Good morning,

A quick breakdown — in case you don’t have the time.

⭐ Bitcoin is now the 7th most valuable asset in the world.

⭐ We broke down how you can best review your own portfolio.

⭐ Mortgage applications are down -50% from 2019, hitting 30-year lows.

⭐ Years during which the S&P 500 returns +30% or more aren’t all that rare.

⭐ Nvidia’s revenue surged +94% year-over-year, AI demand seems strong.

Market Overview

As of market open, 11/21/2024

Chart of the Week

Bitcoin is now the 7th most valuable asset in the world.

Over the last 22 months (start of 2023), the price of Bitcoin has skyrocketed +473% to eclipse $95,000 for the first time in its history. At $95,000 per Bitcoin, this places the asset in 7th place by market cap behind only Amazon, Google, Microsoft, Apple, Nvidia, and all of the world’s physical Gold.

This chart does a wonderful job of illustrating just how big Bitcoin has become, as well puts in perspective just “how high” it could go. For example, you might recall seeing people like Cathie Wood or Michael Saylor predicting Bitcoin will reach $13M over the next 20 years. If that was the case, Bitcoin’s market cap would be equal to $257 trillion — 15X that of all the physical Gold in the world, and 2X the combined GDP of the entire world.

Quite a sensational prediction.

When thinking about your own “profit-taking strategy” for Bitcoin, keep these market caps in mind — and ask yourself: what’s realistic, and what’s not?

With all eyes on Bitcoin, it’s our assumption the asset will trend higher and eventually break above $100K by the end of the year. Once that happens, nobody knows what 2025 will bring.

This is your friendly reminder to be realistic, take profits, and have a plan. Emotions run wild when the “unrealized gains” section of your portfolio is higher than its ever been — keep a cool head.

Public launches the Bond Account, offering a 7.05%* yield.

You may know Public as the all-in-one investing platform where you can build a multi-asset portfolio of stocks, options, bonds, and more. Now, Public has taken another step in making fixed-income investing more accessible with the launch of its Bond Account.

At a time when bond yields are at their highest levels in years, the Bond Account allows you to lock in a 7.05%* yield. In just a few clicks, you can now invest in a diversified portfolio of ten investment-grade and high-yield bonds that generate 20 interest payments annually.

With the Fed preparing for what many expect to be a series of rate cuts, the Bond Account offers a timely opportunity to lock in today’s historically high bond yields.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin walk their listeners through how to conduct an “end of year” portfolio performance review.

Here’s what they shared:

Deciphering Your Employer’s Match — 72% of Americans participate in their employer’s 401(k), and chances are they’re getting some sort of contribution match along the way. With that being said, not all matches are created equal. If you’re contributing to your 401(k) and your employer is matching your contributions, you need to understand if it’s a partial match or a complete match. Additionally, be sure to read the fine print — specifically if it has a vesting schedule and a cliff. It’s also important to know what they’re matching your contributions with — is it company stock or cash?

Comparing Your Holdings and Weightings — There are countless 401(k) providers out there, and they all do one of two things: 1) invest your money on your behalf, or 2) allow you to invest your money yourself. If they’re investing on your behalf, make sure you’re as aggressive as you should be. If you’re investing on your own, make sure you’re choosing the low-cost ETFs and index funds we recommend.

Roth IRA Contributions and Holdings — Do NOT treat your Roth IRA as an account to gamble with. Instead, treat this account as a “Do not touch” account — allowing you to build wealth over time and enjoy the “8th wonder of the world,” compound interest. We recommend having a mix of low-cost ETFs and index funds in this account, and contributing to it often!

Don’t forget to benchmark your year-to-date portfolio returns against the S&P 500 — for example, if your portfolio isn’t up at least 25% in 2024, you’re doing something wrong. You must be performing the same if not better than the S&P 500 every single year. If you’re not, understand the problem and fix it!

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

Mortgage applications are down -50% from 2019, hitting 30-year lows.

