Together with Roi

Good morning,

A quick breakdown — in case you just don’t have the time.

⭐ Wall Street sees +18% upside for Microsoft’s stock.

⭐ How the Fed’s rate cuts will impact you and your money.

⭐ The US National Debt just surpassed $35 trillion.

⭐ Cybercrimes are expected to cost $13.8 trillion annually by 2028.

⭐ NBCUniversal is set to surpass $1.25B in ad sales for the Olympics.

⭐ Download our FREE budgeting template!

Market Overview

As of market close on 7/31/2024

Chart of the Week

Microsoft delivered a monster quarter for artificial intelligence.

The world’s 2nd largest publicly-traded company by market capitalization reported their Q2 earnings Tuesday afternoon — and despite it being “business as usual,” artificial intelligence took center stage once again.

Specifically, Microsoft’s Intelligent Cloud business segment delivered $26.6 billion in revenue — catalyzed by Azure’s continued AI adoption. AI Services contributed +8% of Azure’s +29% year-over-year growth during the quarter — with over 60,000 businesses now classified as “Azure AI customers.”

Wall Street is expecting Azure’s growth to reaccelerate throughout the back-half of the year as investments increase available capacity to serve the growing demand.

Wall Street gives Microsoft a $497 12-month price target, representing +18% in potential upside from current prices. We definitely classify Microsoft as a blue chip stock in our own portfolios!

“We view Q2 as a quarter where the stock is growing into a premium multiple. We believe Microsoft is uniquely positioned to consolidate the $151 billion addressable market for AI infrastructure and applications with a comprehensive AI offering.”

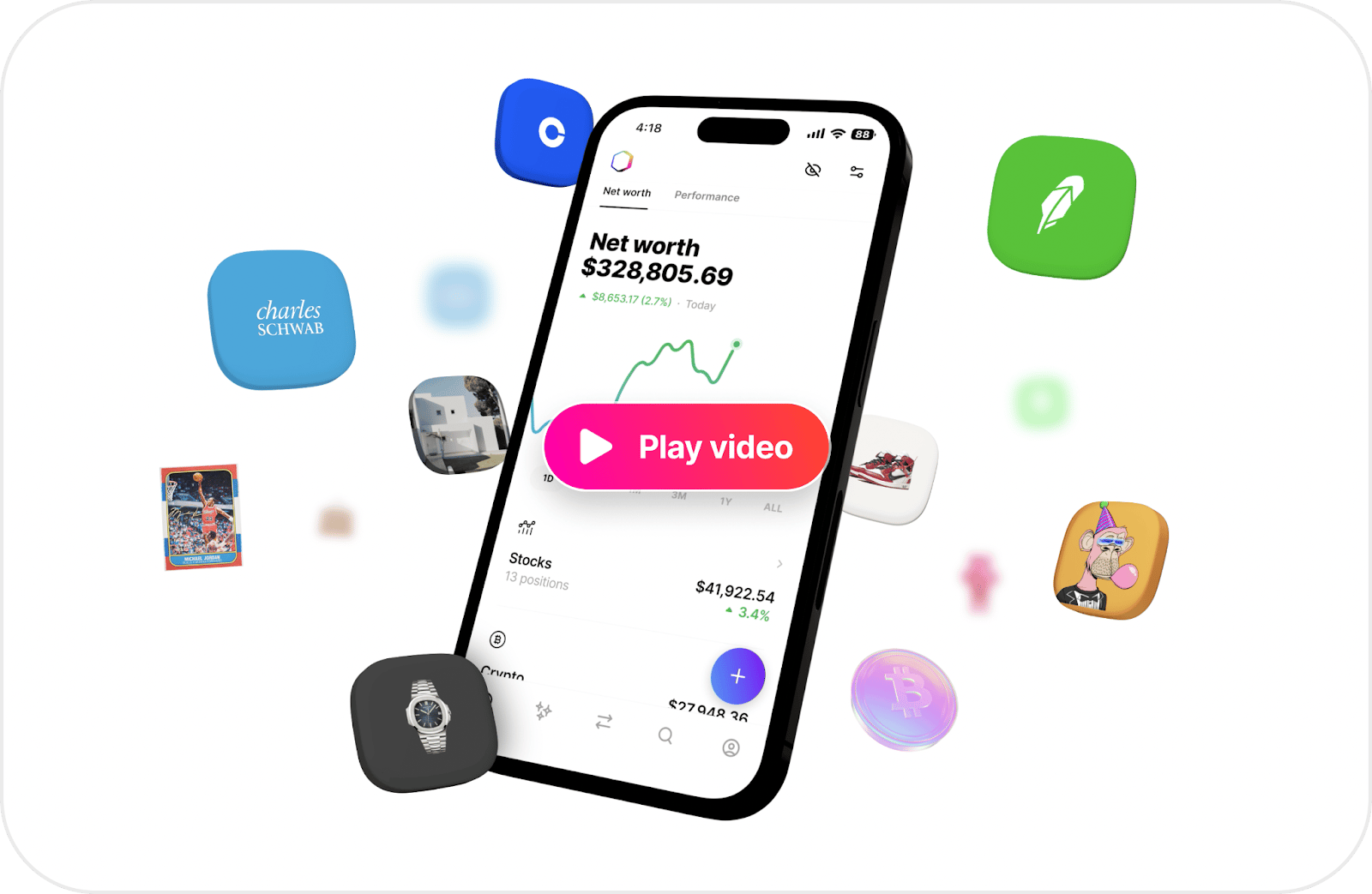

As a listener of the Rich Habits Podcast, you know how important it is to track your net worth. However, most tools out there are unreliable and inaccurate.

