Together with Public

Hi Everyone,

December is flying by and the year’s end is approaching! Now is the time to keep tabs on the markets and make your plans for 2026. Read on for everything you need to know!

Quick shoutout to Austin for launching his new series, Street Cents, on the Shark Tank YouTube channel! Click here to watch Episode 1 — where he asked bachelorettes on Broadway about their finances.

Additionally, make sure you’re following the Rich Habits podcast on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ The Fed cut rates by 25bps — but the real story is what comes next.

⭐ We broke down how to actually approach your 2026 money goals.

⭐ Jobless claims just jumped the most since 2020.

⭐ Silver ETFs are exploding — and the flows are sending a clear message.

⭐ Paramount is attempting a $108.4B hostile takeover bid for Warner Bros.

Market Overview

As of market open, 12/12/25

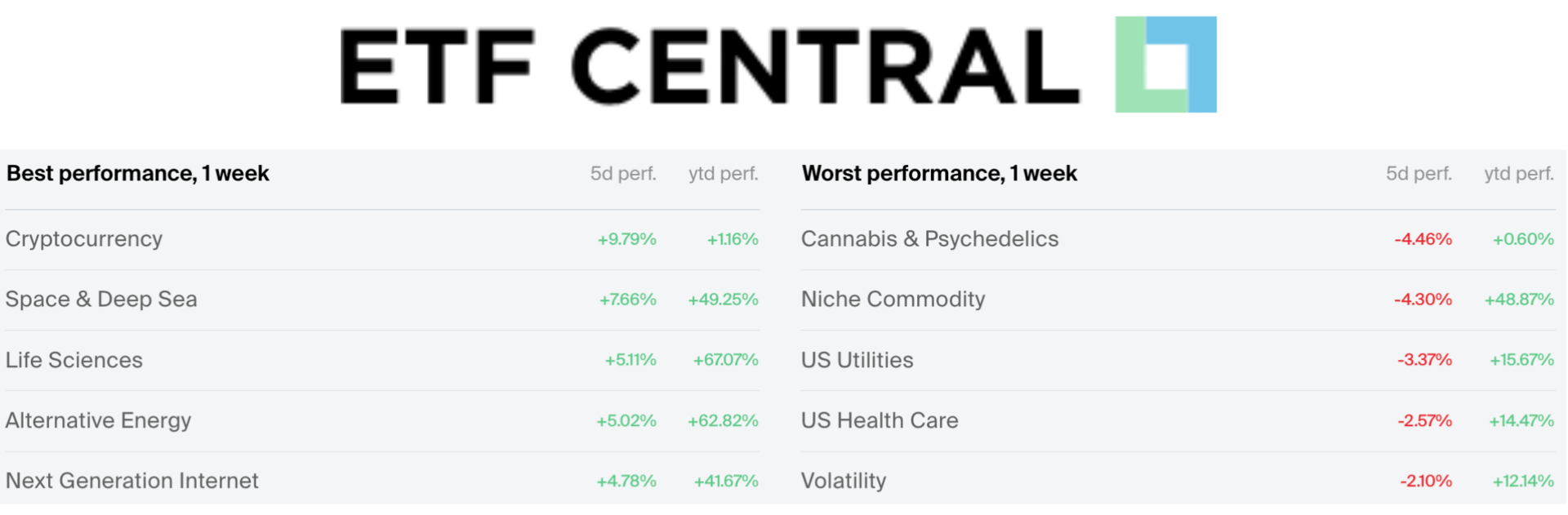

ETF Winners & Losers

Chart of the Week

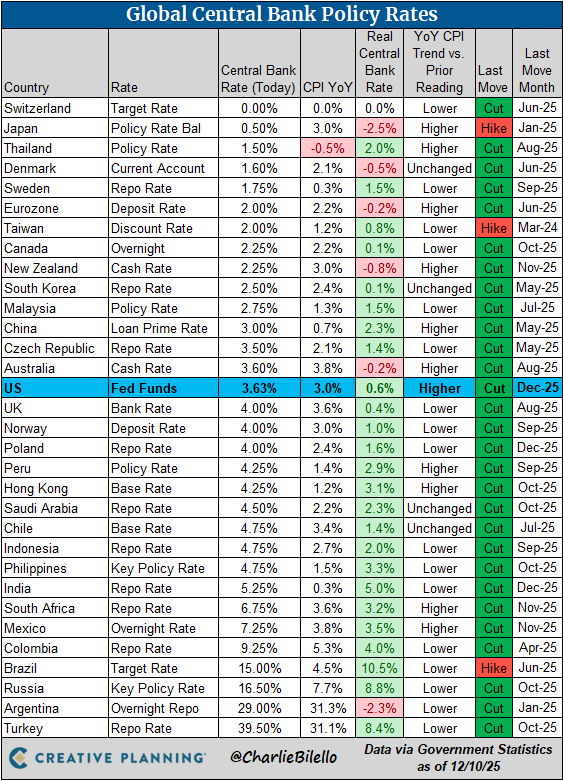

The Fed cut rates by 25bps — but the real story is what comes next.