According to the Mortgage Bankers Association, the Mortgage Application Index has experienced steady declines year after year since 2019. Mortgage applications are a real-time leading indicator of home sales. Considering how low the application volume is (and continues to trend), very low home sale figures will likely be reported over the next 30-60 days.

As you all might remember, this wasn’t supposed to happen! We further explained why mortgage interest rates have been rising as of late in last week’s Rich Habits Newsletter (linked here) — causing homebuyers to remain on the sidelines.

Beyond high interest rates, homebuyer sentiment is low — with 84% of Americans saying it’s a bad time to buy a home in late-2024 according to the University of Michigan Sentiment Survey. Additionally, prices remain elevated. Despite every TikTok Guru calling for a “crash” in 2023 and 2024 … we’ve yet to see one.

If you’re someone who’s waiting for interest rates to come down a bit before buying — don’t. If you can afford to buy, don’t wait. If you can’t afford to buy, continue to save until you can. We’re firm believers that everyone should own a house one day, as it adds predictability in your budget to the largest monthly line item (housing).

Austin’s Callout

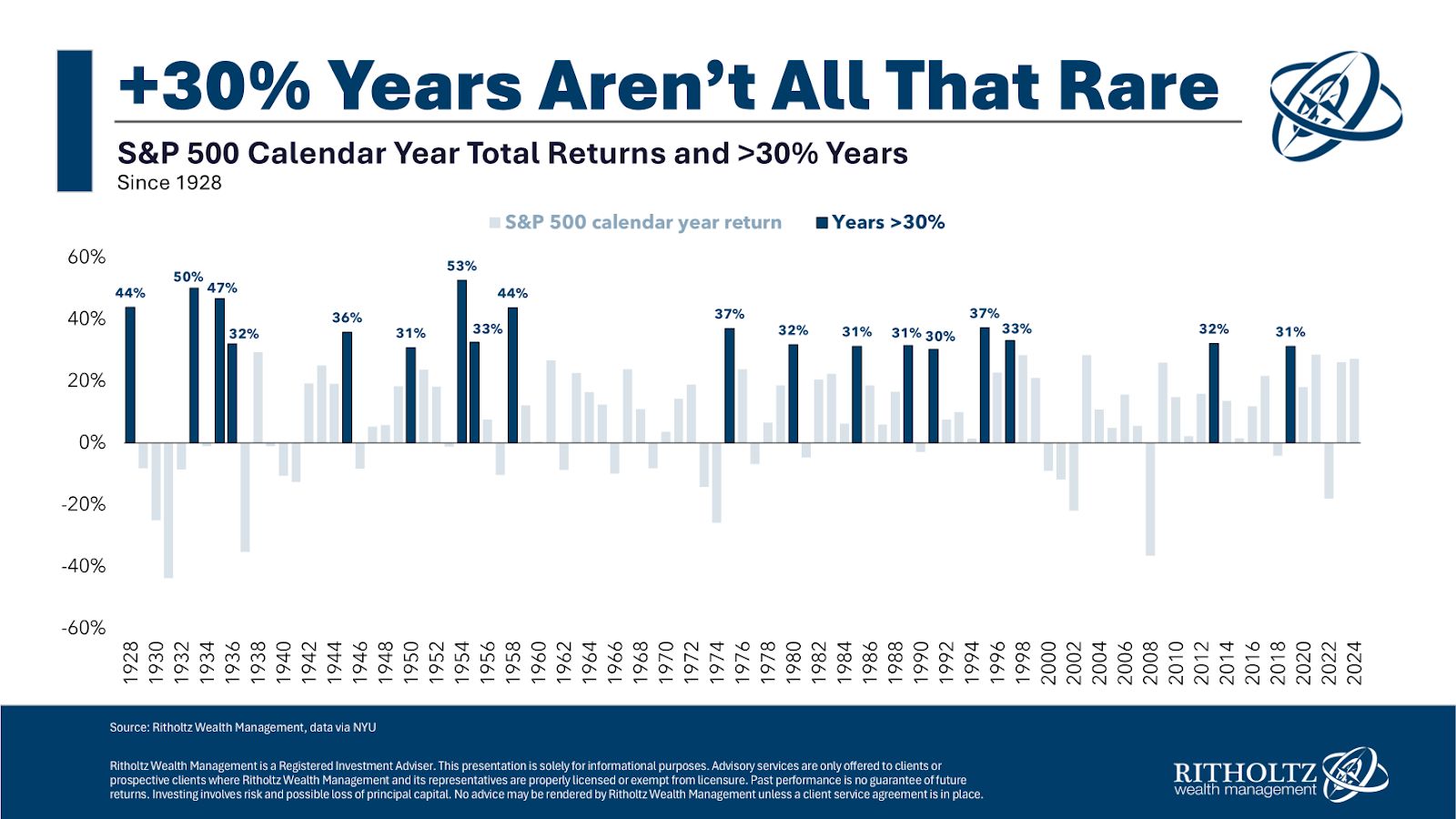

Years during which the S&P 500 returns +30% or more aren’t all that rare.

With six trading weeks left during 2024, it’s very possible we experience a +30% year in the markets. This momentum is extraordinary, especially when you consider the +27% year we experienced in 2023.

If we were to have a +30% year in 2024, this would mark the 19th time this has happened since the inception of the S&P 500 in 1923 — meaning 30% years occur 19.8% of the time. Statistically speaking, that’s a 1-in-5 chance… and I like my chances!

This is a reminder to never forget the saying “Bears sound smart, Bulls make money.” The stock market inherently needs a reason to go down, it does not need a reason to go up. American capitalism at work!

The Rich Habits Radar

👉 Nvidia’s revenue surged +94% year-over-year, AI demand seems strong.

👉 Alibaba will integrate e-commerce operations into a single business group.

👉 Google might be forced by the Justice Department to sell Chrome.

👉 Comcast announced plan to spin-off all of NBCUniversal’s cable networks.

👉 Target had once of its worst trading days ever after a brutal earnings report.

