Together with Frec

Good morning,

A quick breakdown — in case you just don’t have the time:

⭐ Investors have been piling into small-caps (and we called it).

⭐ We spoke with Jaspreet Singh about building a 7-Figure Empire.

⭐ Gold’s gains over the past year might just be the beginning.

⭐ Bitcoin’s seasonality suggests $98K by the end of the year.

⭐ Amazon says Prime Day sales set a new record ($14B).

⭐ Optimize your portfolio with Seeking Alpha.

Market Overview

As of market close 7/17/2024

Chart of the Week

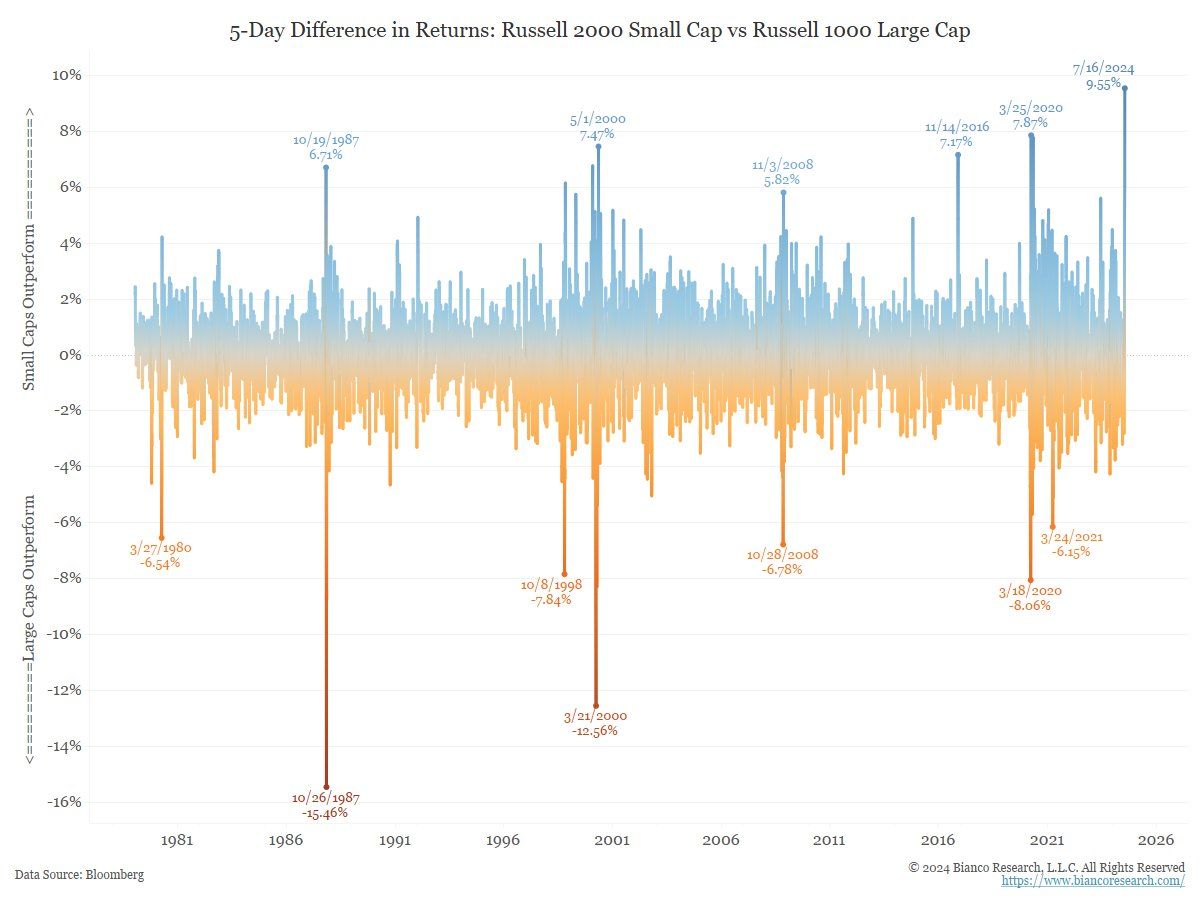

Small-cap stocks surged over +11% as market rotation begins.

Ladies and gentlemen — small-cap stocks (AKA the Russell 2000) have just had their largest outperformance relative to large-cap stocks in history. The data shown in the chart above goes back to 1978.

Why did this happen?

