Together with Frec

Good morning,

Before we begin — we’d like to express our deepest sympathies to the hundreds of thousands of people that have personal connections to those lost on September 11th, 2001.

Yesterday was a very difficult day for a lot of people. We want to honor all of those that were killed, as well as all of the service workers that saved countless lives.

During a time of constant division, we hope that we can return to being as patriotic as we once were — after being unified in heartbreak.

Source: Chip Somodevilla / Getty

A quick breakdown — in case you just don’t have the time.

⭐ A positive inflation report gave investors some ease.

⭐ We’re impressed by the growing overlap of business and sports.

⭐ Goldman Sachs analysts aren’t fully trusting their own models.

⭐ The chance of a 25 basis point cut by the Fed rose to 93%.

⭐ Peter Thiel filed to sell up to $1B of Palantir stock.

We’re up to 447 members!

Thanks to each of you that joined this week’s livestream and for all of the questions that are pouring into our community.

To learn more — click here and watch the short video!

Market Overview

As of market close 9/11/2024

Charts of the Week

Consumer prices rose +0.2% in August; +2.5% year-over-year.

The Consumer Price Index, a broad measure of what goods and services cost across the United States economy, increased +0.2% in August. This increase put the 12-month inflation rate at +2.5% — the lowest level since February of 2021.

Remember, the Federal Reserve’s entire focus since March of 2022 has been to lower inflation back down to it’s long-standing average of +2% — and with it now standing at +2.5%, some argue they’ve accomplished that goal.

Traders and bettors are pricing in an 93% chance the Fed will approve a -0.25% interest rate reduction to the Federal Funds Rate on September 18th. This will be the first rate cut in over 4 years.

If all goes well, the Fed will have been able to successfully reduce inflation while avoiding an economic recession — but only time will tell!

Our friends at Frec just announced a major milestone, reaching $100 million in total customer assets just 9 months after launch! This is a testament to the strong demand for direct indexing, an investment strategy previously limited to clients of wealth advisors.

Frec also introduced four new indices, bringing their total to nine — the most comprehensive selection of any consumer investment platform. You can now direct index Russell 1000, 2000, and 3000, & ESG alongside Frec's flagship S&P indices and more.

Direct Indexing is nearly identical to investing in ETFs, but with a key advantage: it allows you to reap tax benefits by directly owning the underlying stocks. This unlocks significant tax loss harvesting, which is automatically captured by Frec.

The end result? You get market performance with added “tax deduction points” that you can use to offset any capital gains you might have. Best part is, if you don’t use them in a particular year, they carry over indefinitely until they’re used.

We personally invest with Frec, and are really impressed with the tax-loss harvesting capabilities that this company has unlocked for the everyday person.

Check out Frec, click here!

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin spoke with professional athlete and business mogul Paul Rabil. They discussed the following:

Creating a Professional Sports League from Scratch — The intersection of sports and business is booming. Paul discussed how the lifetime value (LTV) of a customer in sports is 30-60 years — which means once you actually acquire a customer, they’re a customer for life. Between media rights, corporate ads, creators, equity for players, merchandise, and ticketing — the “big business of sports” is only getting bigger.

Investing Into Startups — Paul has his own investment firm called Rabil Ventures, and was actually an early investor into Public! He reiterated a lot of what we’ve said about private investments — they are risky and you have to be prepared to lose the money in the process. However, taking some chances on companies that you believe in can be a very rewarding experience.

Learned Experience from Failure — Whether it’s in sports or investing, Paul shared that he values all of the hardships he’s endured. Both physical pain (on the field) and mental pain (from business mistakes) should be treated as lessons that were necessary in the pursuit of your goals. Having an internal fire to learn from your mistakes and grow your business acumen over time is the most important mindset to have.

This was the first time that we’ve ever had someone from the sports world on the show — let us know what you thought!

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from the following members of the Rich Habits Network: Paige M, Silvia & Kayla R, Hannah T, and Dhanishth K

We answered questions from the following emails: Rebecca B, Jacob, and Carson

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content.

