Together with Public

Hi Everyone,

We hope you’re having a great week.

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

Two Important Reminders

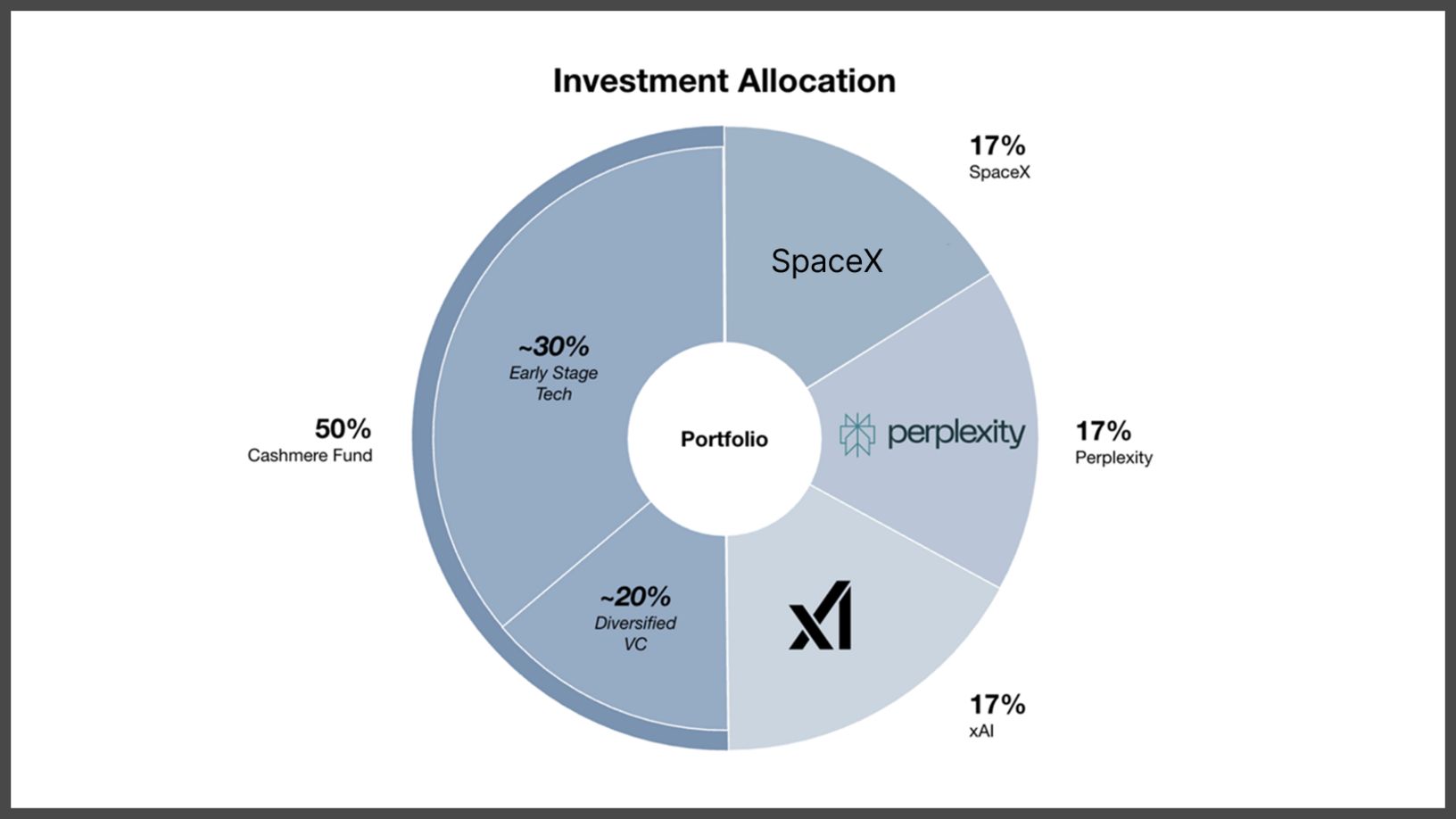

1) Invest Alongside Us in SpaceX, Perplexity, xAI, and the Cashmere Fund

For the first time ever, accredited investors can invest alongside Robert and Austin in SpaceX, Perplexity, xAI, and all 38 holdings inside The Cashmere Fund (including MrBeast’s Beast Industries, Katy Perry’s De Soi, Graza, and more) — all through one single investment ($7,500 minimum).

The structure is simple, yet powerful:

17% SpaceX

17% xAI

17% Perplexity

50% Cashmere Fund

This vehicle provides broad-based exposure across tech and consumer sectors, from Pre-Seed to Pre-IPO — and it’s all accessible through our partnership with Republic.

