Together with Sequence

Hi Everyone,

It’s a crazy time in the markets. We’ll be hosting a two-hour livestream on Tuesday for the Rich Habits Network to break it all down. Click here to start your free trial and join us!

Before you read on — make sure you’re following us on Spotify, Apple, YouTube, or wherever else you watch the show! We want you to get notified when each new episode is released.

A quick breakdown — in case you don’t have the time.

⭐ The January’s jobs report looked strong – but revisions make it questionable.

⭐ Ahead of Valentine’s Day, we broke down financial red flags in relationships.

⭐ Capital is flowing back into large caps – and away from credit risk.

⭐ Consumers hit ‘pause’ in December.

⭐ U.S. January budget deficit fell to $95B, revenue beat spending growth.

Members of the Rich Habits Network have had the opportunity to invest in the following companies over the last several months:

Ongoing opportunities are updated every week!

Congrats to those that joined us by investing in Apptronik! Here’s a link to yesterday’s CNBC article about their round of funding.

It has come to our attention that many of you may not fully understand what it means to invest alongside Robert and Austin in startups and pre-IPO companies.

Over the last 18 months, we’ve provided opportunities for hundreds of accredited investors invest millions of dollars into over a dozen companies (including the ones shown above).

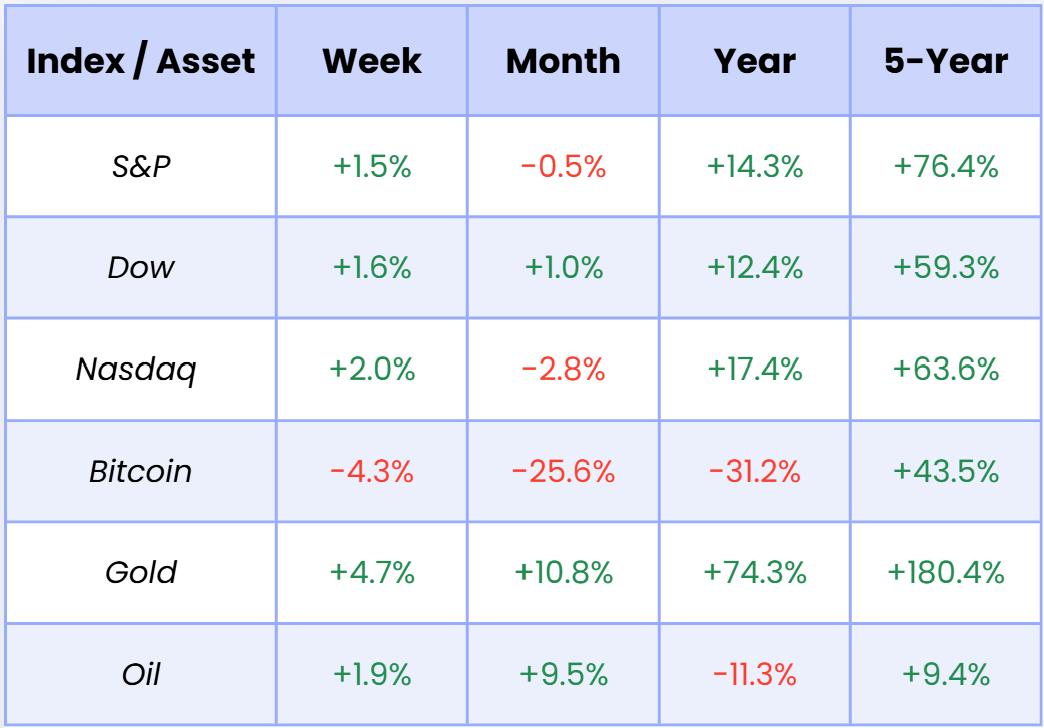

Market Overview

As of market open, 2/12/2026

ETF Winners & Losers

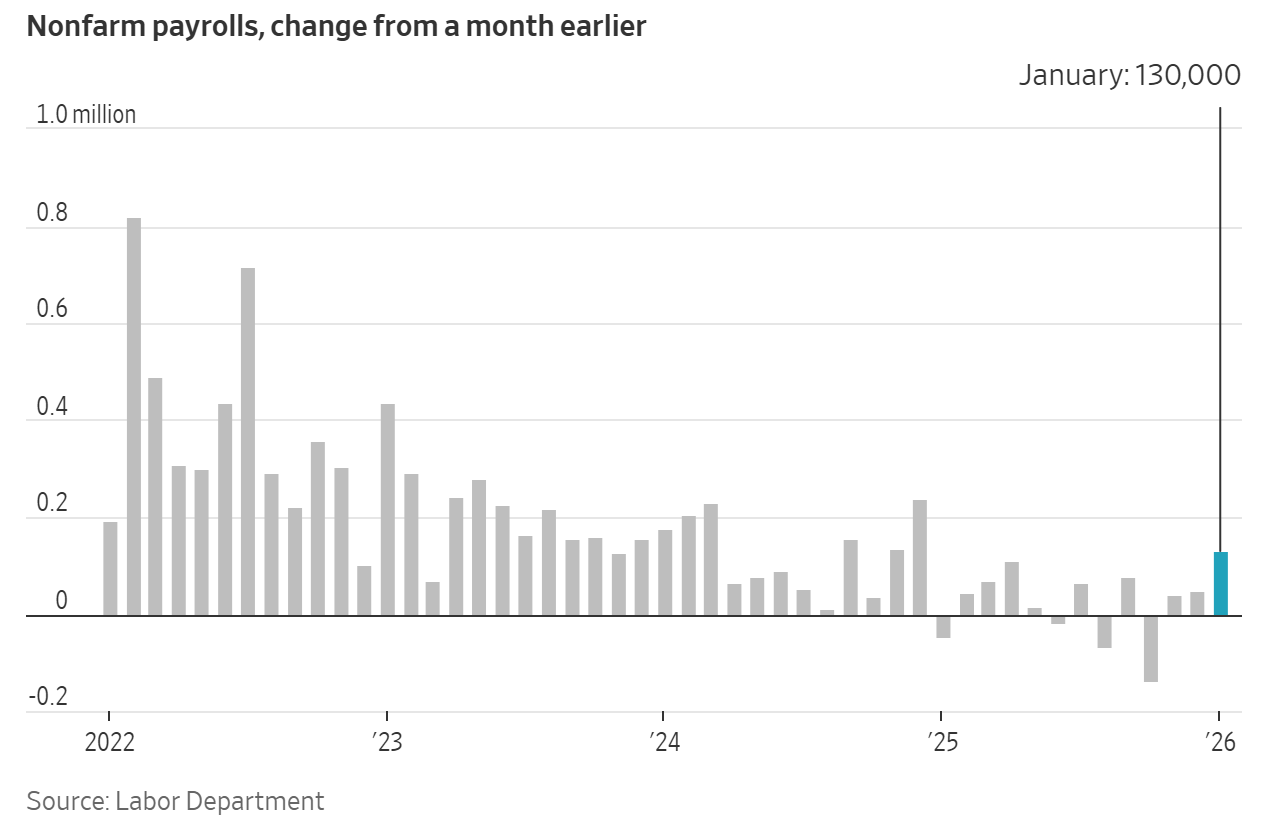

Chart of the Week

The January’s jobs report looked strong — but the revisions tell a different story.

The economy added +130,000 jobs in January, roughly double expectations, while the unemployment rate edged down to 4.3%. On the surface, it was a clear upside surprise. But as you dig deeper, you realize the backward revisions were substantial.

Updated data shows the economy added just +181,000 jobs for all of 2025 — revised sharply lower from the previously reported 584,000. That marks the slowest pace of job growth outside of a recession since 2003, with several months last year showing outright payroll declines.

Healthcare and social assistance accounted for nearly all of the job growth in January, while most other sectors posted minimal gains or losses. Government payrolls continued to shrink as DOGE-related deferred resignations officially hit the payroll data.

The takeaway can be viewed a few different ways. The labor market isn’t collapsing, but it isn’t broadly accelerating either. Growth remains concentrated and fragile, reinforcing the idea that the economy is cooling unevenly rather than reaccelerating decisively.

For markets, that balance matters. A steady unemployment rate alongside modest job creation keeps recession fears contained — but the weak underlying trend suggests policymakers will remain cautious heading further into 2026.

Today’s Rich Habits Newsletter is brought to you by Sequence — the platform that turns good money habits into automatic systems.

Rich Habits teaches you what to do with your money. Sequence makes sure it actually happens — automatically. Together, we built the Rich Habits Money Map, a plug-and-play setup for personal and business finances that helps you save, invest, and make your money work for you without relying on willpower.

