bessant — both massive crypto bulls. Lutnick has even said that he has “hundreds of millions” in Bitcoin exposure.

Here’s a list of other SWFs from around the world, including $1.7 trillion for Norway and $1.3 trillion for China.

#2 — Trump has appointed David Sacks as his “Crypto Czar” and the “Crypto Task Force” has been established with numerous members of Congress. Sacks said during a recent press conference that he “looks forward to working with each of you in creating a golden age in digital assets.”

#3 — Lastly, we have a sitting president that plans to launch a “Bitcoin Plus ETF” via his media company — Trump Media & Technology Group. Not to mention, World Liberty Financial — a company that’s independently operated but connected with his family — has been pouring hundreds of millions into crypto.

Investing in crypto isn’t for the faint of heart. I’m so excited for the future of this industry!

P.S. let’s see if there are any good crypto commercials during the Super Bowl!

Austin’s Callout

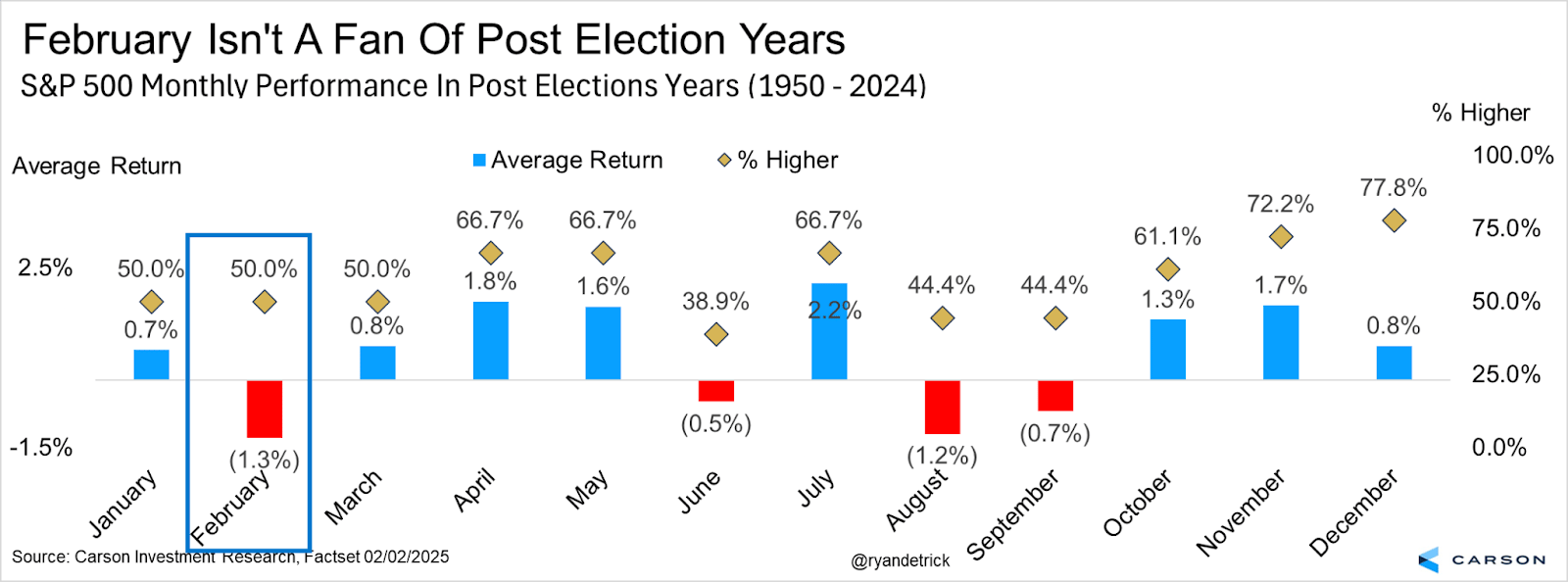

February is typically the worst month of the post-election year.

That said, what comes after tends to be just fine.

Market history tells a clear story: When the S&P 500 gains at least +2% in January (like it did this year), the index delivers a median return of +13.4% over the next 11 months, bringing the total calendar year return to +19.3% — with an 88% success rate!

So while short-term pullbacks or market weakness may grab headlines, history suggests that buying this fear has consistently paid off for the long-term investor.

This is exactly why I continue to stress the importance of a “less is more” approach. Investors who stay focused on long-term market dynamics — rather than getting caught up in daily noise — tend to come out ahead.

We’re in a bull market, and we have been for more than two years.

Trying to time the end of a bull market has rarely been a winning strategy. Markets typical grind higher by climbing a wall of worry, and history shows us that asset prices trend higher over time.

With that being said, I continue to believe double-digit pullbacks in some of our favorite names will continue to happen throughout the year — and I’ll be buying the weakness.

"The world is full of foolish gamblers, and they will not do as well as the patient investor".

The Rich Habits Radar

👉 Google stock dropped -7% after missing on Cloud growth metrics.

👉 Palantir shares rose +33% to $107 after reporting strong Q4 earnings.

👉 AMD stock fell -6.3% despite surpassing profit expectations.

👉 Spotify reported record revenue, operating income, & free cash flow.

👉 Gold hit a record high, driven by safe-haven demand amid trade tensions.

👉 Roblox plummeted -16% on disappointing bookings and a DAU miss.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures:

*Rate as of 2/6/25. APY is variable and subject to change.

**Terms and Conditions apply.

Paid endorsement for Open to the Public Investing, Inc., member FINRA & SIPC. All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Public Investing offers a High-Yield Cash Account where funds from this account are automatically deposited into partner banks where they earn interest and are eligible for FDIC insurance; Public Investing is not a bank. Cryptocurrency trading services are offered by Bakkt Crypto Solutions, LLC (NMLS ID 1828849), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative, involves a high degree of risk, and has the potential for loss of the entire amount of an investment. Cryptocurrency holdings are not protected by the FDIC or SIPC.

Alpha is an AI research tool powered by GPT-4. Alpha is experimental and may generate inaccurate responses. Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. Public makes no warranties about its accuracy, completeness, quality, or timeliness of any Alpha out. Please independently evaluate and verify any such output for your own use case.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.