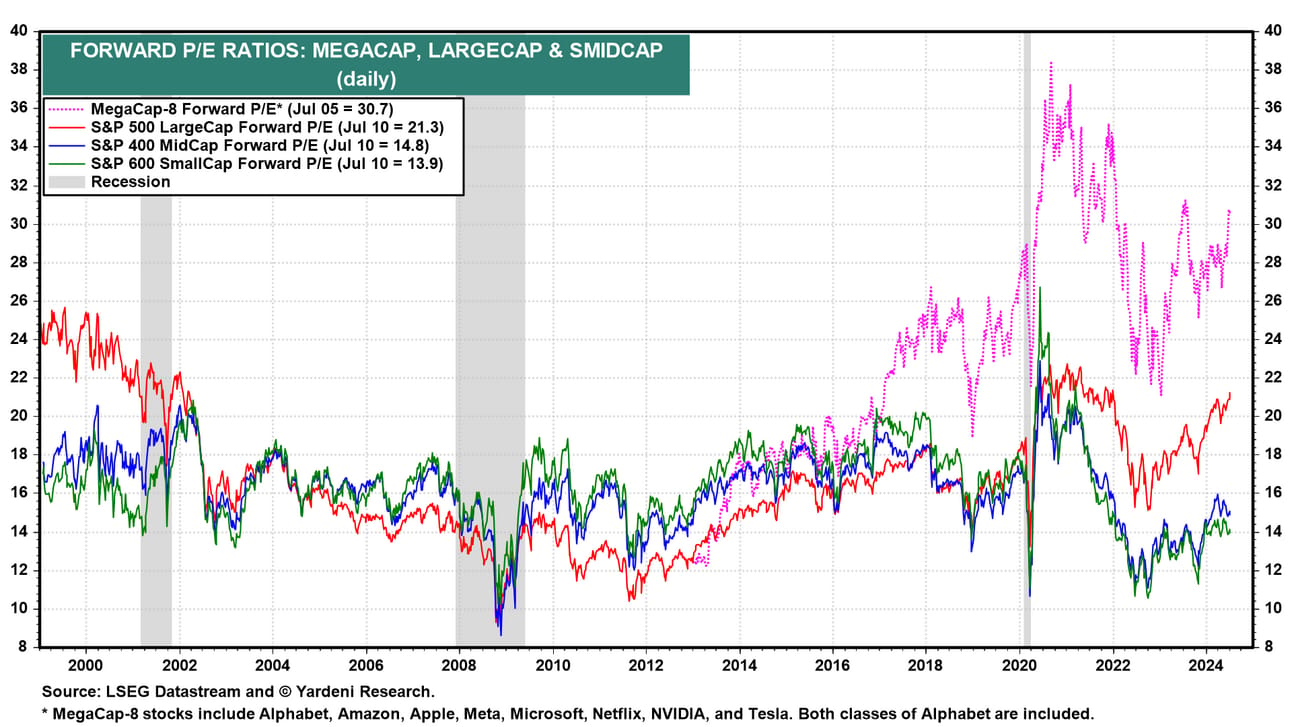

As you can see above — before their recent surge, small-caps stocks (in green) were trading at less than half the valuation of the 8 largest mega-cap stocks (in blue). That’s quite the disparity.

Additionally, since 1950 small-caps stocks have averaged a +27% gain during the 12 months following the Fed’s first rate cut. This is compared to +24% from mid-cap stocks, and +15% for large-caps.

If you listen to our episodes, join our livestreams on TikTok and Instagram, or read what we write — you’ve probably heard us mention small caps over the last couple of months. Here’s a TikTok video Austin posted about this trend three weeks ago.

While we’d like to sound like the smartest guys in the world, it sure seems like that’s Stanley Druckenmiller with how he handled his positioning in both Nvidia and small-caps over the last few weeks.

It wouldn’t surprise us to see a continued rotation into small-caps over the coming months as we get closer to the first Fed rate cut (probably in September). High interest rates disproportionately hurt smaller companies that have balance sheets carrying more debt. Nobody can predict the future — which is why it’s important to always stay up to date on the latest market trends.

If you’re interested in the Russell 2000, but you’re hesitant with the index approaching all-time-highs — you might want to consider $IWMI. The NEOS Russell 2000 High Income ETF seeks to generate monthly income in a tax efficient manner, while giving exposure to the constituents of the Russell 2000.

In other words — investors share in some of the upside exposure, but are protected from some of the downside through their covered call strategy.

If you’re interested in straight up exposure to the Russell 2000 without the tax efficiency / monthly income component — $IWM is what you’re looking for.