Because we’ve partnered with Republic, this opportunity is open to the public. As long as you’re accredited, you can participate. Feel free to share the details with your friends!

2) Free Webinar with CNBC’s Katie Stockton

Austin will be doing a stock pick breakdown with Katie Stockton on Friday, October 31st (Halloween) at 12pm ET. Katie is a renowned technical analyst and consistent CNBC Contributor. Join us or at least sign up to get the recording!

A quick breakdown — in case you don’t have the time.

⭐ Market concentration just hit another all-time high.

⭐ We discussed the 5 financial accounts you should have before 2026.

⭐ The S&P 500 is reporting stronger-than-expected results across the board.

⭐ The Fed just cut rates again with the S&P 500 sitting at an all-time high.

⭐ Fiserv crashed -44% after slashing guidance and launching a CEO shake-up.

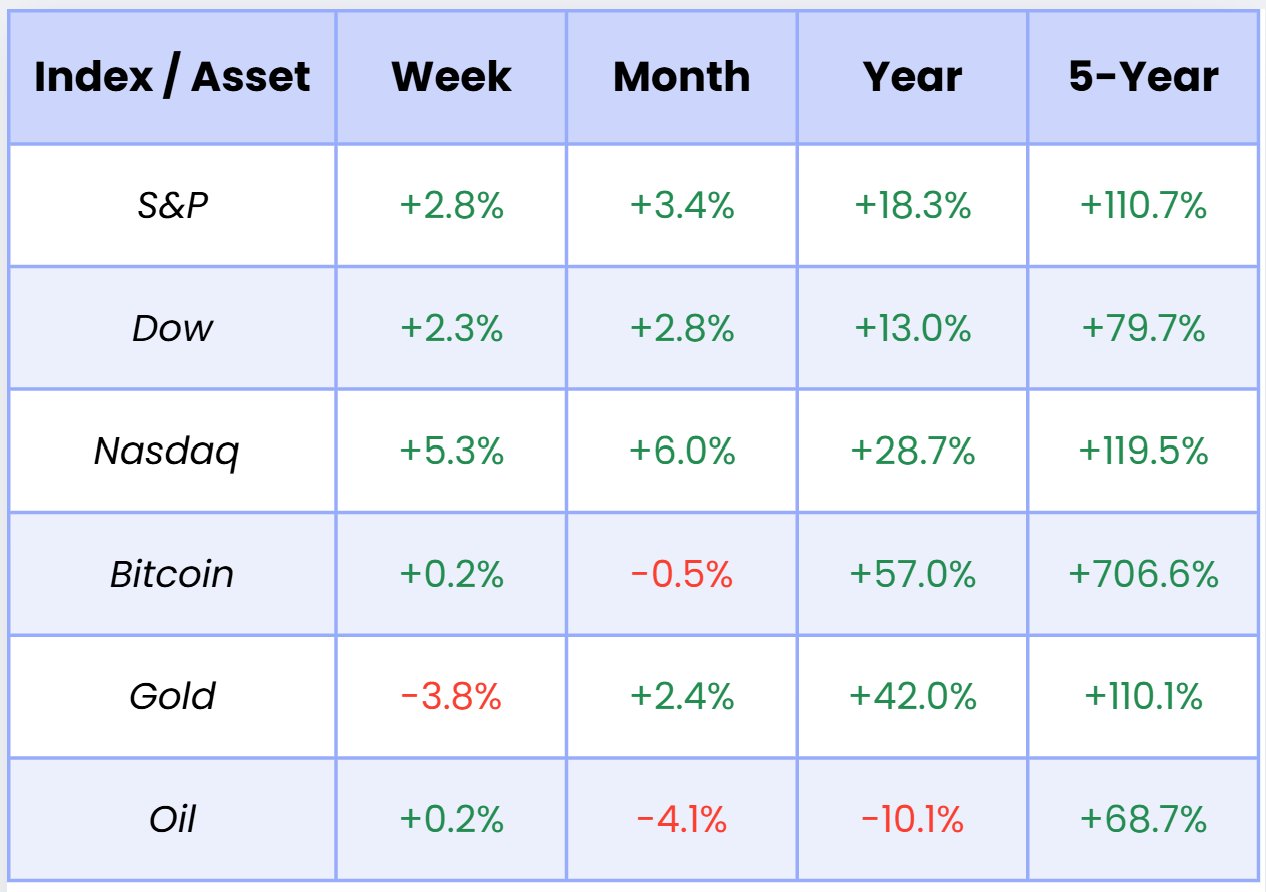

Market Overview

As of market open, 10/30/25

Chart of the Week

Market concentration just hit another all-time high.

