Good morning,

A quick breakdown — in case you don’t have the time.

⭐ A comprehensive overview of the semiconductor industry.

⭐ Its never been easier to make $1,000 online — John Hu explains.

⭐ More stocks declined in value than rose in value over the last week.

⭐ The S&P 500 is assuming we’ll avoid a recession in 2025.

⭐ UnitedHealth Group stock continues to fall since the execution in Manhattan.

Market Overview

As of mid-market, 12/12/2024

Chart of the Week

The semiconductor industry, visualized.

We found this wonderful illustration of the semiconductor industry online and just had to share it with you all! You might recognize a few names inside of the “Fabless Design” section, but it’s important to understand just how many different sectors exist inside of this industry.

Let’s break them down…

Fabless Design — companies that design and sell semiconductor chips, but do not manufacture them. These companies outsource the fabrication of their designs to specialized manufactures around the world, known as foundries.

Foundries — companies that specialize in the manufacturing of semiconductors for other companies, especially those who operate under the “Fabless” model.

Integrated Device Manufacturer — a company that designs, manufactures, and sells its own semiconductor products. They handle all aspects in-house, from design, to manufacturing and testing.

IP & R&D — companies whose business model surrounds technological advancements in chip design, manufacturing techniques, and materials. Once such advancement is discovered, they patent the technology.

Equipment & Components — companies whose machinery and tools are used to design, manufacture, and test semiconductors. The foundries are usually their biggest customers, as are integrated device manufacturers.

Don’t get us wrong, this space is confusing!

However, it’s important to understand the flow from R&D to patent to fabless design to foundries. Once you understand how these products go from “idea” to “being sold to customers” — investing into specific companies becomes a lot easier.

Why Smart Money Is Rethinking Cash Management

Here's an interesting wealth trend I've been watching: Successful professionals are starting to manage their cash like institutions do, not like their parents taught them.

While traditional banks offer "high-yield" savings accounts, institutions have relied on more sophisticated strategies. They use Treasury Money Market Funds, which may outperform while offering tax advantages most people don't know about.

That's why Titan's Smart Treasury caught our attention. They've taken institutional cash management strategies and made them accessible to individual investors. The platform automatically selects the highest yields among their options while optimizing for your tax situation. (For context: investing just $6K in Smart Treasury could cover your entire annual membership – making their professional guidance and premium perks at no cost.)

But here's what makes Titan different from other fintech plays: They pair sophisticated investing with real guidance. You get advisors you can actually message – no scheduling, no gatekeeping, just straight answers when markets move. Plus premium perks you'll actually use, like MSG suite access and impossible-to-get reservations.

Think of it as having a Goldman-caliber wealth manager in your pocket, but built for our generation. Whether you're sitting on cash earning nothing or ready to level up your wealth management game, it's worth checking out.

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin sat down with John Hu, CEO of Stan, to discuss how anyone can begin earning money online in 2025.

Here’s what they learned:

The Average Successful Stan User — John explained that the average user of Stan has between 2,000 and 3,000 followers on social media. Despite not having 100s of thousands or even millions of followers online, they’re still able to earn hundreds every month as they sell digital courses, e-books, and book 1-on-1 calls with customers.

Stan’s Employees Care, A Lot — Being an entrepreneur can be very lonely. As a fellow entrepreneur himself, John realized this — which is why he has built out such a caring and empathetic team at Stan. His employees deeply care about your success on the platform, and he takes pride in knowing how willing they are to jump on a call with their customers to help them overcome a hurdle or troubleshoot a problem.

All-in-One Platform — John shared his excitement for having built such an encompassing platform for entrepreneurs. Instead of paying for nine different subscriptions to gain access to a email marketing software, calendar booking, course selling, community hosting, and DM automation — you get all of that and more in a single subscription with Stan.

This episode was not an advertisement. We didn’t receive a dime in compensation from Stan or anyone else for that matter to have John on the show. We deeply believe in what John and his team are building at Stan, and we want to do everything we can to empower our listeners to begin earning extra money every month following their passions.

If it’s baking sourdough bread, cutting men’s hair, making and selling homemade ice cream, or anything in between — there’s something out there that you’re disproportionately passionate about. Find that thing, make content about it, then sell a digital product about it to your followers — it just might change your life!

Here are some links for you to explore!

- Visit Austin’s Stan Store or Robert’s Stan Store and click “Try 14 Days Free” at the bottom!

Here’s a link to the Q&A episode that was posted this morning.

We answered questions from: James L, Ari S, Jared H, Elena S, Dave R, James H, Angie H, and C Rob

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Robert’s Callout

Source: Jason Goepfert

Over the last week, more stocks have been declining than rising in the market.

Meanwhile, the S&P 500 is sitting at around -1% off its peak. That's happened twice before in the last 25 years — and both of them resulted in large downward moves for the S&P 500.

As investors, we shouldn’t use past performance and seasonality to try and predict future returns. With that being said, it’s important to highlight this extremely rare scenario. We’re certainly in a secular bull market — but it’s important to understand that these bull markets come with volatility.

All-time highs are great! We just might be losing steam.

