Together with Public

Good afternoon,

A quick breakdown — in case you just don’t have the time.

⭐ Used car prices are tanking, down -17.5% since their 2021 peak.

⭐ We made an episode about our disagreements with Dave Ramsey.

⭐ Ethereum ETFs have seen solid inflows during their first trading days.

⭐ Condo listings are skyrocketing, insurance costs are a factor.

⭐ Delta is under investigation for canceled flights, CEO left for Paris.

⭐ Find the right card for you by using our Best Credit Cards Portal.

Market Overview

As of 3:30pm EST on 7/25/2024

Chart of the Week

Car prices are officially crashing.

According to The Kobeissi Letter, used car and truck prices are now down -17.5% since their 2021 peak. This is the largest decline in 15 years.

Over the last 35 years, there were only two times when prices of used vehicles saw a bigger drawdown: in 2004 and 2009.

Overall, U.S. wholesale prices of used vehicles have declined for 22 consecutive months. In June, average wholesale prices decreased by -8.9% year-over-year to $17,934.

EV makers have been hit the hardest — with some EV prices falling more than -40% since last year. The car market bubble has popped.

Remember — a large portion of the Consumer Price Index (inflation) is transportation. About 7-8% of the CPI is made up of the sales of new and used cars. Keep that in mind when you see inflation numbers coming down. It might not necessarily mean that your grocery store visits are getting any cheaper!

If you want to see more content about the car market — check out this video from CarEdge on TikTok. They are are a great account to follow!

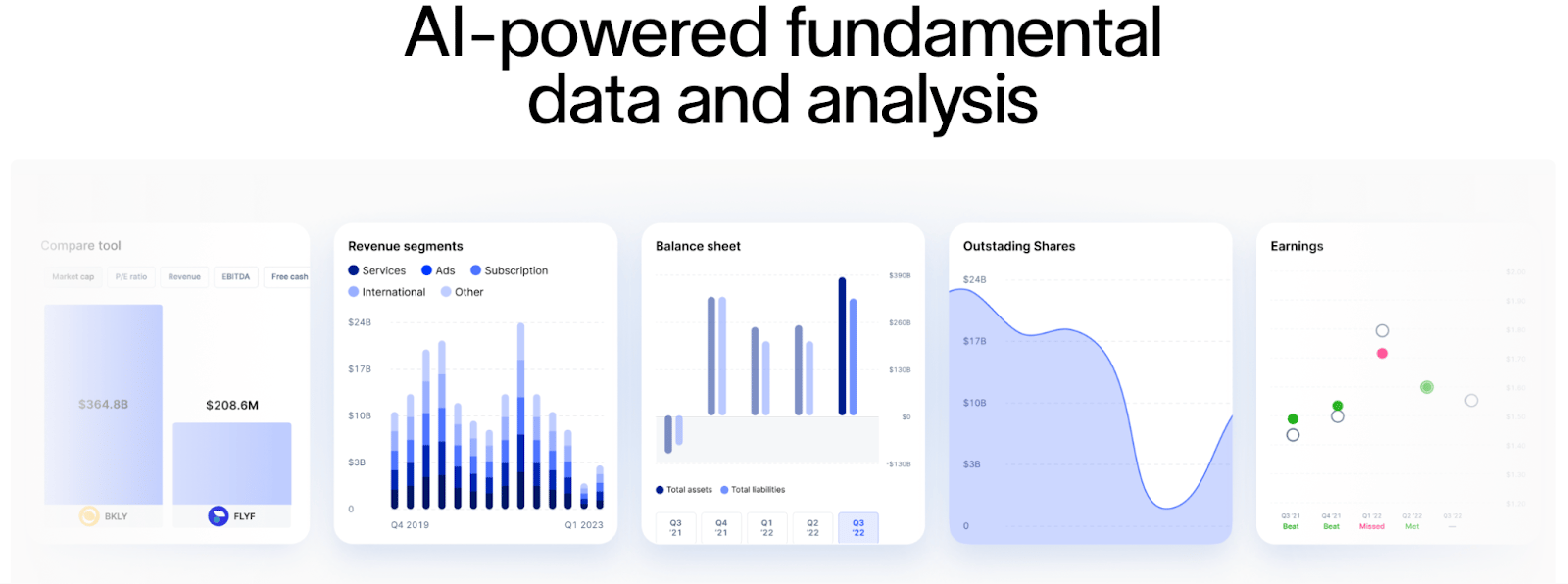

Public… we can’t say enough about them. This company was one of the first to believe in and support what we do here with the Rich Habits community. As the podcast, this newsletter, and the overall following all continue to grow — we want to make sure the spotlight remains on this special sponsor.