The top 10 U.S. stocks now make up 41.4% of the S&P 500’s total market cap, a record share that’s climbed +6.2 points since April and +8.4 points since the start of 2024. Together, these ten companies are now worth over $25 trillion — the first time in history that their combined value equals 83% of the entire U.S. economy.

This isn’t just dominance — it’s economic gravity. Big Tech’s weight is reshaping index performance, investor behavior, and even how policymakers think about market risk. But is this weighting justified? We like to believe so.

These are the same companies who are delivering record revenue (Google’s recent $100B Q3 revenue print), record profits (Microsoft’s recent $28B Q3 net income print), and record efficiency (Meta’s recent +14% increase in ad impressions during Q3 due to the use of AI). On the surface, we’re seeing record highs in the stock market — but these record highs are being met with record profits and efficiency along the way.

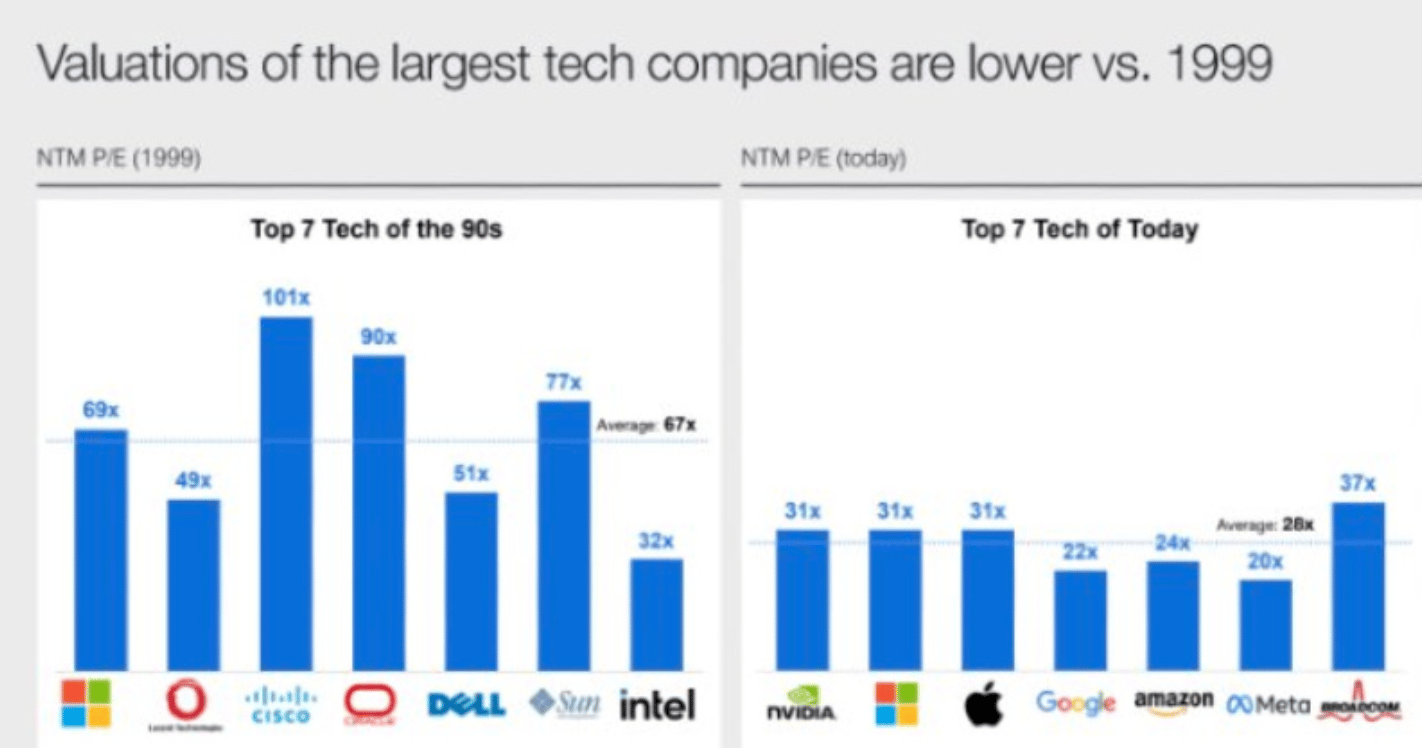

This rally is fundamentally driven — as the Top 10 names expect earnings growth of +15% in 2026 compared to the “other 490” only expecting +7% earnings growth. Below is a (blurry) image that illustrates the P/E ratios of the Top 7 tech companies today vs. the Dot Com Bubble. The average P/E ratio back them was 67X. Today, it’s only 28X.

