Together with Sequence

Hi Everyone,

We hope you’re continuing to stay safe through any winter weather conditions. Don’t slip on the ice!

Before you read on — make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ Gold demand just had a historic year — and the flows explain why.

⭐ We broke down financial “red flags” and “green flags” for 2026.

⭐ The dollar just sent a signal markets don’t usually ignore.

⭐ AI adoption in the workplace is accelerating — but it’s far from universal.

⭐ Microsoft beat earnings as cloud and AI revenue continued to accelerate.

Members of the Rich Habits Network have had the opportunity to invest in the following companies over the last several months:

Ongoing opportunities include:

More to be announced in next two weeks

It has come to our attention that many of you may not fully understand what it means to invest alongside Robert and Austin in startups and pre-IPO companies.

Over the last 18 months, we’ve provided opportunities for hundreds of accredited investors invest millions of dollars into over a dozen companies (including the ones shown above).

Market Overview

As of market open, 1/29/26

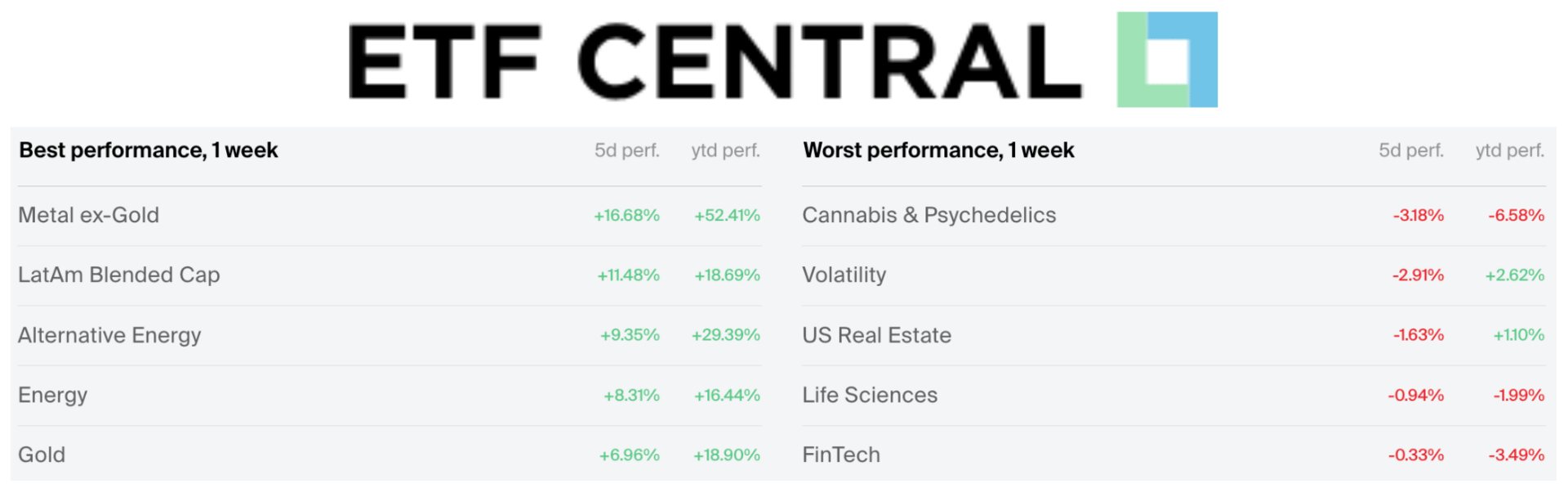

ETF Winners & Losers

Chart of the Week

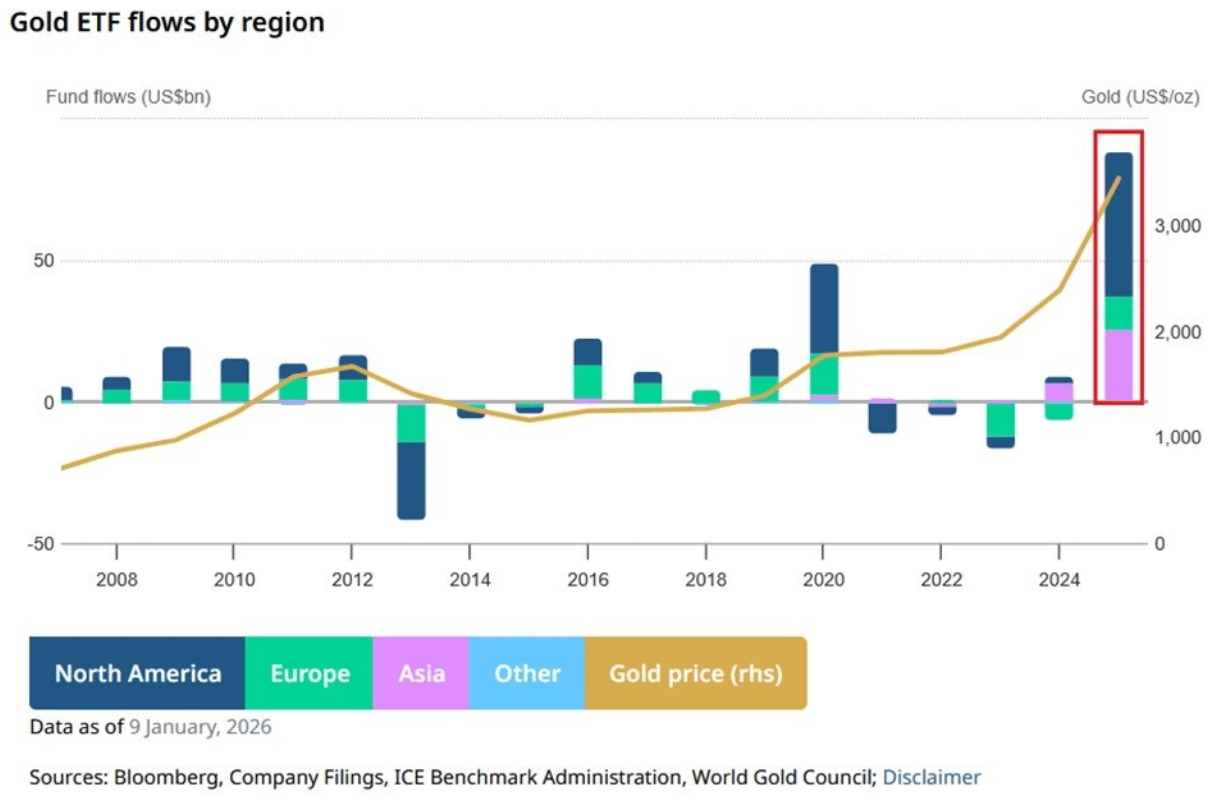

Gold demand just had a historic year — and the flows explain why.

Global gold ETFs pulled in a record $88.6 billion of inflows in 2025, the strongest year on record. North America led the way with $50.7 billion, followed by Asia at $25.3 billion and Europe at $11.7 billion — marking only the second year of positive inflows over the past five.

The acceleration picked up late in the year. December alone saw $10 billion of inflows, one of the strongest months of 2025, pushing total assets under management up 114% to a record $582.9 billion. In tonnage terms, ETF demand reached 801 tonnes — the second-highest annual total ever, trailing only the pandemic-driven surge in 2020.

Price action has followed the flows. Gold futures are up more than $1,000 per ounce on the month, hitting record highs and tracking toward the largest monthly dollar gain in history.

This isn’t just a momentum trade. Persistent ETF inflows signal sustained demand for protection against policy uncertainty, geopolitical risk, and shifting monetary conditions — themes that continue to shape investor behavior heading into 2026.

As you might remember from our “2026 Market Predictions” episode, we believe Copper will be the next precious metal to hit center stage. COPX is already up +25% since that episode, with many copper miners up much more than that. Keep an eye on this one!

Today’s Rich Habits Newsletter is brought to you by Sequence — the platform that turns good money habits into automatic systems.

Rich Habits teaches you what to do with your money. Sequence makes sure it actually happens — automatically.

Together, we built the Rich Habits Money Map, a plug-and-play setup for personal and business finances that helps you save, invest, and make your money work for you without relying on willpower.