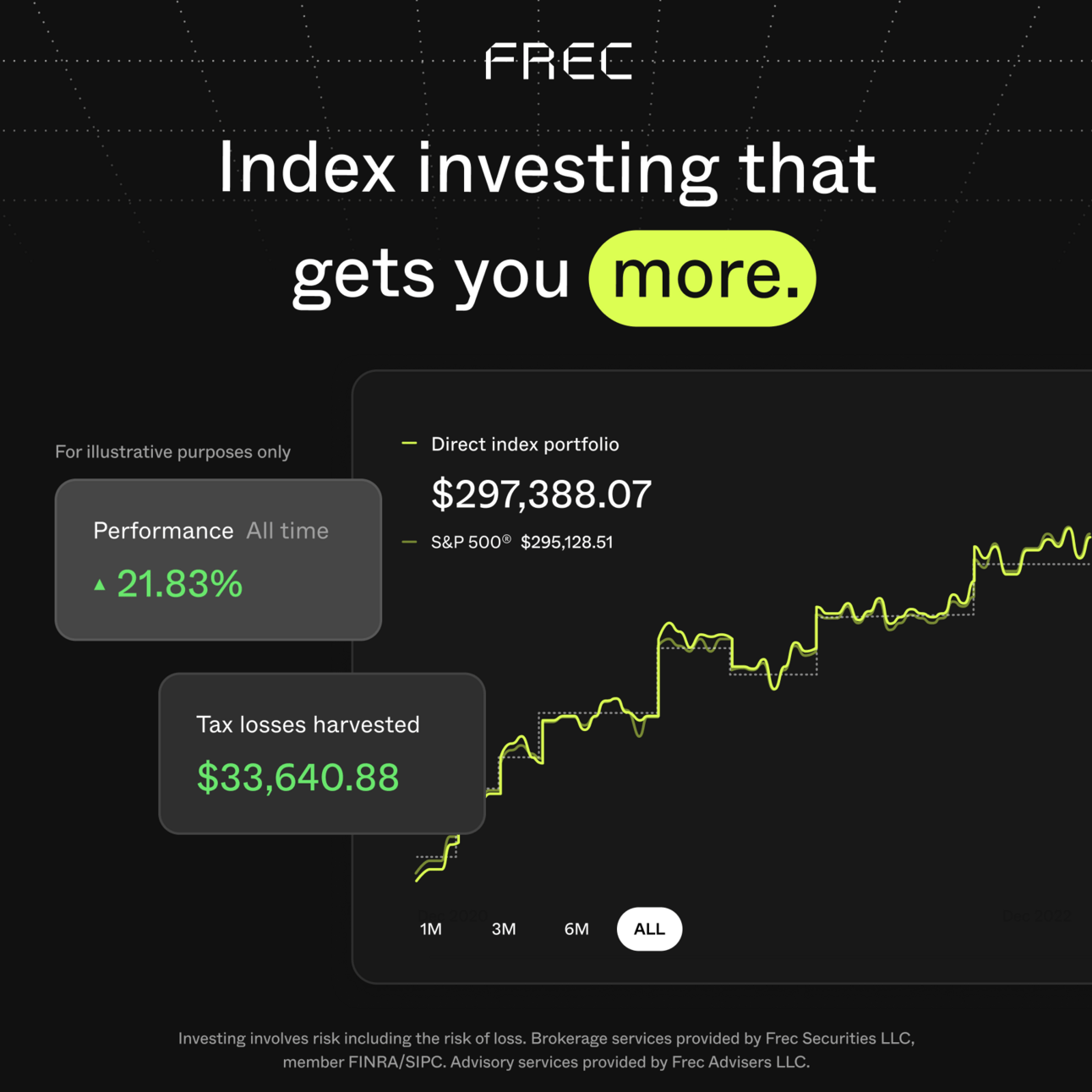

Direct indexing gets you market returns with tax savings, and Frec is making it available to every investor.

How does it work? Direct Indexing is nearly identical to investing in ETFs, but with a key advantage: it allows you to reap tax benefits by directly owning the underlying stocks.

How can you invest? With Frec Direct Indexing, you can invest in popular indices like the S&P 500 while Frec automatically harvests your tax losses. It’s automated and effortless.

Why now? Thanks to recent technological innovations, Frec has made this strategy available to all investors at a low 0.10% fee. High-net-worth family offices have been using it for decades as a way to lower their tax obligations.

We’re excited to share yet another strategy to help with optimizing your wealth building journey!

Rich Habits’ host Austin Hankwitz is a client of Frec. Frec paid a one-time fee for this sponsorship. Investing involves risk, including the risk of loss.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin sat down with entrepreneur and real estate mogul Jaspreet Singh. He’s the CEO of Briefs Media, and you might recognize him from his massive YouTube channel — Minority Mindset.

