Together with Public

Hi Everyone,

We hope you’re having a great week.

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

Read on for this week’s breakdown of the markets!

A quick breakdown — in case you don’t have the time.

⭐ The Fed cut interest rates by 25 basis points for the first time in 2025.

⭐ We talked investing in the next billion dollar idea w/ Ensemble’s Collin West.

⭐ U.S. consumer credit jumped to the third-highest total level on record.

⭐ The S&P 500 has never been more top-heavy than it is today.

⭐ Nvidia announced plans to invest $5B in Intel for a new chip partnership.

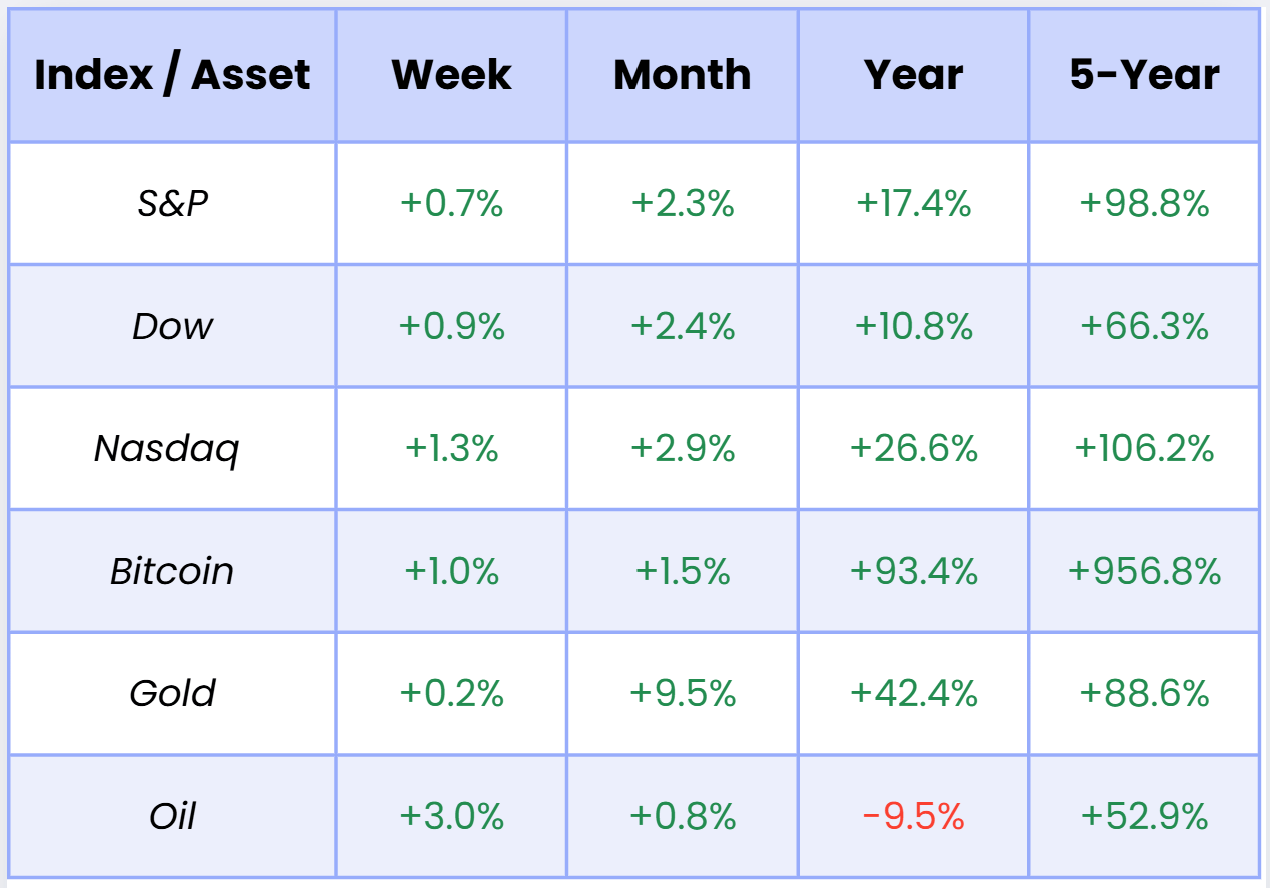

Market Overview

As of market open, 09/18/25

Chart of the Week

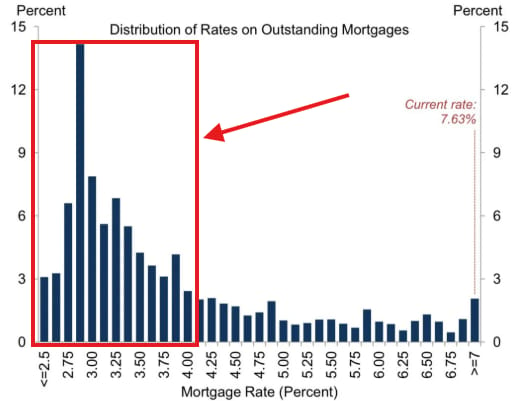

The Federal Reserve cut interest rates by -25 basis points for the first time in 2025— and pointed to a weaker labor market as the driving force.

Immediately after the announcement, the U.S. dollar sank to its weakest level since February 2022. This move was historic: it’s the first Fed rate cut in 30+ years with Core PCE inflation still above 2.9%. Clearly, the Fed’s “dual mandate” has tilted toward jobs over price stability.