The Fed delivered the expected 25 basis point cut, but the tone shifted big time. For the first time, Powell introduced new language questioning the “extent and timing” of future cuts — a clear signal the easing cycle may be slowing.

Their new projections? Just one cut in 2026 and one in 2027. The Fed is nowhere near taking rates back to pre-pandemic levels. They’re stuck between a rock and a hard place — hiring is cooling and unemployment is climbing, but inflation has “moved up” and remains “somewhat elevated.”

The Fed now says downside risks to employment are rising — which is a big shift from earlier in the year when the labor market was their strongest pillar.

Starting December 12, the Fed will buy $40B in T-bills for reserve management, with elevated purchases for a few months, and they’ve removed the cap on the overnight repo facility to keep short-term funding markets stable.

Whether we like it or not — the Fed’s actions have become THE pivotal influence on the stock market. We’ll be watching what happens next year closely, especially as Jerome Powell’s term comes to a close in 2026.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more—it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert broke down how to set money goals for 2026 that actually last past February or March. Most people don’t fail because they’re unmotivated — they fail because they set outcomes, not systems.

Here’s what they covered…

Why Goals Fail — “Save $10K” or “Pay off debt” sounds great, but without daily and weekly behaviors behind it, the goal collapses by February.

Systems Are More Important Than Goals — A goal is “Save $10,000.” A system is “Auto-transfer $425 after every paycheck.” Systems produce outcomes — not the other way around.

Identity-Based Habits — Ask “Who do I want to become?” instead of “What do I want to achieve?” Your identity shapes your behavior, and your behavior shapes your results.

Reverse-Engineering 2026 Goals — Break your goal into weekly actions, automate everything, and track consistency — not dollars.

Habit Stacking — Pair new financial habits with routines you already do so they actually stick.

Austin and Robert wrapped with this takeaway: you don’t rise to the level of your goals — you fall to the level of your systems.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

