Hi Everyone,

We hope you’re having a great week.

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

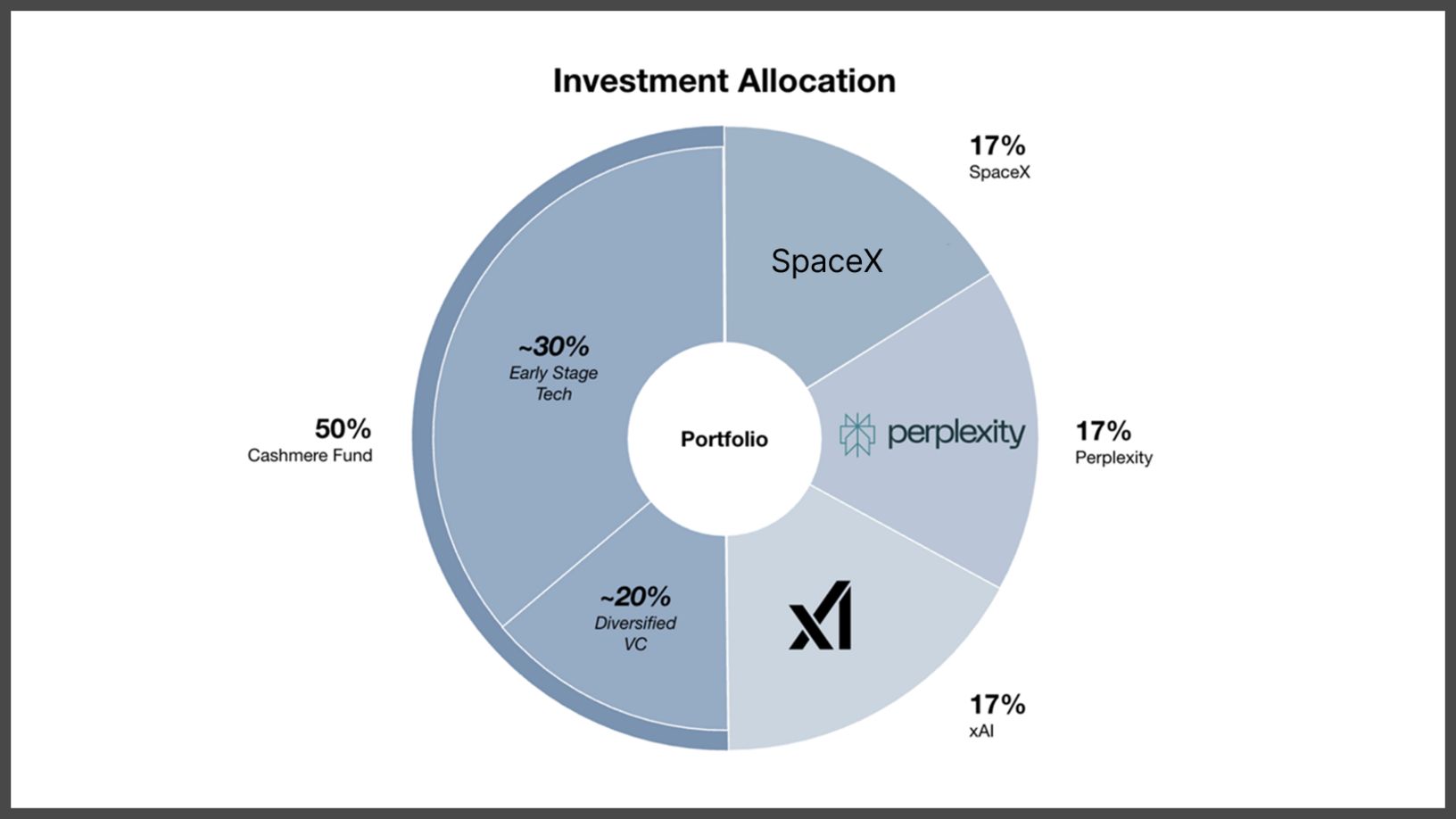

BIG NEWS — we’ve officially launched our first Multi-Asset SPV!

For the first time ever, accredited investors can invest alongside Robert and Austin in SpaceX, Perplexity, xAI, and all 38 holdings inside The Cashmere Fund (including MrBeast’s Beast Industries, Katy Perry’s De Soi, Graza, and more) — all through one single investment ($7,500 minimum).

The structure is simple, yet powerful:

17% SpaceX

17% xAI

17% Perplexity

50% Cashmere Fund

It’s a barbell approach that balances late-stage giants with early-stage disruptors — combining the stability of proven winners with the potential upside of emerging innovation.

This vehicle provides broad-based exposure across tech and consumer sectors, from Pre-Seed to Pre-IPO — and it’s all accessible through our partnership with Republic.

