Together with Moby

Good morning,

A quick breakdown — in case you don’t have the time.

⭐ China's central bank announced a significant stimulus package.

⭐ A discussion on contemporary art investing and beating the S&P 500.

⭐ Underemployment in the U.S. continues to skyrocket.

⭐ Fed rate cuts at all-time highs are historically not bearish.

⭐ Visa got sued by the DoJ, and of course Pelosi’s husband sold right before.

Market Overview

As of market open 9/26/2024

Chart of the Week

China's central bank announced a significant stimulus package.

Key measures include cutting short-term interest rates and lowering bank reserve requirements to 2018 levels. The package also targets the troubled property sector by reducing mortgage costs on $5.3 trillion in loans and easing second-home purchase rules.

Most notably, the People's Bank of China (PBC) will provide 800 billion yuan ($113 billion) in liquidity to support the stock market and is exploring the creation of a market stabilization fund. These moves aim to help China meet its +5% annual economic growth target, but concerns remain about addressing deflationary pressures and weak consumer demand.

Their Ministry of Finance also plans to issue an additional $140 billion of special sovereign debt to stimulate consumption amid growing concerns of a stuttering post-COVID Chinese economy. They’re even providing families with two or more children a $114 monthly allowance per child.

China’s stock market having its best week in nearly a decade!

We don’t share all of this information with you as some “Chinese economic experts,” but instead as curious investors who look for value wherever value can be found. As we’ve shared in the past, the vast majority of our stock portfolios are invested into American companies.

With that being said, we’re going to begin doing more research into this trade idea and share our findings with you all very soon.

Modern strategies for the modern investor in you, only with Moby.

The best-in-class app for concise investment insights and stock picks designed for busy professionals seeking smart financial decisions.

If any of these have crossed your mind, at one point:

How can I stay more updated on financial markets? Where can I see the latest good stock ideas? How can I avoid my inbox being spammed with meaningless updates?

Then, Moby is custom made for you.

The Moby app provides busy professionals with a filtered view on the most important financial news of the day with latest research on profitable trends in the stock market — all done via notifications straight to your phone that only take 3-5 minutes to read.

Moby's insights are driven by the team's experience at Morgan Stanley, Bank of America, and Goldman Sachs — making what used to be complex financial information into easy, profitable, and concise stock recommendations for you.

Examples of Moby latest trends in the market below…

Check out Moby today and gain a competitive edge with how you can make even smarter investment decisions.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin spoke to Scott Lynn, Founder & CEO of Masterworks. They discussed the following:

Adding Artwork to a Portfolio — Adding a new long-term investment to your portfolio comes down to two simple criteria — 1) if the investment will outperform inflation, and 2) if the investment’s historical returns are correlated to some other asset class in your portfolio. Contemporary art has both outperformed inflation over the years and has zero correlation to any other asset class — making the asset class an interesting one to explore.

Outperforming the S&P 500 — Contemporary art has outperformed the S&P 500 over the last 26 years. Scott explained the reason why art prices have risen so much over time is due to both continued purchasing demand from ultra-high net worth individuals while the supply of blue chip artwork shrinks.

Determining Allocations for Alternative Investing — Personal finance is personal, so only you can decide how much of your net worth to allocate to a new asset class. Scott shared during our interview that most Masterworks investors start out by allocating 1-2%, then expanding upon that over time.

If you’ve not yet begun investing into contemporary art — what are you waiting for?

👉 Q&A: $230K Income Living Paycheck to Paycheck, 15 vs. 30-Year Mortgages, & How Inflation is Calculated

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from the following people: Kenneth T, Stacey, Braulio, Sue, Lisa, and Saloman.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content.

Robert’s Callout

The number of “underemployed” Americans continues to rise.

The number of people working part-time jobs while actively seeking full-time employment saw a significant surge in August, increasing by +14.4% to reach 4.8 million.

This is the highest level reported since May 2021.

Over the past 45 years, such sharp increases in part-time employment have been closely linked to the onset of recessions. This troubling rise in part-time employment comes amid a steady decline in full-time jobs — with 1 million fewer workers employed in full-time roles compared to the same time last year. This decline has been persistent, with full-time employment numbers falling for seven consecutive months (as shown below).

If you were on this week’s Rich Habits Network livestream, you may recall Austin and I reiterating that employment data is now the information that will move the market up or down every week / month — not inflation data.

Austin’s Callout

When the Fed has cut rates while the stock marker was near all-time highs — forward 12-month returns have been positive, 100% of the time.