It’s obvious these names are delivering real earnings, very different from the Dot Com Bubble.

The bottom line: when the top 10 move, the market follows.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more—it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert broke down the five essential financial accounts everyone should have set up before 2026.

Here’s why this episode matters: the 2017 Tax Cuts and Jobs Act is set to expire, tax brackets are likely going up, and new rules under SECURE Act 2.0 will reshape retirement contributions and 529s. Waiting until next December could cost you thousands in missed tax breaks, free money, and compounding growth.

Here’s what they covered…

High-Yield Savings Account (HYSA) — This is your emergency fund and the foundation of your entire financial plan. With interest rates still hovering around 4%, every dollar sitting in a checking account is losing money. Austin and Robert explained why you need 3–6 months of expenses in a high-yield savings account. Public is a great option with their high-yield cash account!

Retirement Accounts (401(k), Roth IRA, Traditional IRA) — With tax cuts expiring, Roth contributions are more valuable than ever. Robert broke down how funding your 401(k) to get the full employer match is free money, while Austin showed how even small, consistent Roth IRA contributions could compound to over $1M tax-free by retirement.

Health Savings Account (HSA) — The “triple-tax-advantaged” account most people overlook. Contributions are pre-tax, growth is tax-free, and qualified withdrawals are tax-free. Used strategically, an HSA can double as a stealth retirement account for future medical expenses.

Taxable Brokerage Account — Your bridge to financial freedom before age 59½. The hosts shared how a simple, automated investing plan — $100 to $200 a month into index funds like VOO or VTI — can build long-term wealth while giving you flexibility for big goals like a home, business, or early retirement.

529 College Savings Plan — For parents or future parents, this account offers tax-free growth for education expenses — and, under SECURE Act 2.0, you can now roll up to $35,000 of unused funds into a Roth IRA. That removes the old “what if my kid doesn’t go to college?” fear completely.

Austin and Robert closed with one clear message: your accounts are your financial infrastructure. Without them, you’re overpaying in taxes, missing employer matches, and losing years of compounding.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

