Together with Public

Hi Everyone,

We hope you’re having a great week.

Before we get started, we want to give a major shoutout to the 77,200 of you who had the Rich Habits podcast sitting at #1 spot in your podcast rotation throughout 2025! We are humbled by your relentless support of our show.

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ The labor market just flashed a historically weak reading.

⭐ Austin & Robert broke down leasing vs. buying a car.

⭐ The Nasdaq-100 just flashed a very rare bullish signal.

⭐ Affordability of everyday necessities in the U.S. is decreasing.

⭐ U.S. money-market funds hit a record $8 trillion before more rate cuts.

Market Overview

As of market open, 12/4/25

ETF Winners & Losers

Chart of the Week

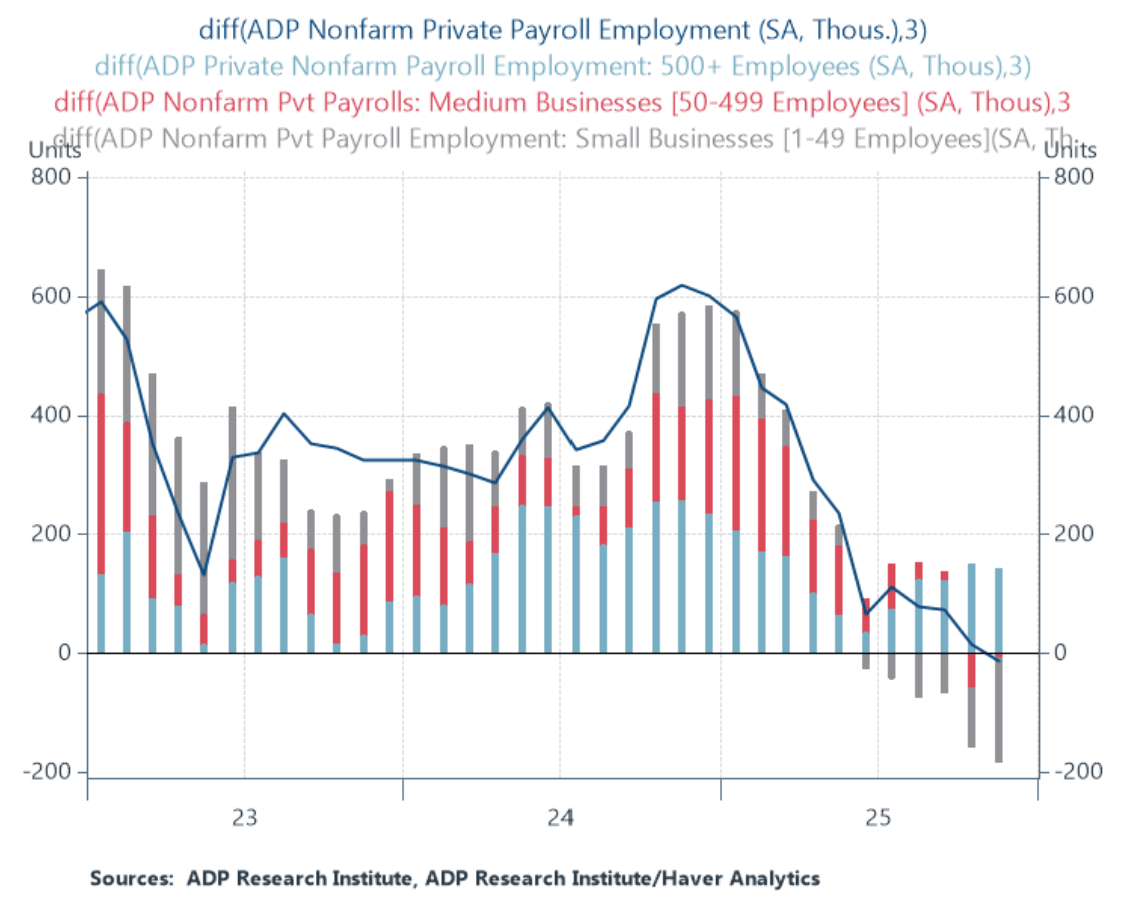

The labor market just flashed a historically weak reading.

ADP data showed private payrolls fell by -32,000 jobs in November, marking the sharpest one-month decline since 2021. Small businesses cut -178,000 jobs over the last three months, while large firms added +143,000. The divergence between Main Street and corporate America is widening — adding more fuel to the “K-shaped economy” narrative.