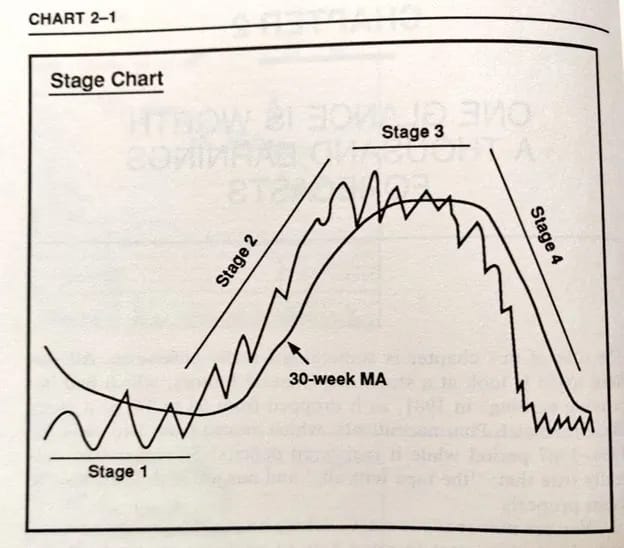

With positions in my portfolio up +70%, +100%, and even +250% year-to-date, I remain bullish. However, it’s important to keep an eye on which “Stage” your stock might be in — as we always want to avoid a “Stage 4 Breakdown.”

If you’re a member of the Rich Habits Network, you may recall seeing this chart during this week’s livestream:

I don’t have a crystal ball and I’m definitely enjoying this rally as we head into January, but I’m preparing myself for an S&P 500 that’s potentially less friendly in 2025.

Austin’s Callout

The S&P 500 is assuming we’ll avoid a recession in 2025.

As you all know, the Federal Reserve began their rate-cutting cycle in September of this year. Looking back through history, the performance of the S&P 500 during the 12-months following the first rate cut either includes a dramatic rally or a fall into bear market territory — no in between.

The variable that causes one of those two scenarios to happen is if the US economy falls into a recession or not. At the moment, the S&P 500 is trading as if we’ll avoid an economic recession and experience a “soft landing” in 2025.

There are several economic factors that support this claim — including a low unemployment rate, steady manufacturing data & building permits, as well as positive non-farm payroll reports.

With that being said, the S&P 500 is also now trading at the highest premium ever when compared to other stock markets around the world. Yes, the S&P 500 deserves to be trading at a premium — as it usually has throughout history — but the current spread is unfathomable.

Either the S&P 500 deserves this premium… or we’re in a huge bubble.

I’d argue we deserve this premium considering the recent AI advancements the Magnificent 7 stocks have realized over the last 24-months alone. The world is being rebuilt with AI in mind, and the United States is leading the charge!

I guess the other side of this trade would be that the stock markets around the world could really begin to catch up performance-wise with the S&P 500?

Regardless, I’m expecting increased volatility in 2025.

The Rich Habits Radar

👉 Google unveiled its impressive quantum computing chip, “Willow.”

👉 Albertsons & Kroger had their merger blocked. Albertsons is suing Kroger.

👉 Elon Musk became the first person to surpass a $400B net worth.

👉 UnitedHealth Group stock continues to fall since execution in Manhattan.

👉 Brian Armstrong trashed the SEC Commissioner ahead of (delayed) vote.

👉 A Trump crypto project bought ETH, LINK, & AAVE.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Titan Disclosures: Titan Global Capital Management USA LLC is an SEC-registered investment adviser. The reference of a $6K investment is based on a calculation that assumes a 4.60% 7-day yield (as of 11/29/2024) for Smart Treasury remains constant for a full year, with a $6K investment and no withdrawals during that period. Due to the fluctuating nature of 7-day yields of money market mutual funds, it is unlikely for them to remain constant, and actual earnings may vary depending on market conditions. The $6K breakeven point is based on the potential annual earnings from Smart Treasury estimated to be $263.45, exceeding the $250 annual membership fee. For purposes of the comparison between yield earned and the membership fee, the estimated earnings was calculated by multiplying 4.60% (current highest yield available in Smart Treasury) by $6,000 (the hypothetical investment amount) for a total hypothetical gross yield earning of $276. After applying the 0.20% advisory fee to the $276 earning + $6,000 initial investment, this hypothetical client would net approximately $263.45 in yield - higher than the annual membership fee of $250. The calculation is gross of any applicable taxes, and does not account for potential compounding. Membership fees are $250/year if paid upfront or $25/month if paid monthly, which would require a higher breakeven point than $6K. Certain money market funds within Smart Treasury have minimum investment requirements of up to $3,000. Investors with balances below these minimums may experience lower yields. Yields fluctuate over time and are not a forecast or guarantee of future earnings. This calculation is for informational purposes only and not a guarantee of earnings. All investments involve risks, including potential loss of principal. Nothing in this content should be construed as personal investment advice. Investments in Smart Treasury are not deposits and are not FDIC-insured like savings accounts. View Smart Treasury risks & disclosures at titan.com/smart-treasury-disclosures. Access to certain membership perks, such as the MSG suite, is subject to eligibility, availability, location, and terms apply. The mention of Goldman Sachs does not imply affiliation, endorsement, or guarantee of specific outcomes. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. This content is for informational purposes only and is not intended to be specific investment advice, tax advice, or a recommendation to buy or sell securities.