Public allows you to invest in stocks, bonds, options, crypto, and more in one place. The platform is SLEEK — and you can use advanced tools / AI-powered insights to make informed investing decisions.

With commission free options trading, a high-yield cash account with 5.1% APY*, the easiest platform to buy T-Bills, and our favorite interface for investing in stocks and ETFs — we’re honored to be partnered with Public!

In Case You Missed It…

In this week’s episode of the Rich Habits podcast (linked here) — Robert and Austin talked about their disagreements with Dave Ramsey, the personal finance media giant.

Below are our three main disagreements with Dave:

All Debt is Bad Debt — The biggest thing that Dave Ramsey says to his audience is to “GET OUT OF DEBT!” Here’s our problem — not all debt is bad debt and this topic isn’t as simple as "stay away from debt at all costs.” Both Austin and Robert have taken out loans for properties. For example, Austin’s mortgage interest rate is 3.3%. He intentionally made the down payment for this house with as little up-front money as possible — knowing that he can make a higher return by investing in the stock market each year. All debt is NOT bad debt.

His Approach to Becoming a Net Worth Millionaire — Dave Ramsey often talks about becoming a “net worth millionaire.” This means that you may not have $1M+ at your disposal, but the combination of all of your investments is worth at least $1M. This is fantastic, but Dave encourages his listeners to pay off their primary residence as quickly as possible and invest 15% of their income toward retirement via a 401k. That’s cool — but you don’t want to have to wait until you’re 70 years old to retire. It’s critical to have a bridge account that you’re building up in a taxable brokerage account.

Bitcoin is a Scam — We can keep this last one brief. Dave Ramsey believes that Bitcoin is foolish to own and we entirely disagree. If there’s anything we can take away from our leaders in government and politics (on both sides of the aisle) — it’s that they don’t care about preserving the purchasing power of the U.S. dollar.

Thanks again to the hundreds of you that attended our webinar last month with Public’s Director of Product – Emily Kurtz!

Emily did a wonderful job simplifying the complicated world of options. As we always remind our listeners, don’t just dive into options without educating yourself first!

Here’s a quick snippet of what Emily had to say:

“Ultimately – for any position or outlook you take on a stock – there are multiple ways to construct a position with options to drive that desired outcome. I think it’s really important to consider how you can use options to reach your personal goals, while still maintaining low risk. Incorporating options properly to a portfolio can be a big difference-maker once you reach a level of comfort and confidence!”

And we couldn’t agree more. For example – Austin has been vocal about generating additional income from selling covered calls against his 200 shares of Tesla (TSLA) stock. He loves Tesla, he doesn’t want to sell it for a very long time, and he doesn’t care about the short-term price outlook of the stock. As a result, he takes advantage of options in a way that works well for his desired outcomes — additional income to the tune of $16K.

But there’s much more to options than just this one strategy — and we certainly don’t pretend to be options experts. That’s why we’re thankful to the folks at Public for providing the resources necessary to educate ourselves!

While we sadly can’t share the webinar link with you, we have the slides from the presentation.

You can access the presentation here, and feel free to share these slides with whoever you think would find them helpful!

If you learn better by watching videos, click here to access Public’s incredible education hub!

And as always – public.com/richhabits was made for each of you! Check it out.

Here’s a link to the Q&A episode posted this morning! During this episode — we took questions from Mike B, Zen J, Stefano S, Michael H, and Max B.

Don’t forget to follow our Instagram, where we share behind-the-scenes content and short clips answering your questions!

Reply to this email or DM us on Instagram with your questions so we can answer them in the next week’s edition. Be sure you’re following along on Spotify, Apple Podcasts, YouTube, IG, and anywhere else you get your podcasts.

Robert’s Callout

Here’s an incredible takeaway here from Eric Balchunas regarding the launch of Ethereum ETFs:

“I was curious how the Ethereum ETFs would rank in Day One volume vs. all 600 or so new launches in the past 12 months — but excluding the Bitcoin ETFs.