The stock market shrugged it off entirely, rallying in response. Investors immediately leaned into the idea that a labor market this soft all but forces the Fed to cut interest rates next week — or at minimum removes any hawkish optionality. Historically speaking, lower interest rates are good for the stock market (despite the pockets of weak economic data that might cause those cuts to take place).

Private hiring has clearly rolled over, small businesses are under pressure, and the “resilient labor market” narrative may be losing steam.

Lower interest rates are bullish for the stock market if we avoid a recession. If we do not avoid a recession, the stock market (like in 2022) will likely trade lower in response. At the moment, we’re not in a recession — but this weak jobs data isn’t helping.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more—it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert broke down the real numbers behind buying vs. leasing a car.

Here’s what they covered…

Lease vs Buy (The Real Difference) — Leasing gives you lower monthly payments, but zero equity. Buying costs more upfront, but once the loan is paid off, you can drive payment-free for years — and that’s when real wealth-building happens.

Who Leasing Makes Sense For — A small group: business owners who can write off payments, ultra–low mileage drivers, people who want a new car every 3 years, and those who hate dealing with repairs. For everyone else, the math rarely works in your favor.

The $40K Car Example — Leasing for 10 years: about $54,000 paid, and you still own nothing. Buying and keeping it 10 years: roughly $45,000 total — plus a car still worth $8K–$12K. That’s a $12K–$16K advantage toward buying.

Hidden Costs Nobody Thinks About — Mileage penalties, wear-and-tear fees, acquisition fees, disposition fees — and you're stuck making payments forever.

The Smarter Middle Ground: Buy Used — A 3-year-old car avoids the worst depreciation, costs far less, and still delivers reliability. For most people building wealth, this is the sweet spot.

Don’t let a car payment steal your financial future — run the numbers and choose the option that maximizes long-term wealth, not short-term comfort.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