Growing a Brand from Nothing — Jaspreet walked us through how he approached building his company from idea to millions per year in revenue. A difficult transition for him throughout that time was going from working in the business to working on the business. He knew he wanted to build something that could live on in perpetuity — even if he decided he didn’t want to run it anymore.

Approaching Real Estate for the First Time — Getting your first rental property can feel daunting, especially when you realize the illiquid nature of real estate. As a real estate investor, it’s important to know your goals from the very beginning. Jaspreet believes to be successful in real estate investing you must invest in what you know. For him, that’s single-family homes in Detroit — for you, maybe that’s something different? Regardless, make sure you’ve build your base first before you start investing into real estate.

Hiring the Wrong People — when asked “What was your biggest mistake along the way?” Jaspreet replied “Hiring the wrong people, for both my business and my real estate.” He explained that hiring the wrong people for his business negatively impacts productivity, and warned against going "too cheap” with real estate contractors. He also stated hiring a cheap accountant once cost him thousands. Don’t go cheap! Find a middle-ground and start there.

Here’s a link to the Q&A episode posted this morning! During this episode — we took questions from Rhythm (cool name), Harrison, Jordan, Michelle, Maria, Samantha, Anakareli, and Cole.

Don’t forget to follow our Instagram, where we share behind-the-scenes content and short clips answering your questions!

Reply to this email or DM us on Instagram with your questions so we can answer them in the next week’s edition. Be sure you’re following along on Spotify, Apple Podcasts, YouTube, IG, and anywhere else you get your podcasts.

Robert’s Callout

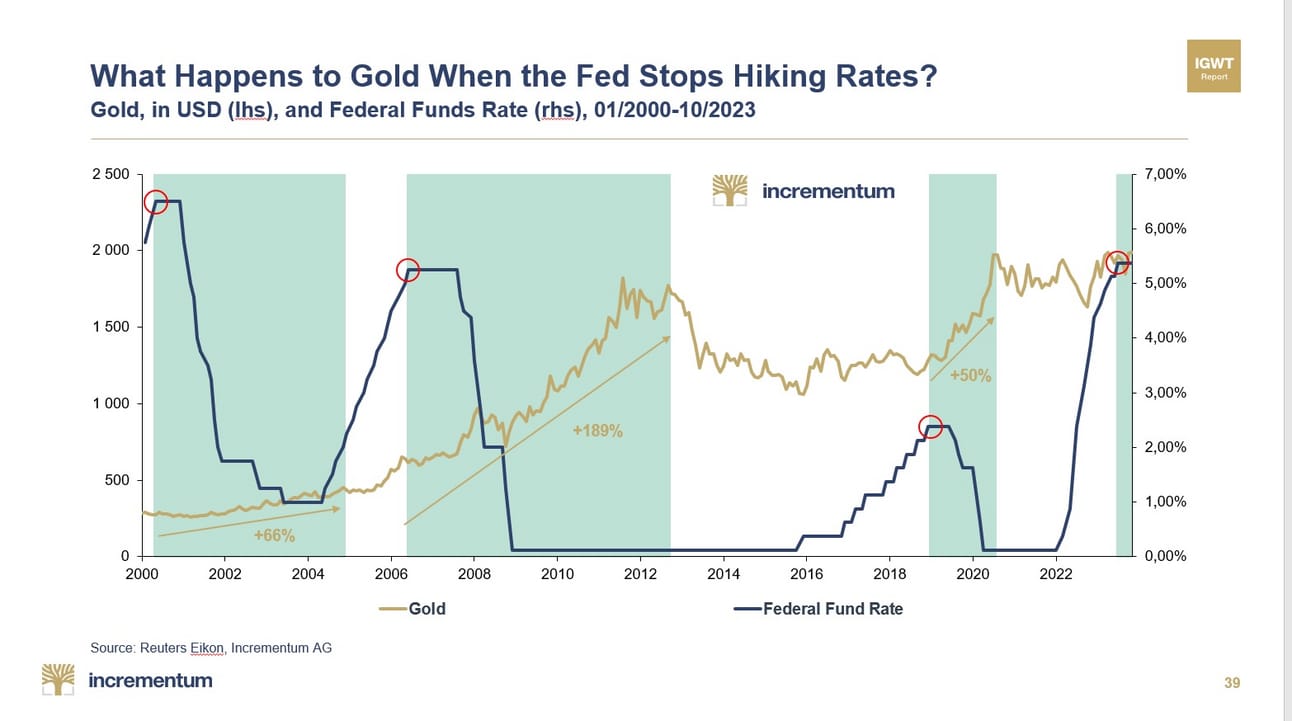

Gold might be gearing up for a major breakout.