Because we’ve partnered with Republic, this opportunity is open to the public. As long as you’re accredited, you can participate. Feel free to share the details with your friends!

A quick breakdown — in case you don’t have the time.

⭐ U.S. technology companies are reinvesting their profits at near-record levels.

⭐ We discussed the ETF boom with Bilal Little of the New York Stock Exchange.

⭐ Investor appetite for tech stocks is off the charts.

⭐ The market’s flashing “Extreme Fear” despite being near all-time highs.

⭐ The Trump admin considers taking stakes in U.S. quantum-computing firms.

Market Overview

As of market open, 10/23/25

Chart of the Week

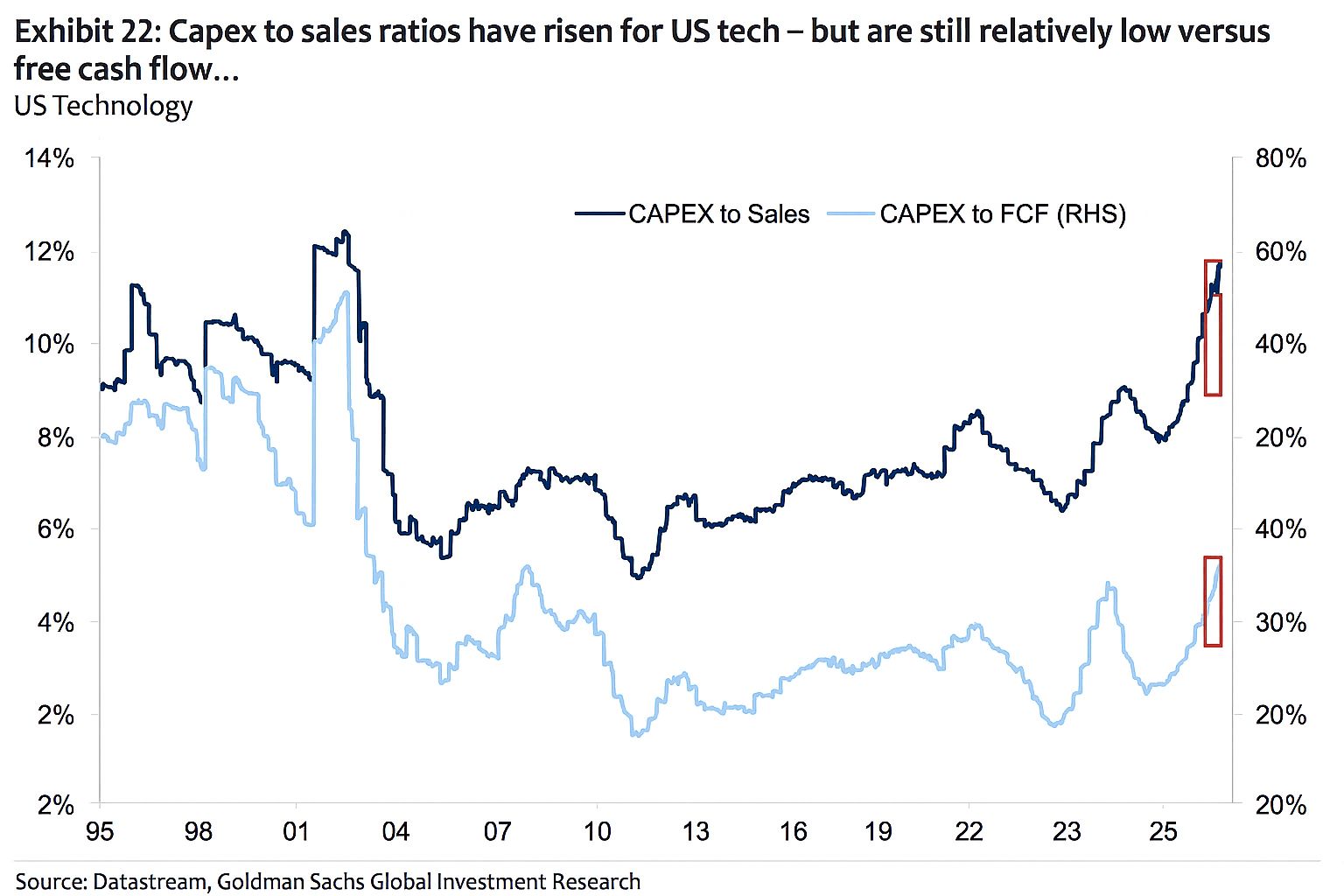

U.S. technology companies are reinvesting their profits at near-record levels.

The CapEx-to-Sales ratio just hit 11% — the highest since the dot-com boom in 2000 — and it’s up nearly 4 percentage points since 2022. That’s one of the largest surges on record, and it signals something powerful: the AI infrastructure buildout is still in full swing.