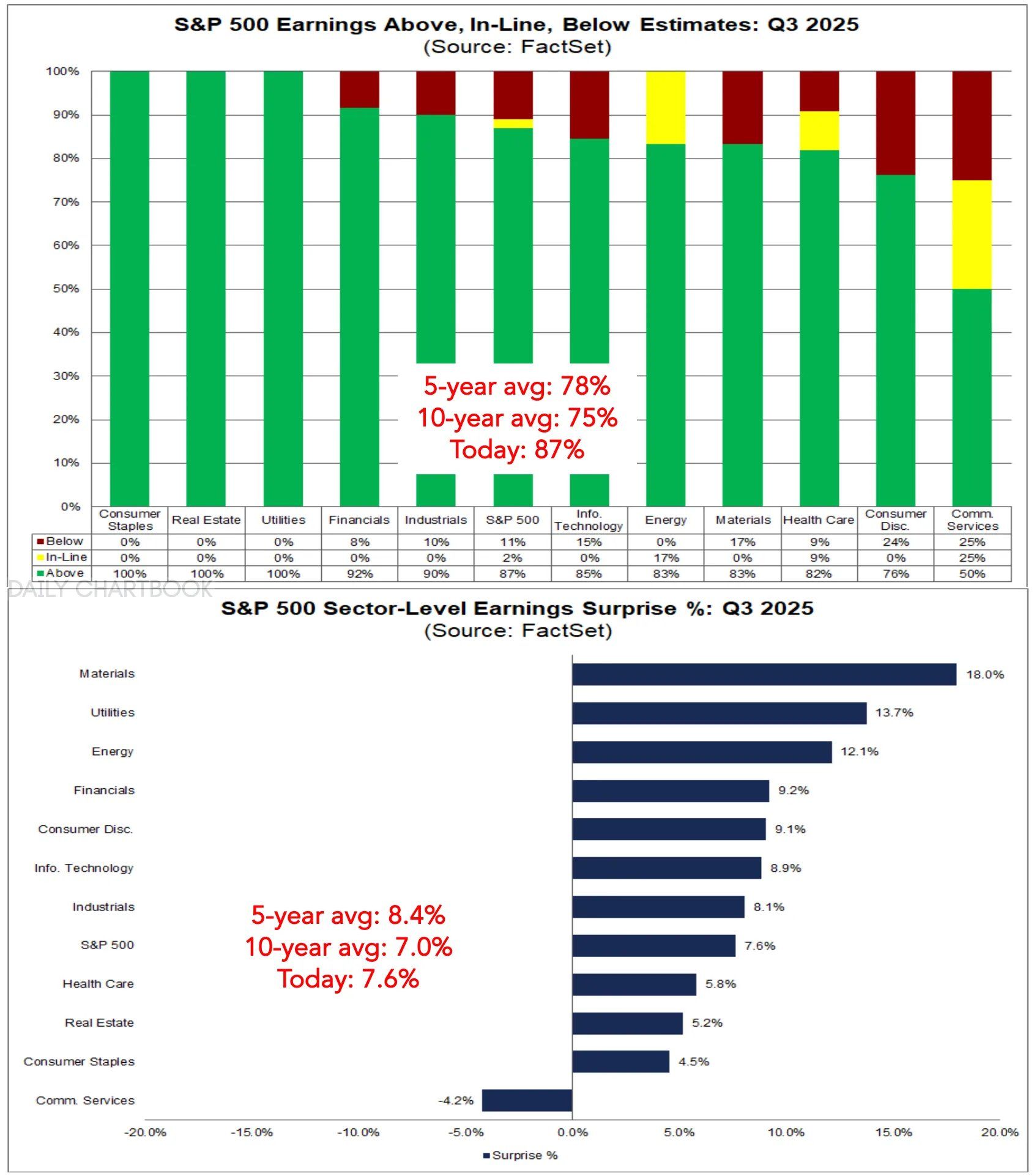

At this stage of Q3 earnings season, the S&P 500 is reporting stronger-than-expected results across the board.

Both the percentage of companies beating earnings estimates and the average size of those beats are running above their 10-year averages — a clear sign of resilience despite tighter financial conditions.

Corporate America is still delivering. Profit margins have stabilized, pricing power remains intact, and consumer demand has proven far more durable than many anticipated heading into 2025. Even sectors that struggled last year — like industrials and materials — are showing signs of recovery, while tech continues to drive the bulk of earnings growth.

When earnings expand while sentiment stays cautious, that’s the setup for multiple expansion. Investors are beginning to recognize that the fundamentals are catching up to the hype. Additionally, over $1 trillion in stock buybacks have already been announced this year — a record! This acts as consistent buying power to keep the stock market moving up and to the right.

Strong earnings are doing the heavy lifting — not just hope.

Robert’s Callout

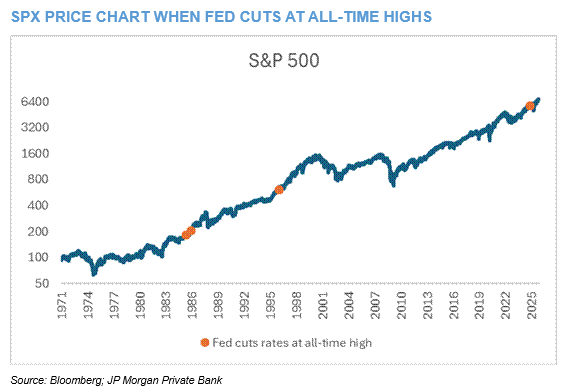

The Federal Reserve just cut rates again with the S&P 500 sitting at an all-time high — a rare alignment that’s only happened four times before in history.

And the record speaks for itself: in every single one of those past instances, the market finished higher 12 months later, with an average gain of nearly +20%. Rate cuts at record highs don’t signal exhaustion — they often signal acceleration.

When the Fed eases into strength, it amplifies liquidity, boosts corporate borrowing power, and fuels the very conditions that keep bull markets running. Investors get cheaper capital, companies see stronger multiples, and optimism spreads fast.

If history is any guide, this cut isn’t the top — it’s the spark that could push the next leg higher.

The Rich Habits Radar

👉 Alphabet beat earnings as quarterly sales surpassed $102B.

👉 Meta missed EPS after a $15.9B tax hit, sending shares sharply lower.

👉 Microsoft finalized a $135B deal to take a 27% stake in OpenAI.

👉 PayPal beat forecasts & announced an OpenAI payments integration.

👉 Fiserv crashed -44% after slashing guidance and launching a CEO shake-up.

👉 Nvidia became the first company to hit a $5 trillion market cap.

👉 The Fed cut rates by 25 bps to 4.25%, citing mixed economic signals.

👉 Amazon announced plans to cut 30,000 jobs in a cost-saving overhaul.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 4.1% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

See terms and conditions of Public’s ACATS & IRA Match Program. Matched funds must remain in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.