Hi Everyone,

Wishing you a wonderful holiday season. Read on for the final Rich Habits Newsletter of 2025!

Make sure you’re following the Rich Habits podcast on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ S&P 500 earnings expectations keep moving higher.

⭐ We spoke with an executive at Google about AI developments.

⭐ The labor market isn’t breaking — it’s quietly cooling.

⭐ Bitcoin’s largest holders are accumulating at a pace rarely seen.

⭐ Oracle slid after reports an AI data center setback spotlighted rising debt.

Market Overview

As of market open, 12/18/25

ETF Winners & Losers

Chart of the Week

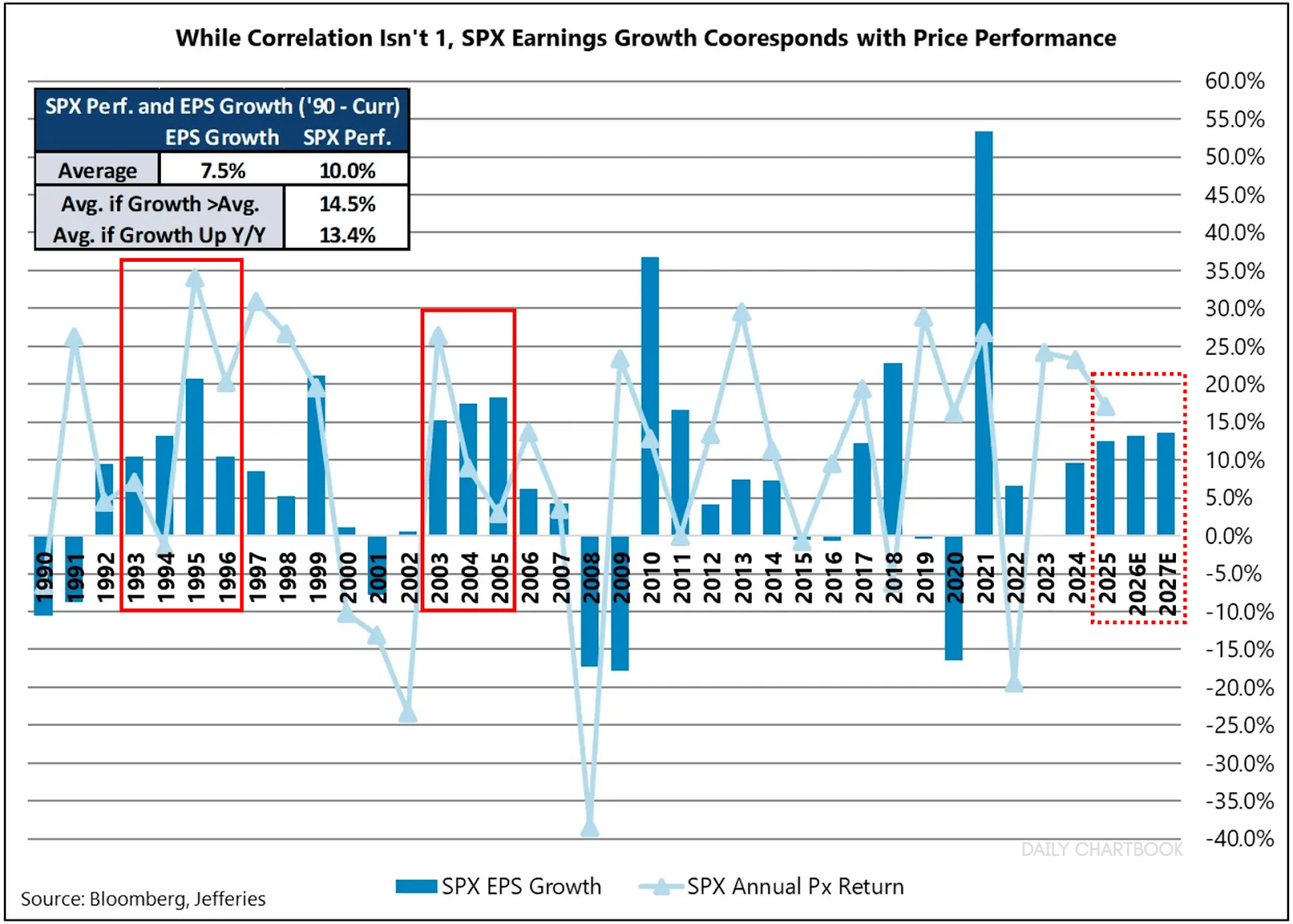

S&P 500 earnings expectations keep moving higher — and history says that matters.

According to Jefferies, 2026 S&P 500 earnings estimates have climbed to $310 per share, implying roughly +13% year-over-year growth. Expectations don’t stop there: analysts are now penciling in +14% earnings growth for 2027 as well.

