Together with Roi

Happy Labor Day Weekend!

A quick breakdown — in case you just don’t have the time.

⭐ $35,136 less of portfolio value from missing the 10 best market days.

⭐ Three ways to generate passive income

⭐ The Home Price Index remains at all-time highs.

⭐ The market broadening can be considered a bullish indicator.

⭐ Berkshire Hathaway hit a $1T market cap for the first time.

⭐ Join our weekly livestreams through the Rich Habits Network!

Market Overview

As of market open 8/29/2024

Chart of the Week

Visual Capital

Bad timing can take a bite out of returns.

Above is a chart by Visual Capital that illustrates what $10,000 invested into the S&P 500 would turn into if you missed only ten of the best performing trading days over a 20-year period of time.

If you stayed invested, your $10,000 would be worth $64,844 — a wonderful +549% return on your investment, or an average annual return of +9.8%. If you had missed out on the ten best trading days … only ten… your returns would shrink to $29,708!

Think about it like this — every year the stock market offers 252 trading days to investors. Stretched out over 20 years that’s 5,040 trading days. If you were uninvested during only ten of those 5,040 trading days your gains would have been cut in half.

The craziest part about that statistic is that seven of those ten best trading days happened during bear markets! This is why we always encourage our listeners to stay invested during times of volatility and ride the wave.

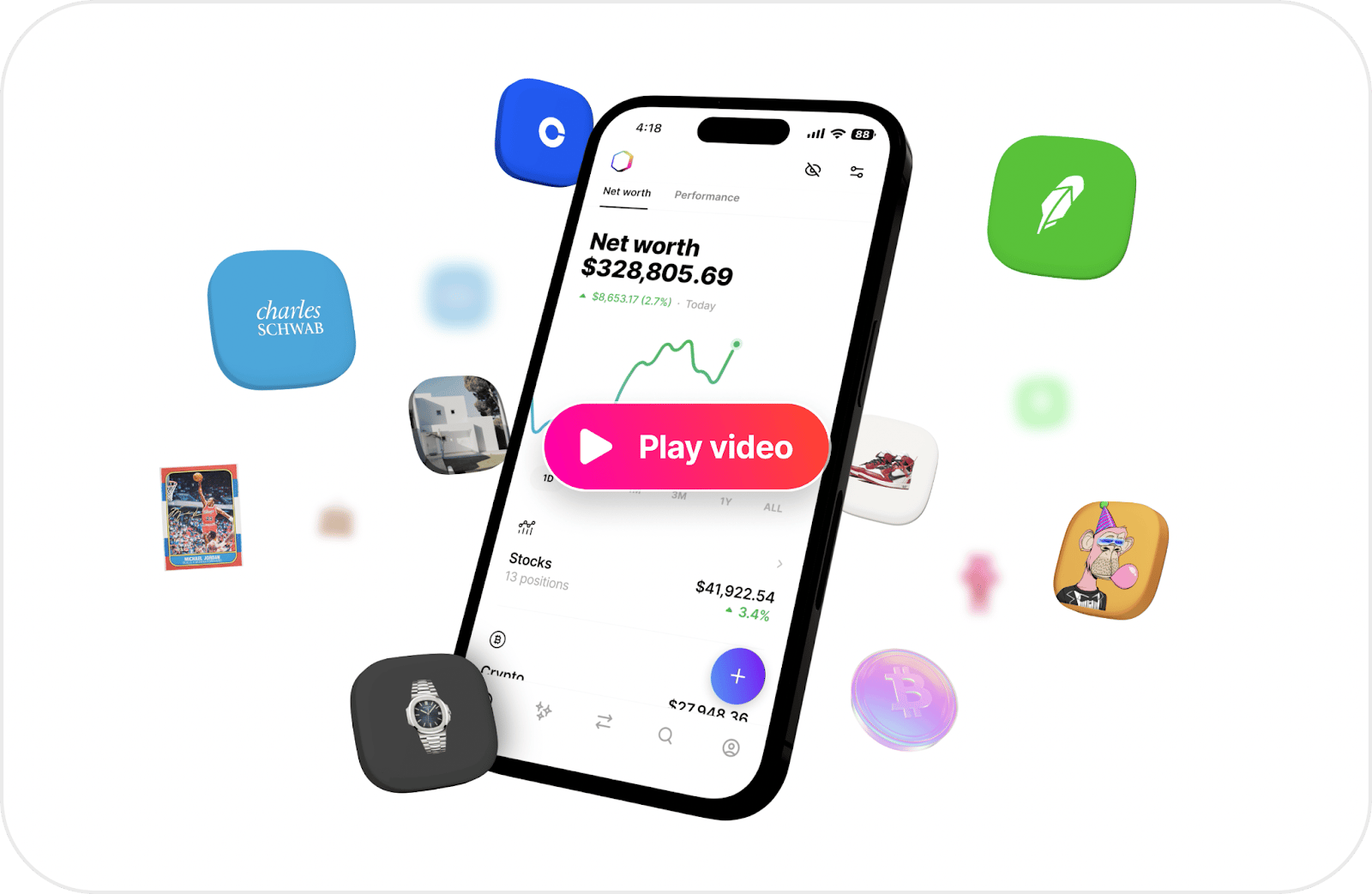

As a listener of the Rich Habits Podcast, you know how important it is to track your net worth. However, most tools out there are unreliable and inaccurate.