As you all know, I love precious metals! I own both physical silver and gold — and believe everyone should have a small percentage of their net worth invested into the asset class. However, the illustration above is an interesting one — especially as the Federal Reserve is expected to cut rates beginning in September.

Historically speaking, the price of Gold skyrockets in value between when the Fed pauses their rate hikes up until when they begin hiking rates once again. The Fed paused their rate hikes as of July of 2023 — and since then the price of Gold has risen +21%. As we look back in time, we may just be getting started.

I have a healthy allocation of my personal portfolio in Gold, so I’m ready! If you’re looking for a way to buy physical Gold — look no further than your local Costco!

Austin’s Callout

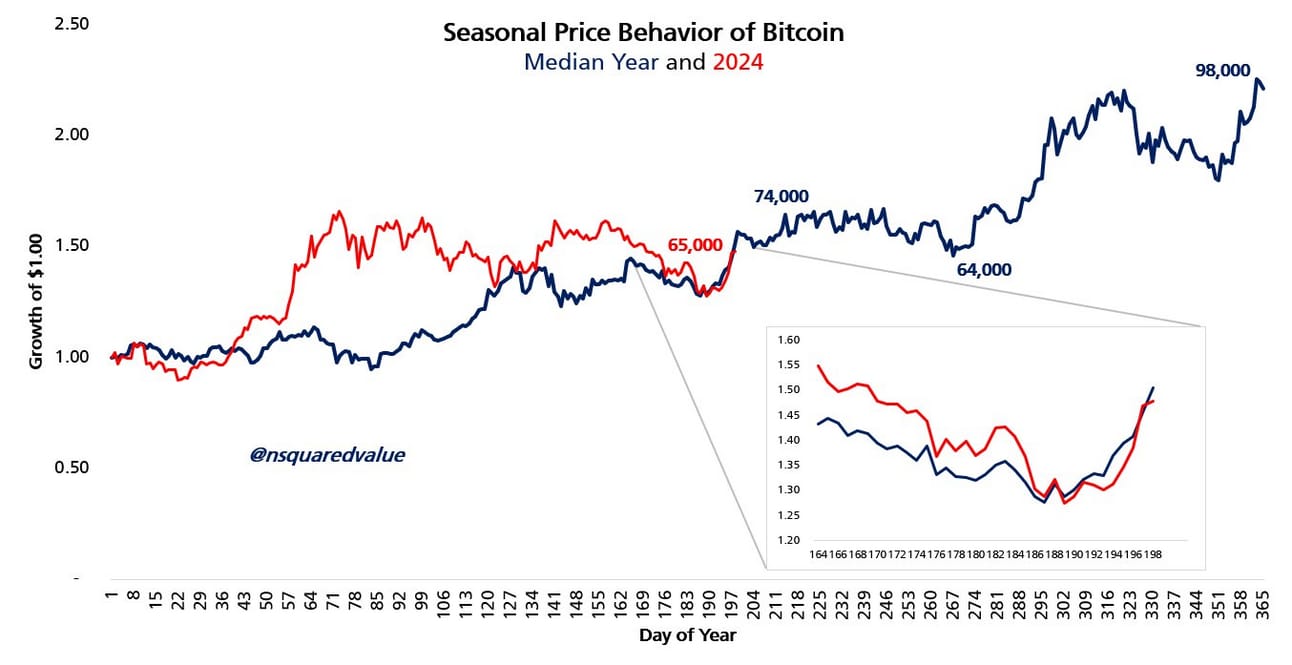

Bitcoin’s 2024 price action is eerily similar to its median seasonality.

What’s more fun than looking back in time to analyze historical price performance? Especially when it comes to volatile asset classes like cryptocurrency. This week, I wanted to highlight a fascinating chart I found on X — illustrating Bitcoin’s price action year-to-date in relation to its median year’s seasonality.

As you can see, we’re right where we’re “supposed to be” by mid-July according to history. Now of course, historical results aren’t indicative of future returns — but if we somehow stay on track with historical price action throughout the remainder of the year, we’ll be only a few thousand dollars away from a $100K Bitcoin.

In my opinion, it’s anyone’s guess as to where Bitcoin’s price might be headed over the coming months and years — all I know is that I want to own the asset class for a long time to come!

The Rich Habits Radar

👉 Elon Musk committed $45M/mo to Trump PAC & moves HQs to TX.

👉 Goldman Sachs is launching three new tokenization projects.

👉 Google parent Alphabet made its largest-ever acquisition: Wiz.

👉 Trump to address nation for first time since assassination attempt.

👉 Philip Morris to open new ZYN plant in Colorado to meet demand.

👉 Amazon Prime Day is expected to drive a record $14B in sales.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.