That kind of consistency is rare. Over the past 35 years, the S&P 500 has delivered double-digit earnings growth for three consecutive years only twice — during 1993–1995 and again from 2003–2005. These earnings expectations aren’t pie in the sky ideas either, as we saw Q3 earnings results come in up +13% year-over-year. Double-digit earnings growth very well could remain our reality for the next several quarters.

This market isn’t being driven by valuation expansion alone. If earnings continue to follow this path, stocks have a fundamental backbone — even in a world where rates stay higher for longer.

With that being said, it’s never been more important to invest in single stocks that actually have earnings. We have a hunch that unprofitable / extremely speculative names will continue to get washed out in 2026.

The Future of AI in Marketing. Your Shortcut to Smarter, Faster Marketing.

Unlock a focused set of AI strategies built to streamline your work and maximize impact. This guide delivers the practical tactics and tools marketers need to start seeing results right away:

7 high-impact AI strategies to accelerate your marketing performance

Practical use cases for content creation, lead gen, and personalization

Expert insights into how top marketers are using AI today

A framework to evaluate and implement AI tools efficiently

Stay ahead of the curve with these top strategies AI helped develop for marketers, built for real-world results.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert sat down with Rose Yao, VP of Product Management at Google Search, to break down how AI is reshaping search, investing, and financial literacy for everyday investors.

Rose leads product teams across Google Search and Google Finance and is at the center of integrating generative AI into tools used by billions of people worldwide.

Here’s what they covered…

The Democratization of Finance — Rose explained how retail investors are finally gaining access to institutional-grade data, driven by better infrastructure, mobile access, and now AI. The revamped Google Finance is designed to level the playing field by making powerful tools free and accessible.

Rebuilding Google Finance — New features like earnings calendars, live audio streams, and real-time transcripts are aimed at fixing the biggest pain points investors face during earnings season: speed, clarity, and context.

Why Generative AI Is Different — Unlike past shifts like mobile or voice, generative AI can reason and synthesize information, fundamentally changing how people research complex financial questions.

Deep Search — A standout feature that runs hundreds of simultaneous searches to answer multi-step questions that standard search never could — unlocking more powerful research for investors.

A Global & Personal Perspective — Rose shared how her experience as both an operator and an investor shapes products built for a global audience, reinforcing that financial literacy is a lifelong process.

AI isn’t just changing how we search — it’s changing how people learn, invest, and make financial decisions.

Want to give the new Google Finance a try? Click here!

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

The labor market isn’t breaking – it’s quietly cooling.

November payrolls came in at +65K, beating expectations, but the details tell a more nuanced story. The unemployment rate rose to 4.6%, the highest level since September 2021, while wage growth slowed to just +0.1% month-over-month.

At the same time, multiple jobholders now make up 5.8% of the workforce — the highest share since 2000.

What’s driving the rise in unemployment matters. It’s not layoffs. It’s new and returning workers entering the labor force in a “low fire, low hire” environment — a very different dynamic than what typically precedes recessions.

For markets, this is more promising than the surface level numbers suggest. A cooling labor market without mass job losses keeps pressure off wages and inflation, giving the Fed room to ease — and that backdrop tends to favor risk assets over time.

Remember, if we can avoid an economic recession history tells us the stock market should trend higher as the Fed cuts interest rates. Seeing the unemployment rate tick higher certainly is not a good sign, but under the surface things don’t look terrible. As long as the economy can continue to muddle along, we should continue to experience higher stock prices (specifically talking about the indices).

Robert’s Callout

Bitcoin’s largest holders are accumulating at a pace rarely seen.

Over the last 30 days, Bitcoin whales have added 269,822 BTC to their holdings. This is roughly $23.3 billion at current prices, marking the largest 30-day accumulation in 13 years.

That scale of buying has historically occurred during periods of consolidation, not late-cycle euphoria.

What makes this notable is the backdrop. Financial conditions are easing, real yields are rolling over, and liquidity expectations are improving — an environment where long-duration and scarce assets tend to quietly find demand.

As on-chain data continues to show, large holders are steadily absorbing supply even amid skepticism and muted price action — positioning for what comes next rather than reacting to today’s headlines.

It’s anyone’s guess if we’re still in a Bitcoin bull market or if we’ve officially entered a Bitcoin bear market. What’s important for you to do is focus on the asset class long-term, assuming that was your original assumption. I have a ton of Bitcoin, and I plan to hold and accumulate more for years to come!

The Rich Habits Radar

👉 Micron crushed earnings as AI-driven memory demand accelerated.

👉 Oracle slid after reports an AI data center setback spotlighted rising debt.

👉 Medline soared +40% on the first day after its initial public offering.

👉 Ray Dalio announced plans to help seed Trump-backed investment accounts

👉 Warner Bros. Discovery rejected Paramount’s Hostile $108B Bid.

👉 Waste Management plans 14.5% dividend increase + new share buyback.

👉 Barron’s shifted 2026 stock picks from high-growth to more “boring.”

👉 Nasdaq submitted SEC paperwork to launch 23 hour/day weekday trading.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.6% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.