👉 Blackstone bought a majority stake in Jersey Mike’s Subs ($8B valuation).

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves risk. Brokerage services for US listed securities, options and bonds in a self-directed brokerage account are offered by Public Investing, member FINRA & SIPC. Not investment advice.

*This yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees, as of 11/21/2024. Because the YTW of each bond is a function of that bond’s market price, which can fluctuate, your yield at time of purchase may be different from the yield shown here and your YTW is not “locked in” until the time of purchase. A bond’s YTW is not guaranteed; you can earn less than that YTW if you do not hold the bonds to maturity or the issuer defaults.

A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this account are used to purchase 10 investment-grade and high-yield bonds. The 7.05% yield is the average, annualized yield to worst (YTW) across all ten bonds in the Bond Account, before fees, as of 11/21/2024. A bond’s yield is a function of its market price, which can fluctuate; therefore a bond’s YTW is not “locked in” until the bond is purchased, and your yield at time of purchase may be different from the yield shown here. The “locked in” YTW is not guaranteed; you may receive less than the YTW of the bonds in the Bond Account if you sell any of the bonds before maturity or if the issuer defaults on the bond. Public Investing charges a markup on each bond trade. See our Fee Schedule.

Bond Accounts are not recommendations of individual bonds or default allocations. The bonds in the Bond Account have not been selected based on your needs or risk profile. You should evaluate each bond before investing in a Bond Account. The bonds in your Bond Account will not be rebalanced and allocations will not be updated, except for Corporate Actions.

Fractional Bonds also carry additional risks including that they are only available on Public and cannot be transferred to other brokerages. Read more about the risks associated with fixed income and fractional bonds. See Bond Account Disclosures to learn more

While corporate bond yields should fall in reaction to a Federal Reserve rate cut, we cannot know whether that will be true of the bonds in the Bond Account, how quickly bond yields will respond, or how much they will decline.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.