Robert’s Callout

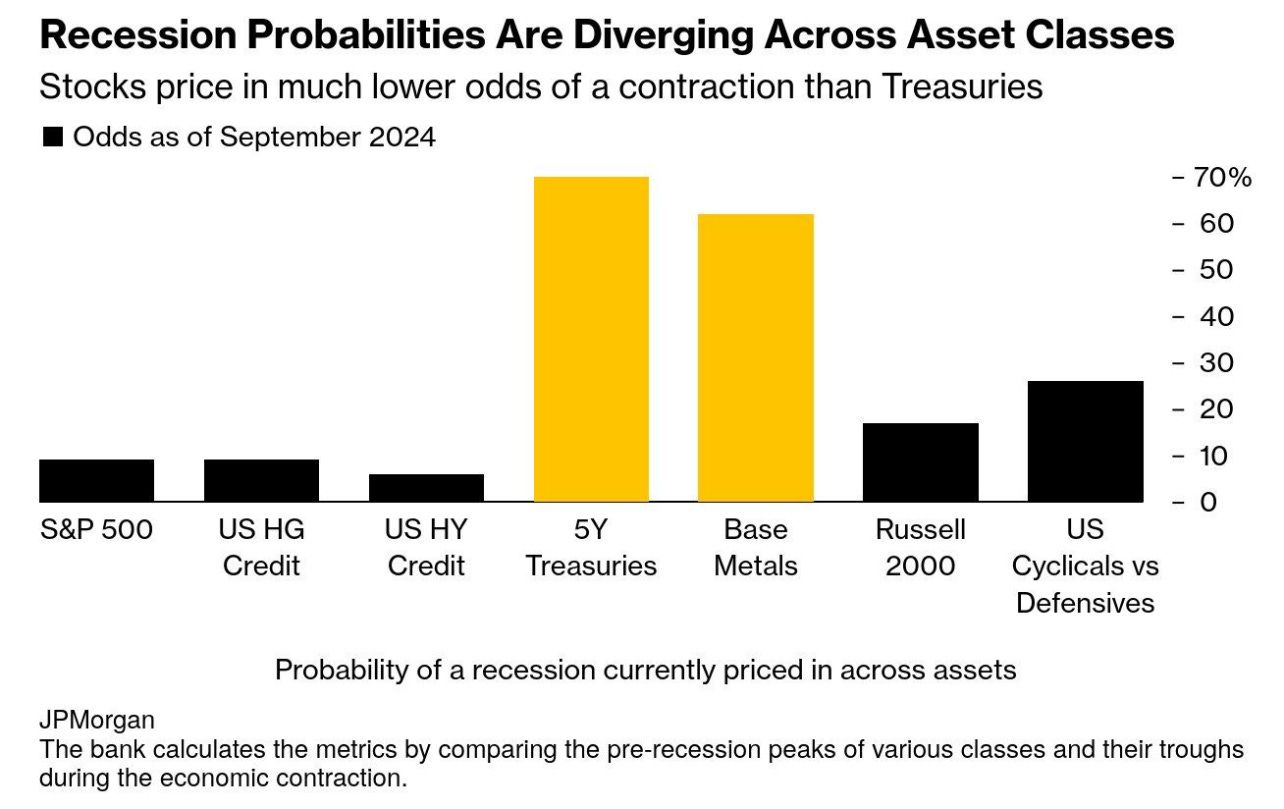

Source: Bloomberg

Data models from Goldman Sachs and JPMorgan are seeing rising recession risks based on Treasuries and Base Metals.

According to recent reports, rate markets are signaling a growing chance of economic slowdown. Goldman Sachs recently estimated a 41% probability of a U.S. recession — up from 29% in April. JPMorgan calculates the odds at 31% — jumping from 20% since March. These increases are driven by repricing in U.S. Treasuries and expectations of aggressive Fed rate cuts.

However, despite these market signals, economists and analysts still predict a soft landing for the economy. Goldman’s own economists are going against their market models and estimate a recession probability of just 25%. They also claim that credit markets aren’t flashing significant concern.

Goldman’s not even trusting their own models… so where does that leave investors?

While it’s essential to be aware of rising recession risks, it’s also crucial to not overreact to constantly-changing predictions. Keep an eye on key indicators, but don’t stray from your long-term strategy.

I still personally think that a pullback in the markets would lead to small caps performing well ($IWMI) and there’s no way I’m selling my crypto anytime soon!

Austin’s Callout

There’s now a 93% chance the Fed will cut rates by -0.25% in September.

These odds are up from only ~60% just one short week ago. The reason for the immediate increase in odds is the Consumer Price Index — specifically it being in-line with economist expectations for the month of August.

It’s a major reason why we saw the market rally on Wednesday — it loves predictability. It now looks nearly certain that there will be a 25 basis point cut, so the market “knows” that a crazy surprise isn’t coming from Jerome Powell and the Fed.

With this new reassurance, still comes a lot to be discovered. Beaumont Capital argues that the messaging of hawkish vs. dovish language from the Fed could be even more important than the rate cut itself.

As we’ve discussed before, the stock market and the economy are two completely different things. The former is forward-looking, the latter is revealing data from the past. I continue to have a cautious eye toward economic data, but I refuse to let it spook me away from my dollar-cost averaging — especially as I begin to add “defensive” stocks to my portfolio (shown below).

I still believe that a large storyline for 2024 has been the broadening of the market. We’ll see if the beginning of Fed rate cuts lead to more rotation toward the “defensive” market sectors highlighted above.

The Rich Habits Radar

👉 Apple introduced the iPhone 16 and iPhone 16 Plus.

👉 Starbucks’ new CEO wrote an open letter, wants better service.

👉 Berkshire Hathaway sold even more Bank of America stock.

👉 Amazon Web Services will invest over $10B in U.K. data centers.

👉 Peter Thiel filed to sell up to $1B of Palantir stock.

👉 Big Lots filed for Chapter 11 bankruptcy, plans to sell its assets.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.