With Sequence, you can:

Automatically save first and invest consistently every time you get paid

Route money for taxes, debt repayment, and goals using simple rules

Manage personal and business finances in one clean, automated system

Get expert help to tailor your Money Map to your specific situation

If you want your Rich Habits to run on autopilot, check out the Rich Habits Money Map at getsequence.io/richhabitspodcast.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert break down the financial green flags that predict wealth in 2026, and the red flags that quietly hold people back.

This episode isn’t about obvious advice. It’s about subtle habits that compound over time — either working for you or against you.

Here’s what they covered…

Green Flag #1: Tracking Net Worth, Not Just Income — Wealthy people focus on what they own minus what they owe. Income looks good on paper, but net worth tells the truth about whether you’re actually getting richer.

Green Flag #2: Investing Before Spending — The wealthy invest automatically first, then build their lifestyle around what’s left. When investing happens last, it rarely happens consistently.

Green Flag #3: Always Learning About Money — Building wealth requires continuously improving your understanding of investing, taxes, and financial systems — and acting on what you learn.

Red Flag #1: Buying Things Just Because They’re on Sale — Discounts feel productive, but often lead to unnecessary spending. A deal is only a deal if you were going to buy it anyway.

Red Flag #2: Monthly “Emergencies” — If emergencies happen every month, they’re really just predictable expenses that weren’t planned for. Wealthy people forecast; broke people react.

Red Flag #3: Waiting for the Perfect Time — Delaying investing while waiting for ideal conditions is one of the most expensive mistakes you can make. Consistency beats perfect timing.

The takeaway: fix red flags before stacking green ones. Small habit shifts, applied consistently, are what separate people who build wealth from those who stay stuck.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

The dollar just sent a signal markets don’t usually ignore.

The U.S. Dollar Index suffered its biggest single-day drop since last year’s tariff-driven selloff, falling back to levels last seen in early 2022. What made the move notable is the backdrop: Treasury yields were rising and the Fed was expected to hold rates steady — conditions that typically support the dollar.

Instead, the currency weakened sharply. Part of the move reflects renewed strength in the Japanese yen amid speculation of policy intervention, but broader forces are at work. Growing fiscal concerns, political polarization, and increasing pressure on the Federal Reserve have begun to weigh on investor sentiment toward the dollar.

For markets, dollar weakness is less about U.S. economic decline and more about shifting global risk appetite. With U.S. equities at all-time highs and non-U.S. markets outperforming, capital is rotating — and the dollar is adjusting accordingly.

This screams “emerging markets.” Consider learning more about the sector, and perhaps adding some shares of EEM to your own portfolio.

Robert’s Callout

AI adoption in the workplace is accelerating — but it’s far from universal.

A new Gallup survey shows AI use continued to rise in late 2025, with daily, frequent, and overall usage all increasing in Q4. In just over two years, the share of U.S. employees using AI every day at work has tripled, while those using it at least weekly or occasionally have more than doubled.

That said, adoption remains uneven. As of Q4 2025, only 12% of workers report using AI daily, up from 4% in mid-2023. Nearly a third of tech workers now use AI every day, compared with just 8% in government and community services — and nearly half of the U.S. workforce still says they never use AI on the job.

The takeaway is less about hype and more about diffusion. AI is becoming embedded where it clearly boosts productivity, while large parts of the economy remain largely untouched.

For markets, this suggests the AI story is still early and structural. Productivity gains are building gradually — not all at once — and the economic impact is likely to unfold over years, not quarters.

The Rich Habits Radar

👉 Tesla stock soared after disclosing a $2B investment in xAI.

👉 Microsoft beat earnings as cloud and AI revenue continued to accelerate.

👉 Meta crushed earnings, posting strong ad growth and expanding margins.

👉 ASML beat earnings & reaffirmed demand driven by AI chip spending.

👉 Amazon announced plans to lay off roughly 16,000 employees.

👉 Coreweave stock jumps after Nvidia announced a $2B investment.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.3% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Timeshare Exit — Exit an unwanted timeshare

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: This content is sponsored by NEOS Investments. The creator is compensated by NEOS to discuss NEOS ETFs. This content is for informational purposes only, and is not personalized investment, tax, or legal advice, and does not constitute an offer to buy or sell any security. Investing involves risk, including possible loss of principal. Before investing, carefully review the NEOS ETFs prospectus at neosfunds.com.