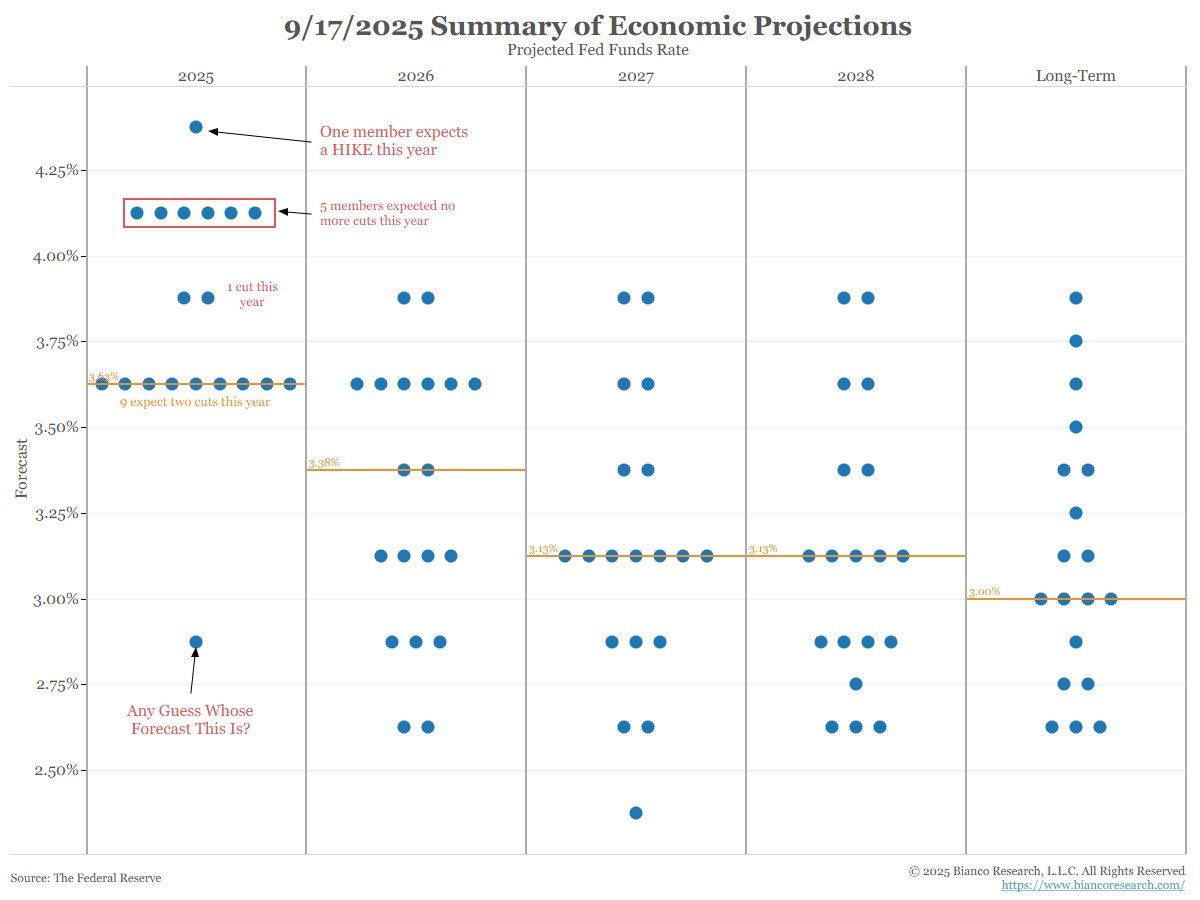

But the Fed is far from unified. The updated “dot plot” revealed deep divisions:

9 of 19 Fed officials expect two more cuts this year.

6 of 19 expect no further cuts at all.

One official dissented in favor of a 50 basis point cut immediately.

One official wants 125 basis points of cuts in the next two meetings.

Meanwhile, economic projections show inflation holding higher for longer (PCE revised up to 2.6% in 2026) alongside unemployment stuck in the mid-4s. That combination is exactly what economists fear most: stagflation.

For markets, the message is clear — policy uncertainty is rising, the Fed is divided, and the path forward for both stocks and bonds may have just gotten a bit more complicated

We expect some serious volatility into the year’s end! We’ll remain riding the wave for now. Remain a net-buyer of assets. If inflation reignites and the US dollar continues to weaken, owning assets is the only way to survive. Think stocks, ETFs, crypto, real estate — anything that appreciates in value over a long period of time.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more—it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert sat down with Colin West, Founder & Managing Partner at Ensemble VC.

