Together with Public

Hi Everyone,

Welcome to our first post of 2026! Thanks again to the hundreds of thousands of you that made 2025 so special.

The Rich Habits ecosystem has never seen such incredible growth — and you’re the ones to thank. A special shoutout to the ~80,000 of you that had the Rich Habits Podcast as your #1 show on Spotify last year! That’s more than the total amount of people that will be attending the Fiesta Bowl (Ole Miss vs. Miami) tonight!

Make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ Retail investors are risk-on to begin 2026.

⭐ We broke down our 2026 “Money Calendar” — and suggest you save it!

⭐ America’s blue-collar job engine is quietly stalling.

⭐ Rent prices continue to roll over — and supply is doing the heavy lifting.

⭐ The U.S. will indefinitely control Venezuelan oil, reshaping energy flows.

Market Overview

As of market open, 1/8/26

ETF Winners & Losers

Chart of the Week

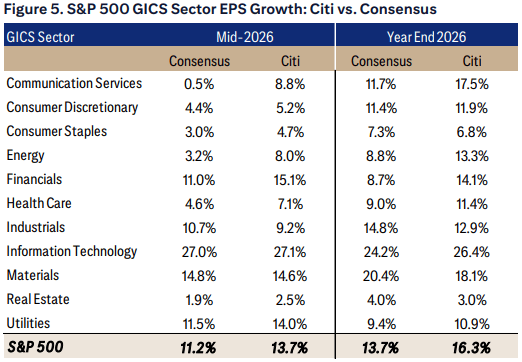

Wall Street is expecting Tech profits to grow by +26% in 2026.

Analysts on Wall Street are expecting the S&P 500 to grow profits (in aggregate) by +13.7% in 2026, compared to an estimated +12.1% in 2025. However, one sector of the index is expected to grow profits nearly twice as fast as the others — technology. According to Citi, Wall Street’s 2026 consensus expectation for profit growth in the technology sector is +24.2%, with the bank’s own forecast sitting at +26.4%.

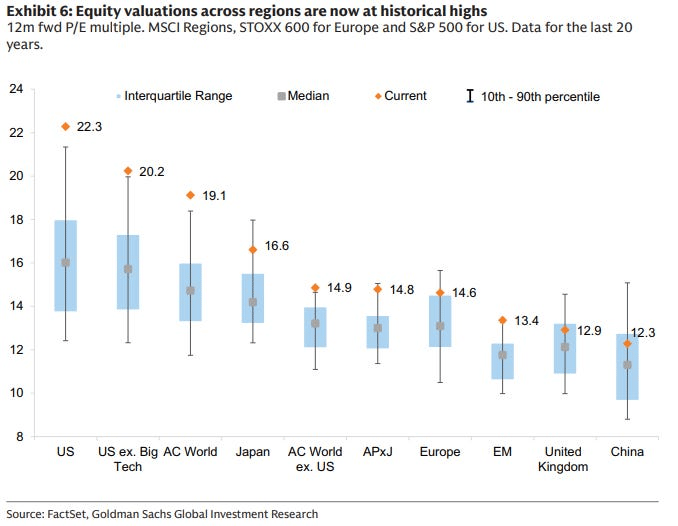

In our view, this earnings growth is very much welcomed. The S&P 500 entered 2025 with a forward P/E ratio of roughly 22x — well above historical norms. Despite this, the index delivered a total return of +17.8% last year. Only about 3% of that return came from multiple expansion, with the remainder driven by earnings growth. As we enter 2026 with the S&P 500’s forward P/E ratio in the 94th percentile historically, continued earnings growth will be required to push markets higher.

Despite a rising unemployment rate and fading momentum in high-beta stocks, we continue to believe the S&P 500 will deliver mid-to-high single-digit returns in 2026. In our view, Wall Street’s earnings expectations support that outlook.

Today’s Rich Habits Newsletter is brought to you by Public, the investing platform that combines a broad range of asset classes with the tools you need to build and manage your wealth.