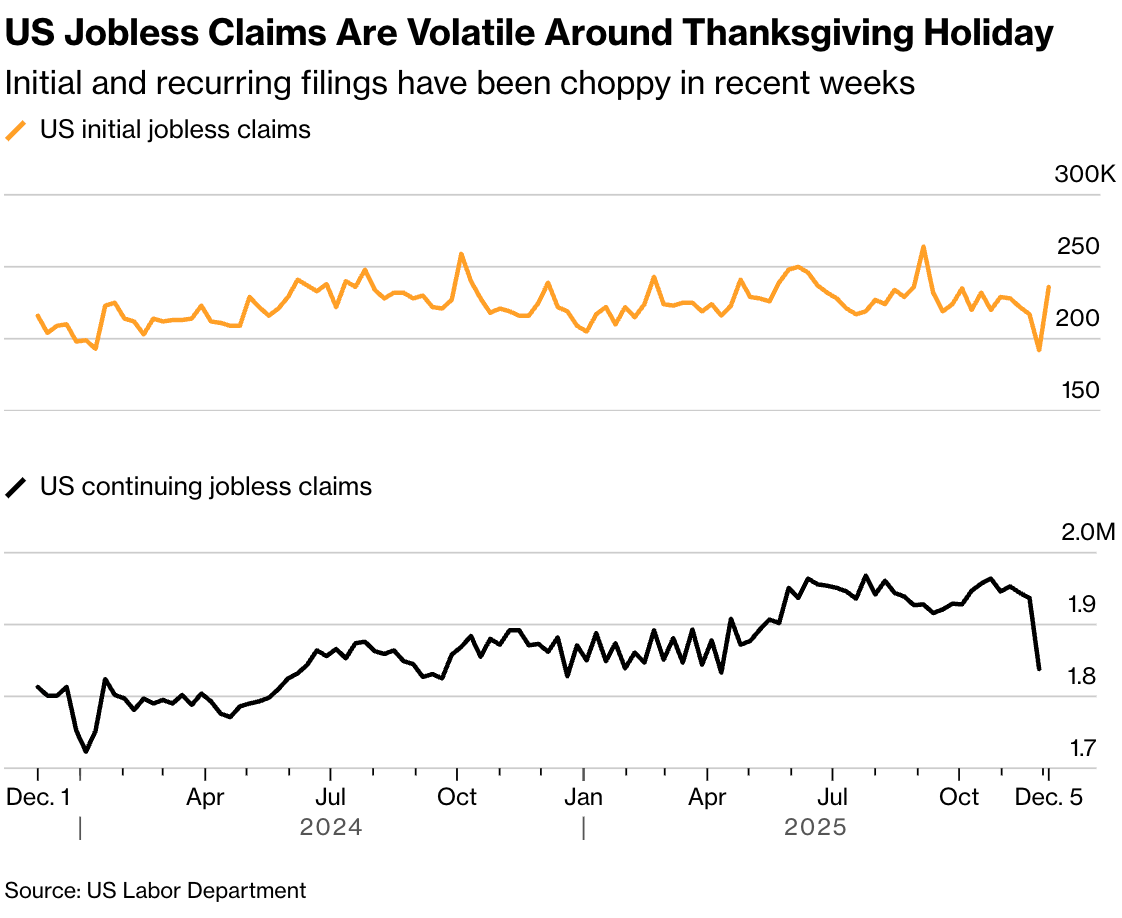

Jobless claims just jumped the most since 2020.

Jobless claims spiked +44,000 last week — the biggest jump since early 2020 — but it came right after a Thanksgiving dip that pushed claims to a 3-year low. In other words: this move is more seasonal whiplash than labor-market collapse.

Yes, companies like PepsiCo and HP are cutting headcount, and October layoffs hit the highest level since early 2023. But smoothing out the noise puts weekly claims right around 215K–220K, which economists say still reflects a labor market that’s cooling — not cracking.

Powell reinforced that message this week, calling job creation “extremely low” while still cutting rates for the third straight meeting to support a slowing economy. Markets care less about this choppy data and more about the broader trend: the labor market is loosening just enough for the Fed to stay in easing mode.

A softening labor market + steady rate cuts = an environment where quality growth, tech, and rate-sensitive sectors tend to outperform.

Remember, the Fed cutting interest rates has historically been positive for the stock market as long as the US is not in an economic recession. Stay out of a recession and risk-on assets should continue to rise.

Robert’s Callout

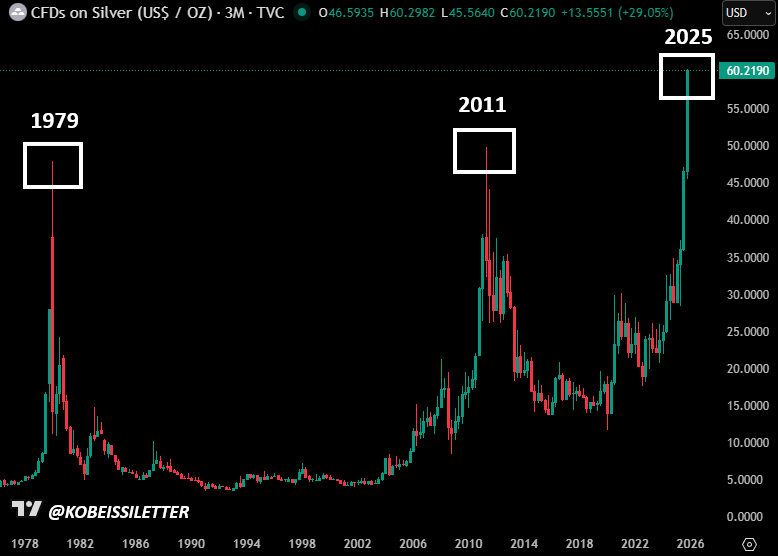

Silver ETFs are exploding — and the flows are sending a clear message.

Physical silver-backed ETFs saw +15.3 million ounces of inflows in just four days last week — the second-largest weekly haul of the entire year. That one week nearly matched all of November’s inflows on its own.

If this pace continues, silver ETFs will notch their 10th inflow month of 2025, marking one of the strongest sentiment shifts the metal has seen in over a decade.

The biggest fund in the space, SLV, is where things really get wild. It pulled in nearly $1 billion last week, outpacing the largest gold ETF, and its two-week haul is now the second-largest in history — only the February 2021 frenzy was bigger.

And the price action is confirming it: Silver is now on track for its strongest 12-month gain since 1979, a period defined by surging inflation and a massive flight to hard assets.

Investors are positioning for a world where monetary policy gets looser, real yields fall, and hard assets continue to claim the center stage.

The Rich Habits Radar

👉 Adobe beat earnings, gave cautious guidance w/ slower enterprise spending.

👉 Oracle stock sank after revenue fell short of Wall Street estimates.

👉 Department of Commerce ruled NVDA can sell its H200 chips to China

👉 SpaceX moved forward w/ late 2026 IPO plans as it reorganized Starlink unit.

👉 Paramount is attempting a $108.4B hostile takeover bid for Warner Bros.

👉 GameStop showed sliding quarterly sales and profits.

👉 JPMorgan stock tanked after warning of higher expenses

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.6% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

See terms and conditions of Public’s ACATS & IRA Match Program. Matched funds must remain in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.