$ETHA would be #1 (by a lot), $FETH #2, $ETHW #5 and $ETH 7th, and $ETHV in 13th spot. And $CETH — which was lowest among group — would still rank in Top 10% vs a normal new launch. Just another way to illustrate how unusual all this is.”

Have the ETF listings for both Bitcoin and Ethereum been “sell the news” events in some ways? Sure.

However — it can’t be overstated how important it is for traditional financial markets to accept these cryptocurrencies. More ETFs will come and hundreds of millions of dollars are being actively invested into Bitcoin and Ethereum as more time goes by.

As we continue to experience volatility — I encourage you to sit back and relax. We believe in crypto for the long-term and these ETF listings are a wonderful milestone.

Austin’s Callout

Condo sales are stagnating.

According to EPB Business Cycle Research, the monthly supply of condos / co-ops is up over +170% over the last two years.

A big part of the reason? Insurance prices.

Higher premiums are raising the price of homeownership and making it much harder to sell units. With most condos having association fees — the average condo dues have risen +20% between 2022 and 2024.

Home insurance premiums also rose by more than +10% on average in 19 states in 2023 after a series of big payouts related to floods, storms, wildfires, and other natural disasters.

I can see this taking effect very personally. First of all — my mother lives in a condo in Florida. Due to the increased prices of insurance for her condo, she’s decided to sell. She was shocked to find out how many other people are experiencing the exact same thing.

Another way I’m seeing this condo crisis first-hand is by living right here in Nashville, Tennessee.

The amount of listings for condos is unbelievable. A few of my friends have recently been looking at making their first real estate purchases — and they’ve found the most willingness to negotiate coming from condo owners. The insurance prices here are also getting out of hand, but high interest rates are keeping the closed volume very low.

Let’s check back in on this and see if cutting interest rates leads to an uptick in real estate activity — as we all predict will happen.

The Rich Habits Radar

👉 Wiz decided to walk away from a $23B deal with Google.

👉 Delta is under investigation after thousands of canceled flights.

👉 Spotify shares surged after recording record profit.

👉 Tesla shares slid after missing the mark on earnings expectations.

👉 Google shares fell after worries surrounding AI investment returns.

👉 Apple might release a foldable iPhone as early as 2026.

👉 Elon Musk still endorses Trump, but denies $45M / mo donations.

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 5.1% on your savings

Public — Trade stocks, options, and crypto

Frec — Use direct indexing to invest & save on taxes

Grifin — Automatically buy stock where you shop

Acorns — Get $35 free when you subscribe

Suriance — Protect your family with term life insurance

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Roi — Use code “Habits” and start tracking your net worth

Dynasty — Protect your home in a trust

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclaimer: *Rate as of 7/23/24. APY is variable and subject to change.

Paid endorsement for Public Investing, Inc. All opinions are those of Rich Habits. Public Investing or any of its affiliates are not affiliated with Rich Habits. All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Public Investing offers a High-Yield Cash Account where funds from this account are automatically deposited into partner banks where they earn interest and are eligible for FDIC insurance; Public Investing is not a bank. Brokerage services for alternative assets are offered by Dalmore Group, LLC, member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions, LLC (NMLS ID 1828849), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative, involves a high degree of risk, and has the potential for loss of the entire amount of an investment. Cryptocurrency holdings are not protected by the FDIC or SIPC. Brokerage services for treasury accounts offering 6-month T-Bills are offered by Jiko Securities, Inc., member FINRA & SIPC. Banking services are offered by Jiko Bank, a division of Mid-Central National Bank.

Securities investments: Not FDIC Insured; No Bank Guarantee; May Lose Value. See public.com/#disclosures-main for more information.

Before investing in an ETF, you should read the prospectus, which provides detailed information on the ETF’s investment objective, principal investment strategies, risks, costs, and historical performance (if any), among other things. Prospectuses can be found on the ETF issuer's website. All investments involve risks, including the loss of principal. Performance data represents past performance and is no guarantee of future results. Investment returns and principal value will fluctuate such that an investment, when redeemed, may be worth more or less than the original cost.

Alpha is an AI research tool powered by GPT-4. Alpha is experimental and may generate inaccurate responses. Output from Alpha should not be construed as investment research or recommendations, and should not serve as the basis for any investment decision. Public makes no warranties about its accuracy, completeness, quality, or timeliness of any Alpha out. Please independently evaluate and verify any such output for your own use case.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.