From stocks to bonds, options, crypto, and more—it’s all here. You can even generate fixed income with a suite of yield accounts. If you’re looking for more than just a place to trade, discover the investing platform that’s as serious about your money as you are.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert laid out a simple, month-by-month money calendar for 2026, designed to help you stay consistent all year without getting overwhelmed.

Here’s what they covered…

January — Calculate net worth, set budget

February — Credit check, debt strategy

March — Insurance audit, HSA review

April — Taxes, retirement contributions

May — Mid-year progress check

June — Portfolio review, rebalance

July — Spending audit, vacation budgeting assessment

August — Raise prep, side income

September — Education, skill investing

October — Tax planning, deductions

November — Holiday budget, smart shopping

December — Year-end review, 2027 planning

The big takeaway: you don’t need to fix everything at once — just focus on the right money move each month.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

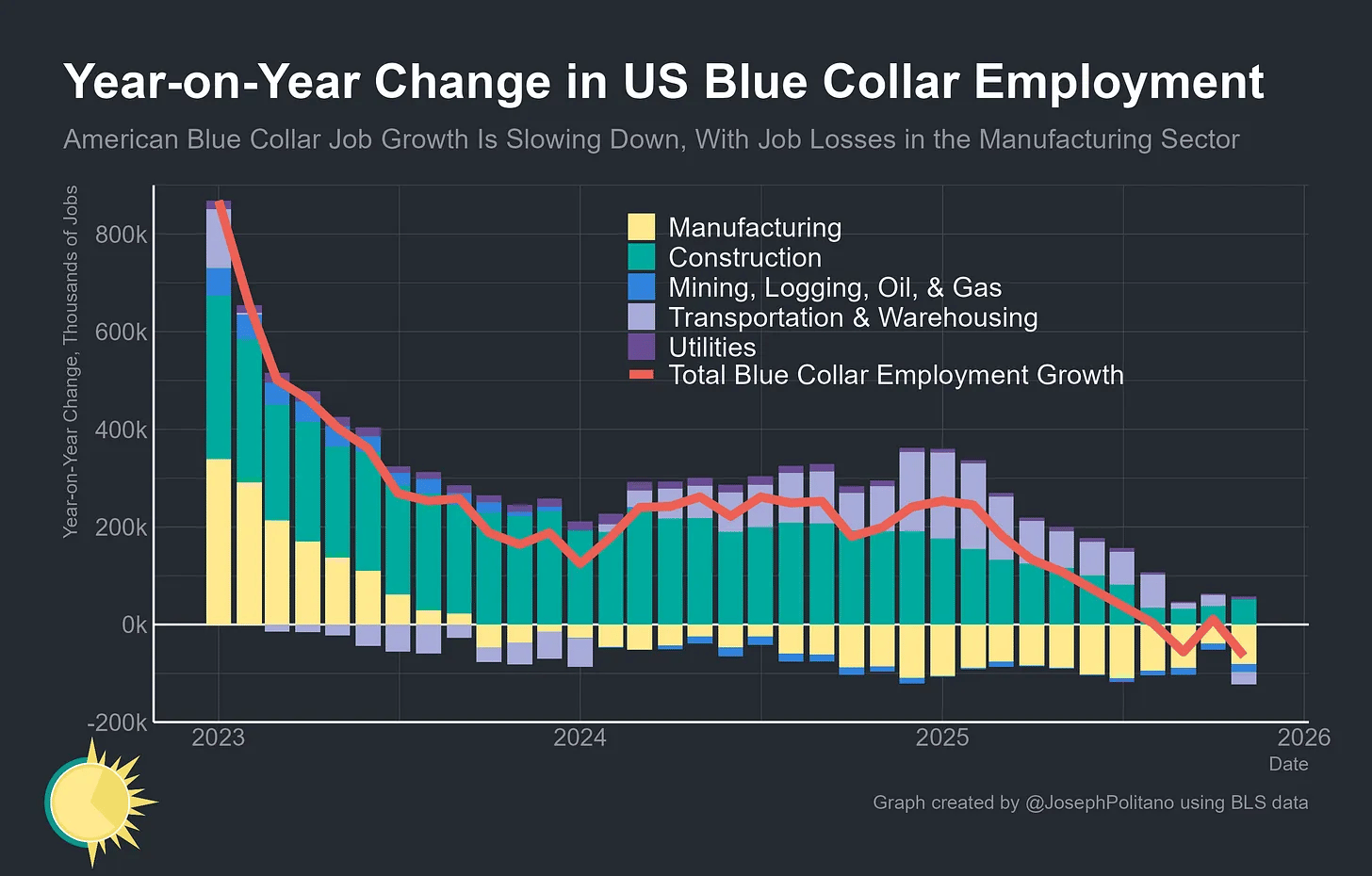

America’s blue-collar job engine is quietly stalling.

Employment across trades and industry is now down roughly 123K from its early-2025 peak, marking the first sustained decline in blue-collar jobs since the pandemic and the depths of the Great Recession. Over the past year alone, the U.S. has lost about 65K industrial jobs — a sharp reversal from 2024, when the economy added roughly 250K.

Manufacturing and transportation are driving most of the losses. Manufacturing employment has now been falling for more than two years straight, with the sector’s share of the workforce dropping below 8% — a record low. Transportation equipment and electronics lead the declines, but the weakness has become broad-based across nearly every major industry.

Construction is now rolling over as well. Job growth in the sector has slowed dramatically, adding just 52K jobs over the last twelve months versus 191K the year prior. Residential contractors — plumbers, electricians, roofers, and specialty trades — have lost nearly 55K jobs over the past year as the post-COVID building boom fades.

This isn’t a single-issue slowdown. Cooling demand, lower energy prices, and policy headwinds are all weighing on hiring — and it highlights how uneven this labor market really is beneath the surface.