Even more telling — the CapEx-to-Free Cash Flow ratio sits around 38%, meaning most of this investment is being funded directly from profits, not debt. Back in the late 1990s, that number was closer to 60%, suggesting today’s expansion is far healthier and more sustainable.

Tech companies are spending aggressively on the future — but they’re doing it from a position of strength. This AI-driven capital cycle has the potential to redefine productivity, reshape margins, and extend the bull market far longer than most expect.

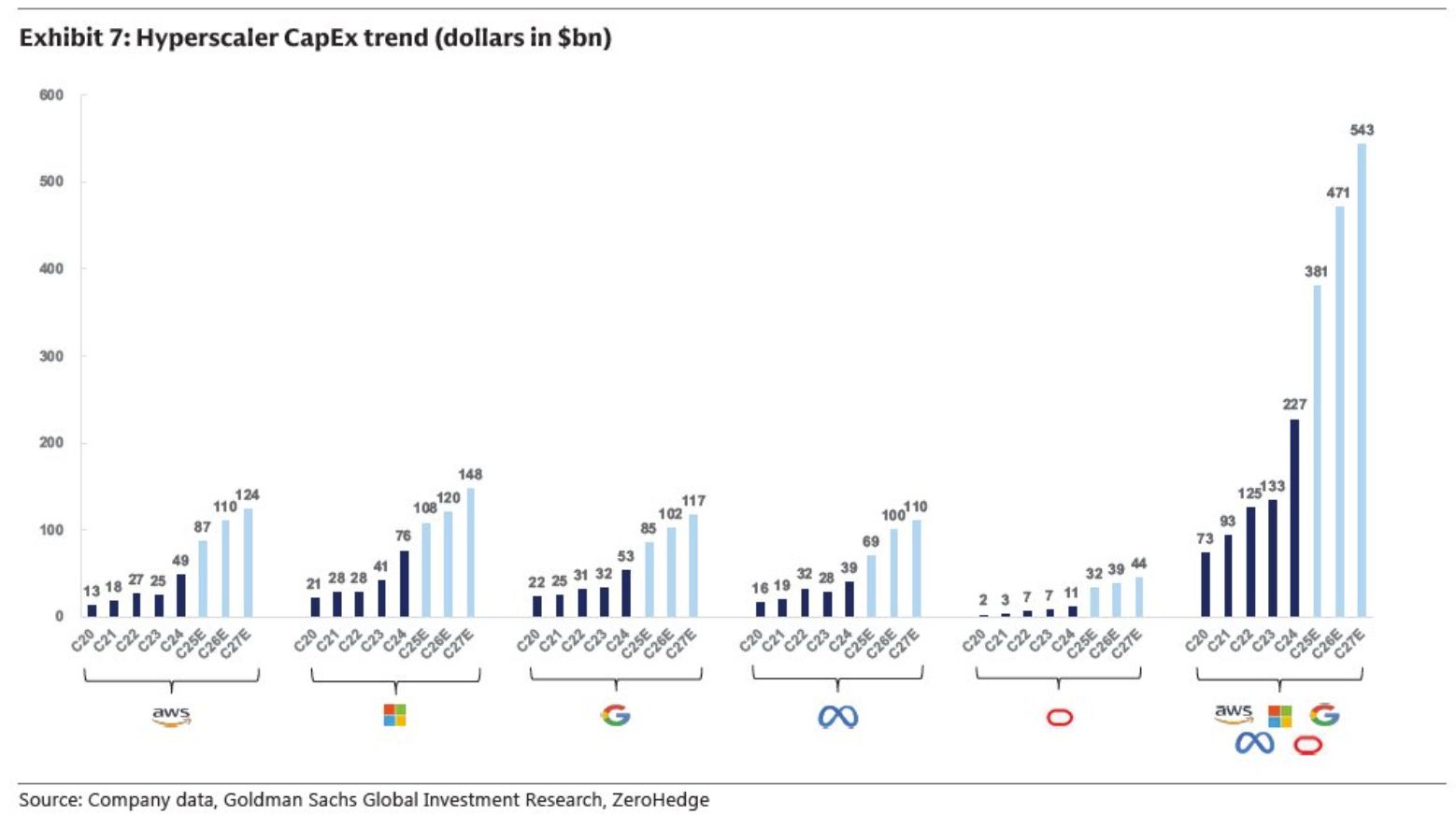

Additionally, hyperscalers are reinvesting nearly half a trillion back into their own CapEx infrastructure. Remember, the $500B to leaves their bank accounts as “expenses” are booked as $500B in “revenue” in someone else’s. The key is to find who’s receiving this as revenue as to invest early.

The bottom line — the AI investment boom still has room to run.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert sat down with Bilal Little, Director of Exchange Traded Funds at the New York Stock Exchange, to unpack one of the biggest shifts in modern investing: the global ETF boom.