Introducing Roi — the best app to know and grow your net worth across all your existing accounts.

They support literally everything from your stocks to cash, bonds, crypto, company equity (Carta), collectibles, and more.

It’s the first app that lets you track your all investments, as well as place trades across all your existing accounts as well. You can buy and sell stocks through your Robinhood, Charles Schwab, Public (soon), Coinbase accounts all directly in their Roi app.

Roi connects with over 10,000 different platforms where you might have your money or investments.

Tracking your net worth on Roi is free — but if you want portfolio insights or to copy the trades of investors like Pelosi, you can get one month of Premium free with our code “HABITS”.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin explained how the upcoming rate cuts by the Federal Reserve will impact you and your money.

Housing — despite the Federal Funds rate and mortgage rates NOT being directly tied to one another, they’re very much connected! As the Fed begins to cut rates in September, expect mortgage rates to come down as well. Lower interest rates = lower monthly payments for borrowers, potentially causing home prices to rise.

Stock Market — historically, when the Fed would cut interest rates the stock market would climb higher. However, it’s important to remember why the Fed is cutting interest rates… to stimulate the economy. If the Fed can successfully cut rates while keeping the economy out of a recession, we suspect stock prices will continue to rise over time.

Your Debt — the Fed raising interest rates in 2022 made it more expensive to borrow money, as the average APR on credit cards rose +14% to over 30% in only 18-months. As the Fed begins to cut rates later this year, expect some relief when borrowing money from your local credit union or bank!

High Yield Savings Accounts — the APY you earn on your high-yield savings is directly tied to the bond market. As the Fed cuts rates, bond yields fall — causing your APY to fall as well. Don’t be surprised if you begin to see your HYSA account paying less and less over time.

Here’s a link to the Q&A episode that was posted THIS MORNING.

Reply to this email with your questions so that we can answer them in the next week’s edition! Be sure to watch the video version of our podcast on Spotify — or simply listen on Apple Podcasts, or wherever you listen to podcasts.

Robert’s Callout

The US National Debt has increased by +$5B every single day in 2024.

Since 2016, the US national debt has increased by +75% — with the alarm bells seeming to fall on deaf ears. Washington policymakers have taken little action to limit deficits in recent years, with the debt now representing 120% of GDP after a peak of 125% during 2020.

The Congressional Budget Office is now projecting the debt could represent as much as 166% of America’s GDP by 2054.

I’ve said it once, and I’ll say it again — buy some Bitcoin.

Who knows where all of this is headed, especially as we enter another presidential election cycle. It’s becoming increasingly important to diversify into alternative asset classes, like Bitcoin, Gold, and Real Estate, as the national debt seemingly climbs higher every year.

Austin’s Callout

Cybercrime is expected to skyrocket through 2028.

Despite Crowdstrike causing 8 million Microsoft computers to experience the “blue screen of death,” this wasn’t a cybercrime. However, with the exponential rise of artificial intelligence and cloud computing it doesn’t take a rocket scientist to conclude cybercrimes will become much more common.

According to Statista, the annual cost of cybercrimes worldwide are expected to eclipse $13.8 trillion by 2028 — a +49% increase when compared to 2024’s estimates.

AT&T was recently the victim of a cybercrime, with the hackers stealing data from 110 million customers worldwide. We later found out the hackers were exploiting a bug inside of Snowflake, a popular data center company.

Additionally, Google just tried to acquire Wiz, a cybersecurity company, for $23 billion before being told “No” by their CEO. If Google is willing to spend that kind of money on a cybersecurity product — I’m willing to be an investor in the space!

Regardless of your perspective on AI or cloud computing, I would argue cybersecurity companies have never been more important. Personally, I own stock in Palo Alto Networks (PANW), Crowdstrike (CRWD), and SentinelOne (S).

The Rich Habits Radar

👉 Fed Chair Powell said September rate cuts are “on the table.”

👉 Airbnb is considering adding chefs and massages to its offerings.

👉 Taco Bell will roll out AI drive-thru ordering in hundreds of locations.

👉 Meta Reality Labs posted a $4B+ operating loss.

👉 Texas won $1.4B in a lawsuit against Meta about biometric data.

👉 NBCUniversal set to surpass $1.25B in ad sales for the Olympics.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.