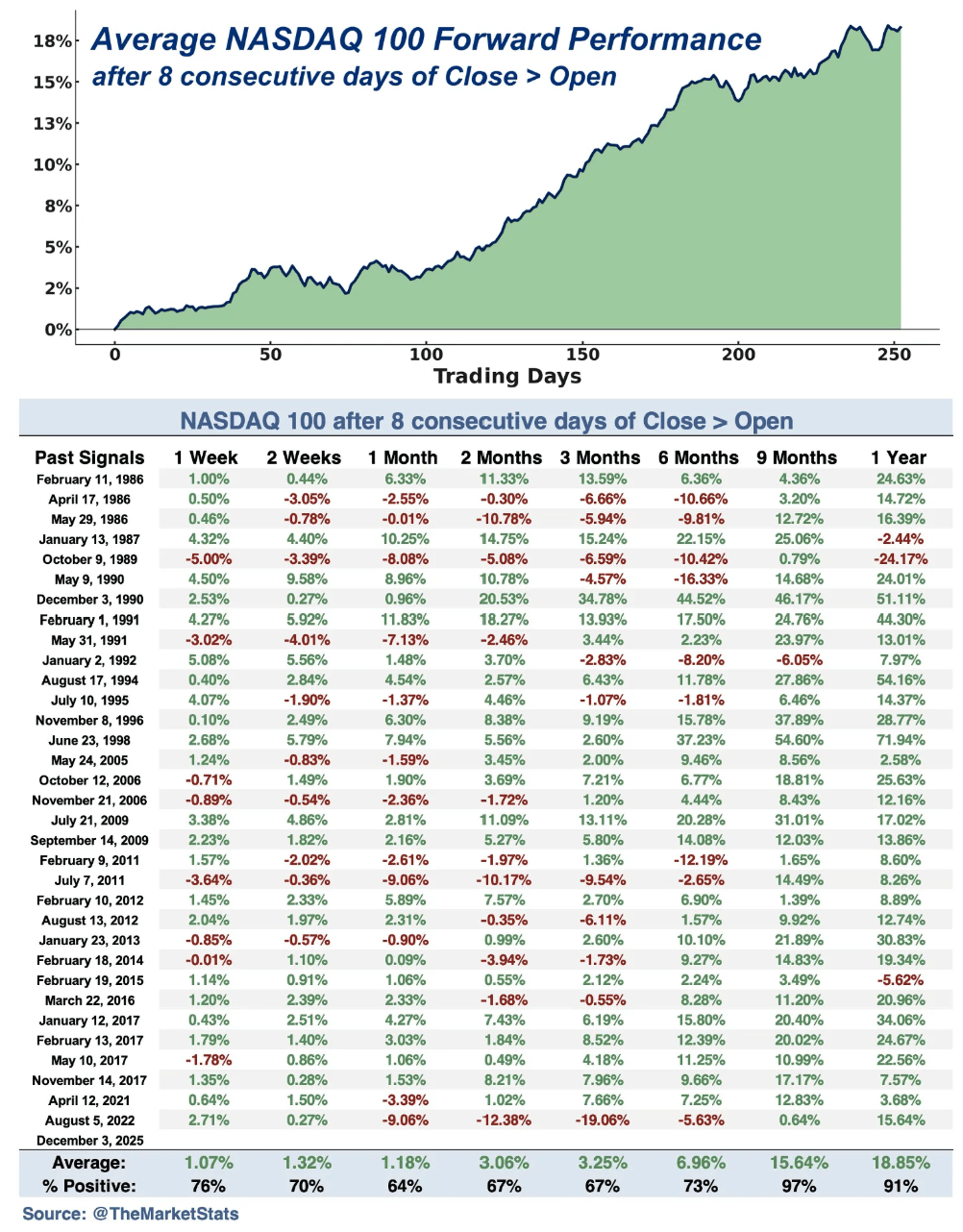

The Nasdaq-100 just flashed a very rare bullish signal.

The tech-heavy index just strung together 8 straight trading sessions of closing above its open — a momentum streak investors look for when gauging underlying demand. It doesn’t show up often, but when it does, the forward returns are remarkably consistent.

Historically, in 33 similar streaks, the Nasdaq rallied 32 out of 33 times over the next nine months, averaging +15.6%. That’s the kind of pattern that normally appears at the front end of durable uptrends, not the back end.

What makes this signal more interesting isn’t just the chart — it’s the macro backdrop surrounding it:

Inflation remains stable, easing pressure on risk assets.

Rate-cut expectations are trending in the market’s favor over the medium term.

Strong earnings momentum is carrying across AI-related names.

Momentum doesn’t guarantee anything… but when you get a technical signal with this kind of historical reliability right as macro conditions are slowly tilting risk-on, it’s worth paying attention. Despite the short-term volatility we experience in the markets, we remain bullish over the coming quarters. If rate cuts continue to take place, earnings continue to expand, and we avoid a recession — the future is bright.

Robert’s Callout

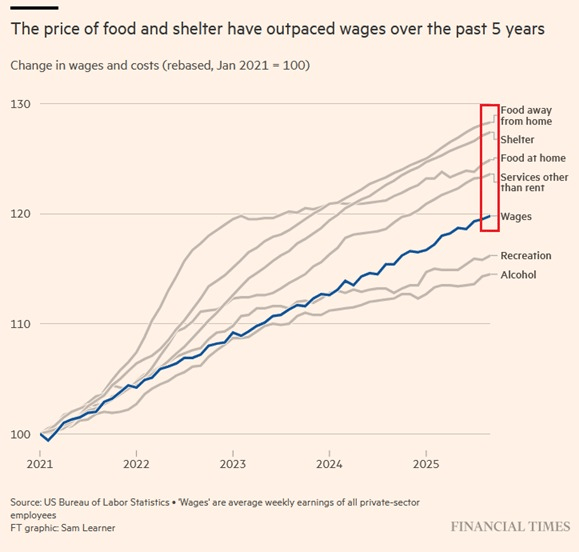

Affordability of everyday necessities in the U.S. is decreasing.

While headline inflation has cooled over the last few years, the real story for consumers is the continued surge in the cost of basic living. The gap between wages and essentials is widening, not narrowing.

Since January 2021, prices for core necessities have pushed to new highs: Food away from home is up +28%, shelter costs have climbed +27%, and food at home and core services have risen +25% and +24%, respectively. All of these mark record levels.

Wages, by comparison, have advanced just +20% over the same period. That spread is the pain consumers feel — incomes simply aren’t keeping up with the cost of living.