Introducing Roi — the best app to know and grow your net worth across all your existing accounts.

They support literally everything from your stocks to cash, bonds, crypto, company equity (Carta), collectibles, and more.

It’s the first app that lets you track your all investments, as well as place trades across all your existing accounts as well. Roi connects with over 10,000 different platforms where you might have your money or investments.

For example — you can buy and sell stocks through your Robinhood, Charles Schwab, and Coinbase accounts all directly in their Roi app. If you use Public like we do, they’ll be launching their official integration with them next month!

Tracking your net worth on Roi is free — but if you want portfolio insights or to copy the trades of investors like Nancy Pelosi, JD Vance, Michael Burry and more you can get one month of Premium free with our code “HABITS”.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin shared three additional ways investors can generate income inside of their portfolios:

Real Estate Investment Trusts — REITs, which own and operate real estate to generate income, are required to pay out 90% of their profits as dividends, offering attractive yields to investors. With interest rates expected to decline, these REITs could experience increased profitability — leading to higher dividends and share prices. This explains the recent rise in stock prices for REITs like Realty Income Corporation (O), Brixmor Property Group (BRX), and VICI Properties (VICI).

Corporate Bonds — Public has made corporate bonds accessible to the average investor. With T-Bill yields expected to drop as the Fed cuts rates, Public has introduced a Corporate Bond Account offering a blended yield of 6.9% (at the time of writing this) by investing in 10 different corporate bonds that mature over a four year period of time.

Small Caps — The Russell 2000 includes 2000 of the smallest companies listed on the Russel Index with an average market cap of just over $2.7 billion — far from the mega-cap tech giants. With interest rate cuts on the horizon, these companies could see a significant boost in profits from refinancing their debt, which is why the Russell 2000 often outperforms the S&P 500 during post-rate-cut periods. For yield, IWMI is a great option that offers a 14% distribution yield.

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from the following members of the Rich Habits Network: Kiy S, David R, Claudia R, Travis Z, Connor L, Laura D, & Fransisco F

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content.

Robert’s Callout

The Home Price Index remains at all-time highs.

Do you all remember when folks on TikTok and YouTube were calling for a broad housing market crash? I sure do — and it’s not here.

Have there been pockets of the country (like parts of Florida) that have experienced a correction? Absolutely. But generally speaking, the country did not experience a broad-based housing market crash. In fact, the Home Price Index remains the highest it has ever been.

As an investor, here’s where my head is at —

The monthly supply of new houses in the United States remains low. New housing starts remain low as well. Both presidential candidates agree that the United States has a housing problem — we need more units built and for cheaper prices.

I’ll personally be keeping an eye on the iShares Home Construction ETF (ITB) over the coming months. Regardless of who wins the presidency, we’re building more houses and these companies will benefit.

Austin’s Callout

The Equal-Weight S&P 500 has hit new all-time highs.

As you all know, the S&P 500 is one of our favorite index funds. It’s “self-cleansing,” has a long track record of success, and is easy / cheap to invest into via VOO.

However, because it’s market cap-weighted this index can easily be influenced by the performance of the mega-cap technology stocks like Apple, Microsoft, Google, Amazon, Meta Platforms, and others. The Magnificent Seven makes up roughly ~30% weighting in the index — a very good thing if these stocks are ripping higher like they were in 2023. Not a good thing if they’re taking a break.

Over the last several weeks, these mega-cap technology stocks have begun to contract — while the other “493 stocks” have experienced expansion.

XLF is hitting new all-time-highs (Financials)

XLP is hitting new all-time-highs (Consumer Staples)

XLV is hitting new all-time highs (Healthcare)

XLI is hitting new all-time highs (Industrials)

XLC is hitting new all time highs (Communication)

Just to name a few…

The chart above explains why — as mega-cap technology stocks’ (Microsoft, Nvidia, Amazon, Google, Meta Platforms) earnings growth decelerates year-over-year, the median S&P 500 company’s earnings growth is accelerating.

The markets are broadening out — a bullish indicator in my humble opinion.

The Rich Habits Radar

👉 Nvidia beat earnings & revenue expectations, stock still dropped.

👉 Berkshire Hathaway hit a $1T market cap for the first time.

👉 The NFL is allowing PE firms to purchase up to 10% stakes in teams.

👉 Yelp is suing Google, alleging Google’s search engine blocks them

👉 U.S. Q2 GDP saw an increase in its second estimate, 2.8% to 3.0%.

👉 SMCI plummeted -20% after delayed annual report & short reports.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.