With more than $53 billion flowing into ETFs every week and total assets nearing $18 trillion, these funds have officially become the preferred vehicle for millions of investors — but few people actually understand what’s inside them or how they work.

Here’s what they covered…

The Rise of ETFs — Bilal explained why ETFs have overtaken mutual funds as the go-to investment tool for both beginners and professionals. Beyond their low fees and easy access, ETFs offer a key advantage: tax efficiency. Only 5% of ETFs paid capital-gains distributions last year, compared to 43% of mutual funds — a major edge for long-term investors.

Thematic Investing & Investor Awareness — Despite the explosion of AI, clean energy, and space-themed ETFs, most new investors don’t fully understand how these products work. Bilal broke down the importance of looking “under the hood” to ensure sure your portfolio isn’t just chasing trends, but instead aligned with your goals and risk tolerance.

Diversification Done Right — With the “Magnificent Seven” making up nearly a third of the S&P 500, Bilal emphasized that many portfolios that look diversified really aren’t. He shared how ETFs can help spread risk — but only if investors understand overlapping holdings and sector exposure.

The Future of ETFs — From active ETFs (which grew +55% last year) to tokenized assets and personalized portfolios, Bilal believes the next few years will bring more innovation, customization, and access than ever before.

ETFs vs. Direct Indexing — The conversation wrapped with a comparison between ETFs and the rising popularity of direct indexing, which Public recently launched. Bilal highlighted when each approach makes sense — ETFs for simplicity and liquidity, direct indexing for tax optimization and customization.

Bilal’s insights made one thing clear: ETFs aren’t just a trend — they’re a foundation for building long-term wealth when used intentionally.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

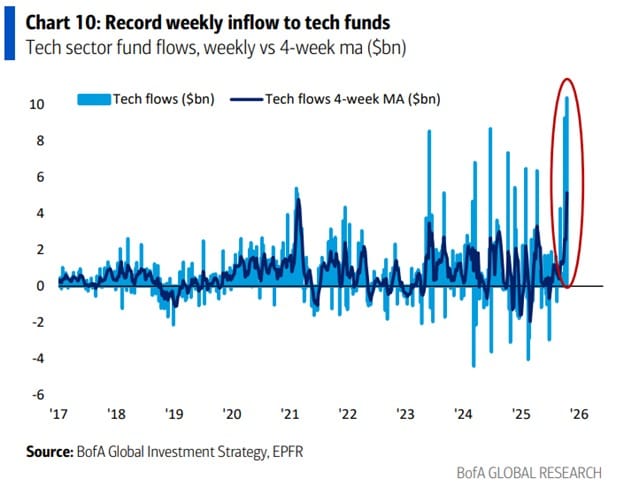

Investor appetite for tech stocks is off the charts.

Tech funds just saw a record $10.4 billion in inflows last week — on top of $9.2 billion the week before. That’s the largest two-week inflow in history, with money pouring in at a pace we haven’t seen in years.

The momentum doesn’t stop there. This marks four straight weeks of inflows, pushing the 4-week moving average to $5.2 billion, a new all-time high. Outflows? Just five weeks this entire year.

From retail investors to pension funds, capital is flowing into the same sectors driving productivity, profits, and long-term innovation. Every cycle has its story — and right now, the story is clear: investors are betting that AI will keep reshaping the global economy.

Stay disciplined, but don’t ignore what the data is telling you — momentum this strong rarely happens by accident.

Robert’s Callout

Once again, the market’s flashing “Extreme Fear” despite being near all-time highs.

And it’s all because the S&P 500 fell just -1% in a single day…

Let’s be clear: this is not the kind of sentiment you see before a crash. In fact, it’s usually the opposite. Panic over small pullbacks often marks periods of underlying strength, not weakness.

We’ve been conditioned to think every red day signals the top — but the data says otherwise. Corporate earnings are growing, liquidity is expanding, and the economy remains solid. Fear-driven selloffs in strong markets tend to be opportunities, not warnings.

So while headlines scream “volatility,” remember: investors are emotional, markets are rational over time.

If you’re investing for the long game — stay focused. Moments like these are when patient capital quietly builds generational wealth.

The Rich Habits Radar

👉 The Trump admin considers taking stakes in U.S. quantum-computing firms.

👉 Alphabet’s CEO says quantum chip achieved first-ever quantum advantage.

👉 Tesla reported Q3 earnings – revenue hit ~$28.1B, but profits missed.

👉 Netflix missed Q3 earnings - $619M Brazil tax charge hit EPS and shares fell.

👉 Oklo extended its slide after FT profiled the $20B startup with no revenue.

👉 Beyond Meat jumped 82% as meme-stock mania returned.

👉 Google confirmed it’s the developer behind a $1B data center in Indiana.

👉 Warner Bros. Discovery rejected 3 offers from Paramount as they started exploring a sale

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.1% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.