Zooming out makes the picture even clearer. Shelter costs have surged nearly +50% since 2015, the steepest 10-year increase since the mid-1990s. Housing, food, and services have structurally repriced higher — and the reset hasn’t been matched by wage growth.

This is why the “inflation is cooling” narrative feels disconnected from reality for many households. The cumulative hit from the last decade is still working its way through budgets, and affordability has not recovered.

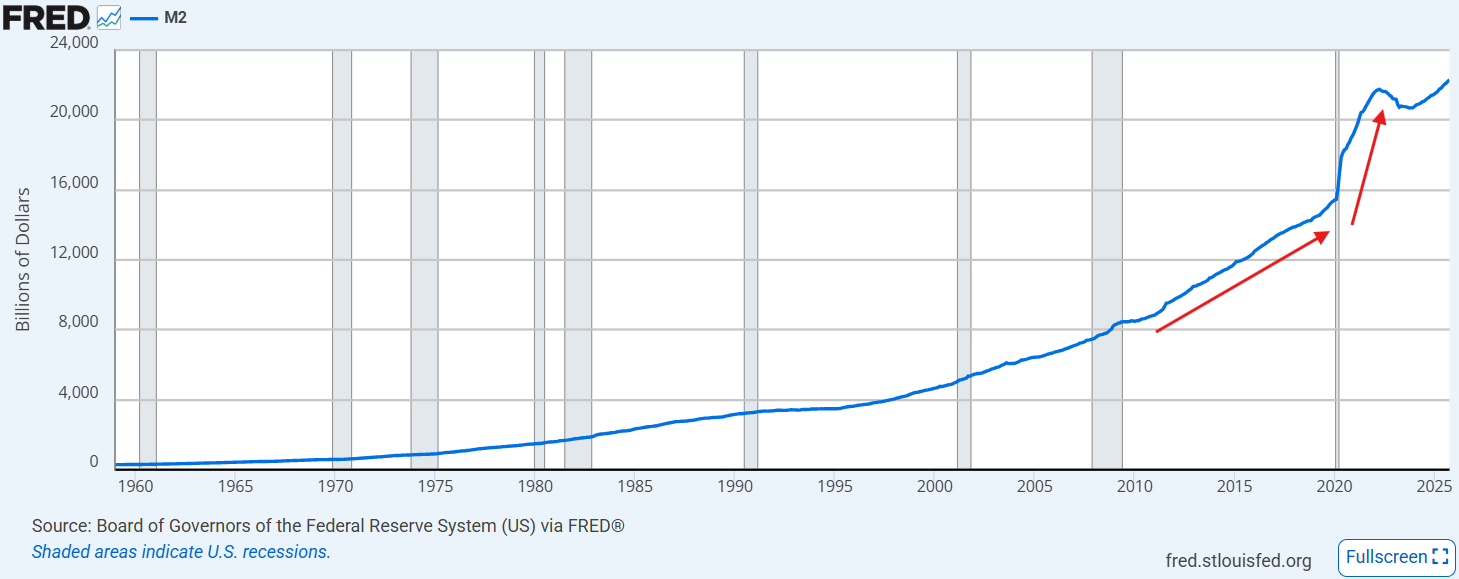

Asset owners have been the only real beneficiaries of this environment — as home values, stocks, and hard assets continue to outrun income growth. It’s painfully obvious we printed too much money in 2020, and now we’re all paying the price (shown above).

“Inflation is a tax on the middle class” is a quote I’ve heard a lot. And now the middle class is paying a new “tax” of 7% on their shelter — a “tax” that didn’t exist before January 2021.

The Rich Habits Radar

👉 Netflix & Warner Bros. Discovery explored a price-lowering combo.

👉 Sam Altman declared a “code red” inside OpenAI as competition rises.

👉 Anthropic rumored to be preparing for one of the largest IPO’s ever.

👉 Salesforce raised forecasts as Agentforce sales topping $500 million.

👉 Michael Dell unveiled a $6 billion gift to “Trump accounts.”

👉 Marvell agreed to buy chip startup Celestial AI for $3.25 billion.

👉 Intel shares climbed more +8% after reports it would supply chips for Apple.

👉 U.S. money-market funds hit a record $8 trillion before more rate cuts.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.6% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

See terms and conditions of Public’s ACATS & IRA Match Program. Matched funds must remain in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.