Since launching Ensemble in 2020, Colin has been pioneering a data-driven approach to venture capital — backing transformative teams that scale globally. His track record includes early investments in giants like Zoom, Carta, Groww, and ICON… along with a Guinness World Record for rowing unsupported across the Arctic Ocean.

Here’s what they covered…

Venture Investing at Scale — Collin shares Ensemble’s investment thesis and how a data-first approach has helped him back multiple billion-dollar unicorns.

Traits of Successful Founders — From Zoom to Chaos to Groww, Collin highlights the mindset, grit, and foresight that set exceptional entrepreneurs apart from the rest.

Navigating the Goose Eggs — Venture investing isn’t all wins. Collin opens up about the hard lessons he’s learned, and what he wishes he knew earlier in his career.

Trends & Technology — From emerging September 2025 trends to the launch of Ensemble’s new AI co-pilot for VCs, Collin explains how the next wave of innovation could reshape how startups get funded.

As always, our goal is to bring you insights from the trailblazers building the future. Collin’s perspective offered a rare inside look at what it takes to spot — and scale — the next generation of unicorns.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

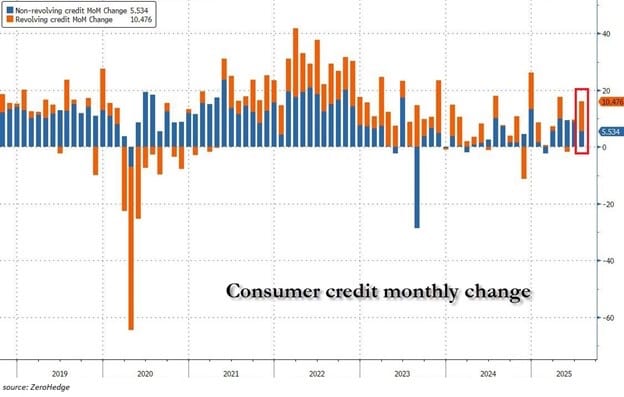

U.S. consumer credit jumped by +$16 billion in July, lifting total balances to $5.06 trillion — the third-highest level on record.