The chart above shares three important pieces of data — 1) when the Fed cut interest rates, 2) how close the S&P 500 was to all-time-highs when that happened, and 3) how the index performed over the next 1, 3, 6 and 12 months.

As you can see, the average 12-month return was +13.9%, while the median 12-month return was +9.8%.

In the near term, it’s a coin flip if the S&P 500 will be trading higher or not — but as you begin to extrapolate the time horizon out further and further, the returns become positive 100% of the time.

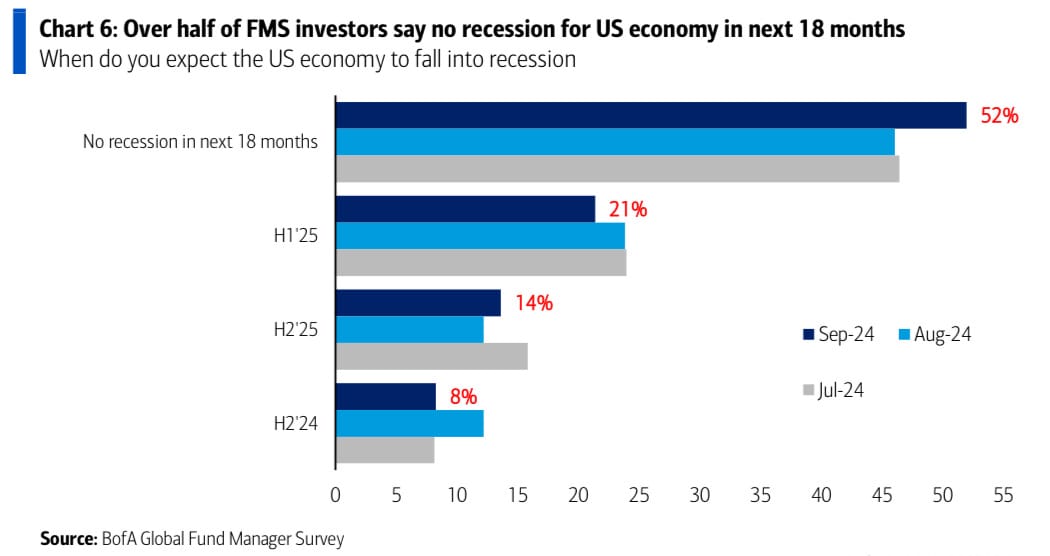

According to BofA Global Research, 52% of hedge fund managers believe the US will NOT experience a recession within the next 18-months — and they’re positioning their portfolios accordingly.

I’m not saying in 12-months from now the S&P 500 will 100% be trading higher than it is today — but I am saying history is on our side, the Fed believes they’ve tamed inflation, there’s a clear path to a soft landing, and the “smart money” isn’t expecting a recession.

I’m positioning my portfolio for growth, not defense, over the coming 12-months.

The Rich Habits Radar

👉 Visa got sued by the DoJ, and of course Pelosi’s husband sold right before.

👉 U.S. GDP rose +3.0% in Q2, meeting expectations for its 2nd revision.

👉 Smartsheet is going to be acquired by Blackstone and Vista Equity Partners.

👉 Bath & Body Works will be replaced in the S&P 500 by Amentum.

👉 KB Home stock fell after it posted a mixed earnings report.

👉 Jamie Dimon stated that geopolitical instability is his biggest caution.

👉 Southwest Airlines might have its CEO ousted by Elliott Investment Mgmt.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: Paid endorsement for Public Investing, Inc. Not investment advice. All investing involves the risk of loss, including loss of principal. Brokerage services for US Listed and registered securities, options and Bonds in a self-directed brokerage account are offered by Public Investing. ETFs, options and Bonds are available to US members only.

Bond investing carries risk including the risk that you lose some or all of your investment. High Yield bonds carry greater risk of default. All yields and prices are subject to change without prior notice. Public Investing earns a fee on every bond trade.

*A Bond Account is a self-directed brokerage account with Public Investing, member FINRA/SIPC. Deposits into this Account are used to purchase 10 fractional investment-grade and high-yield bonds in equal par value allocations. Yield represents avg. annualized rate of return across all bonds, before fees, for 9/18/2024. Yield can change daily, and yield at time of purchase may be different from yield shown. Return may be affected if you do not hold a bond to maturity, or if the issuer defaults or calls the bond. Bonds are securities, not FDIC insured, and may lose value. Fractional bonds come with additional risks and limitations. Public earns a fee on each Bond Account transaction. Bond Accounts are not investment recommendations; do your own research. See https://public.com/disclosures/bond-account.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.