Robert’s Callout

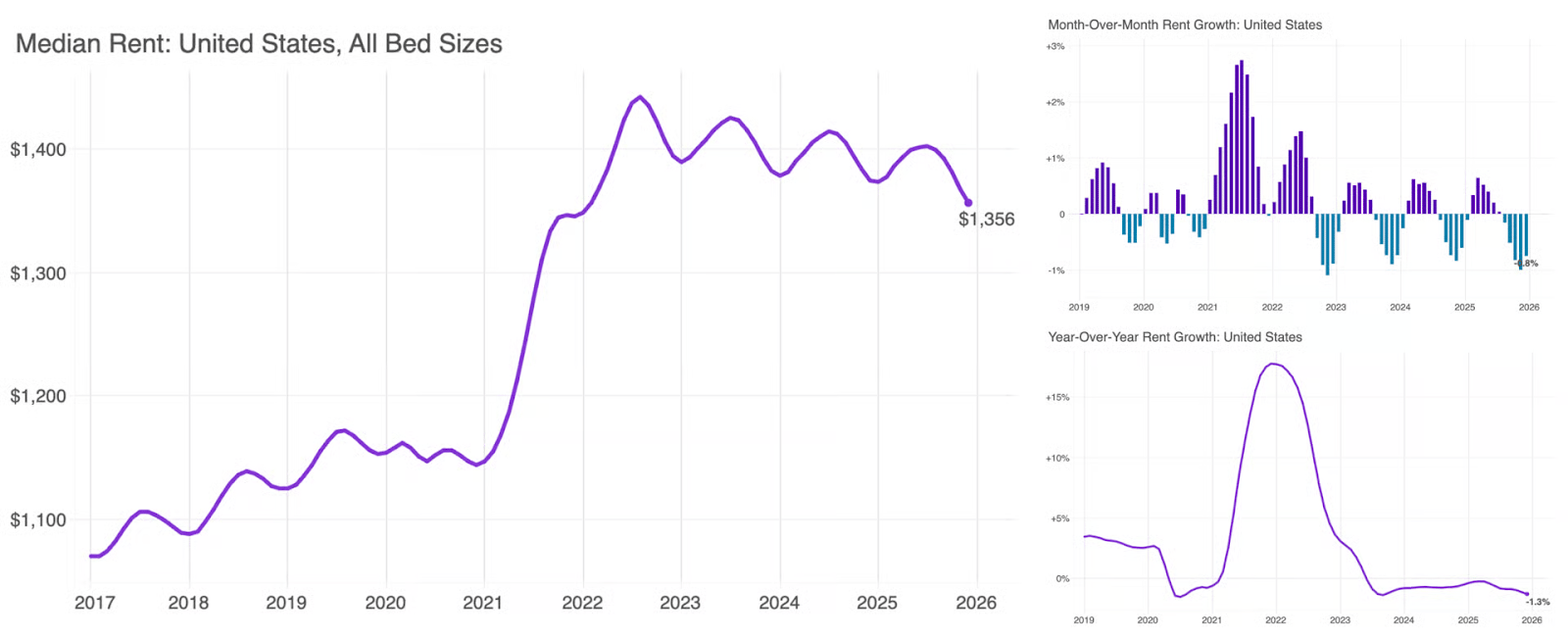

Rent prices continue to roll over — and supply is doing the heavy lifting.

The national median rent fell another 0.8% in December to $1,356, closing out 2025 with five straight months of declines. Rents are now down 1.3% year-over-year and nearly 6% below their 2022 peak, with modest additional softness likely into early spring.

Vacancies tell the story. The national multifamily vacancy rate has climbed to 7.3%, the highest level on record, as a wave of new supply continues to hit the market while demand remains sluggish. Units now take an average of 39 days to lease – another post-2019 high.

This is a tale of two markets. Austin remains the softest large metro, with rents down 6.6% over the past year, while supply-constrained areas like Providence are still seeing growth north of 5%.

For real estate, this looks less like a structural problem and more like a cyclical reset. As supply gets absorbed and rates eventually ease, demand should stabilize — setting the stage for healthier fundamentals in 2026.

The Rich Habits Radar

👉 Trump wants to restrict institutional buyers from single-family housing.

👉 Anthropic reportedly raising at a $350B valuation amid surging AI demand.

👉 U.S. job openings fell to a 14-month low as hiring momentum weakened.

👉 Bitcoin held above $91,000 as crypto markets began 2026 decently well.

👉 The U.S. will indefinitely control Venezuelan oil, reshaping energy flows.

👉 Nvidia CEO Jensen Huang took the CES stage to outline the next wave of AI.

👉 SanDisk stock is ripping, extending a rally on memory-market optimism.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.3% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Timeshare Exit — Exit an unwanted timeshare

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Public Disclosures: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Cryptocurrency trading services are offered by Bakkt Crypto Solutions (NMLS ID 1890144), which is licensed to engage in virtual currency business activity by the NYSDFS. Cryptocurrency is highly speculative and involves a high degree of risk. Cryptocurrency holdings are not protected by the FDIC or SIPC.

As part of the IRA Match Program, Public Investing will fund a 1% match of: (a) all eligible IRA transfers and 401(k) rollovers made to a Public IRA; and (b) all eligible contributions made to a Public IRA up to the account’s annual contribution limit. The matched funds must be kept in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time. See full terms here.

See terms and conditions of Public’s ACATS & IRA Match Program. Matched funds must remain in the account for at least 5 years to avoid an early removal fee. Match rate and other terms of the Match Program are subject to change at any time.

Disclosure: The author of this post has an existing business relationship with NEOS Investment Management, LLC, and is also a holder of numerous NEOS ETFs. The thoughts and opinions in this written piece are solely those of the author.