This marks the second-largest monthly increase of 2025, following a +$9.6 billion gain in June. In fact, over just the last five months, consumer credit has surged by + $103 billion, underscoring how reliant households remain on borrowing.

Breaking it down:

Revolving credit (credit cards and other short-term debt) rose + $10 billion to $1.31 trillion, the highest level since November 2024.

Non-revolving credit (auto loans, student loans, etc.) added another + $6 billion, reaching a fresh record of $3.75 trillion.

The trend highlights both resilience and risk. On one hand, consumers are still spending — keeping the economy afloat. On the other, the ever-growing mountain of debt raises concerns about sustainability, especially with interest rates remaining elevated.

As you continue on your financial journey, PLEASE remember to take care of high-interest debt FIRST! You don’t need to be investing in things like stocks and crypto if you have a pile of credit card debt!

Austin’s Callout

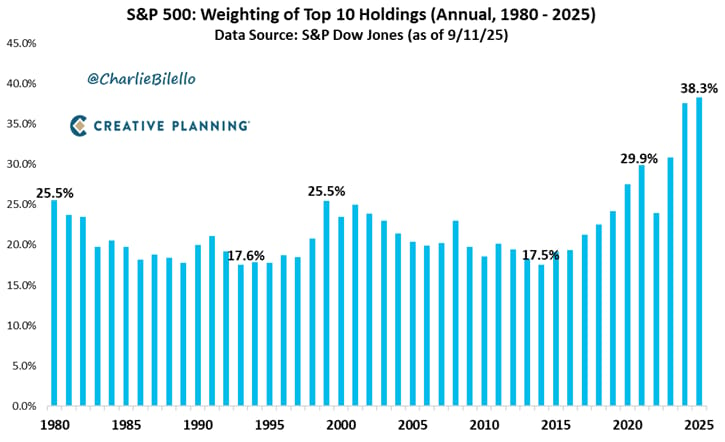

The S&P 500 has never been more top-heavy than it is today.

The 10 largest companies now make up 38.8% of the entire index, the highest concentration on record.

This means a handful of mega-cap names — Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and a few others — are driving a disproportionate share of market returns. Investors who own the index today are, in effect, heavily exposed to these giants whether they realize it or not.

One way to see this imbalance is by comparing the traditional S&P 500 (market-cap weighted) against the Value Line Geometric Index, which tracks roughly 1,700 companies on an equal-weight basis. The gap between the two underscores just how much performance is being carried by the “Magnificent 10,” while many smaller and mid-sized companies lag behind.

For investors, this concentration cuts both ways: it highlights the power of owning the winners, but also the risks of overvaluation if these few stocks stumble. Diversification — across sectors, sizes, and even asset classes — has never been more important.

And this is also why I’ve been investing toward small caps recently. I think this lagging sector of the market is starting to catch up in a big way!

The Rich Habits Radar

👉 Nvidia announced plans to invest $5B in Intel for a new chip partnership.

👉 US retail sales rose 0.6% in August, beating expectations.

👉 China banned domestic firms from purchasing Nvidia’s advanced AI chips.

👉 The US & China made a framework deal to keep TikTok operating in America.

👉 Robinhood filed plans to launch a venture fund open to retail investors.

👉 Meta debuted $799 Ray-Ban “Display” smart glasses with an in-lens screen

👉 Alphabet joined the $3T market-cap club as AI momentum built.

👉 Workday agreed to buy AI firm Sana for $1.1B.

👉 Elon Musk bought ~$1B of TSLA, his first open-market buy since 2020.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.1% on your savings

Public — Trade stocks, options, and crypto

Roi — Use code “Habits” and start tracking your net worth

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.