With Sequence, you can:

Automatically save first and invest consistently every time you get paid

Route money for taxes, debt repayment, and goals using simple rules

Manage personal and business finances in one clean, automated system

Get expert help to tailor your Money Map to your specific situation

If you want your Rich Habits to run on autopilot, check out the Rich Habits Money Map at getsequence.io/richhabitspodcast.

In Case You Missed It…

In this week’s Monday-morning episode of the Rich Habits Podcast (linked here) — Austin and Robert break down the quiet money red flags that show up in relationships… and how to spot them before they turn into serious problems.

With Valentine’s Day around the corner — and Americans projected to spend $14.6 billion ($185 per person) — this episode explores why money gets irrational when love is involved, and how small financial misalignments can quietly compound over time.

Here’s what they covered…

Red Flag #1: Lack of Financial Transparency — If you can’t talk about income, debt, or money goals when the stakes are low, you definitely won’t handle those conversations well when the stakes are high. Couples who avoid financial conversations early often build resentment that surfaces later during major life decisions.

Red Flag #2: Normalizing Overspending — When “everyone lives like this” becomes the justification for lifestyle creep, debt quietly fills the gap. If one partner values long-term goals and the other values keeping up appearances, conflict is inevitable unless expectations are clearly aligned.

Red Flag #3: Measuring Value by Cost — When love is expressed primarily through spending, financial pressure builds fast. This mindset often leads to financial infidelity — hidden purchases, secret accounts, and unspoken money anxiety that erodes trust over time.

The bigger message: avoiding money conversations doesn’t protect your relationship — it weakens it. Intentional, honest communication about spending, expectations, and values is a skill that compounds just like investing does.

Valentine’s Day isn’t really about the dinner reservation. It’s about whether you’re making financial decisions intentionally — together — or reacting to outside pressure.

Here’s a link to the Q&A episode that was posted this morning.

You can submit questions for these episodes by asking them inside of the Rich Habits Network, replying to this email, or sending us a DM on Instagram.

The Rich Habits Podcast is available on Spotify, Apple, iHeart, YouTube, and wherever else you get your content!

Austin’s Callout

Capital is flowing back into large caps and away from credit risk.

U.S. large-cap equities led inflows last week, followed by global equities and consumer cyclicals. Investors are clearly leaning into size, liquidity, and earnings visibility rather than hiding on the sidelines.

At the same time, high-yield bonds saw the largest outflows, even as the broader fixed-income universe still attracted capital. Investors appear comfortable owning duration and quality — but are dialing back exposure to lower-credit-risk assets.

This isn’t panic positioning. It’s selective risk-taking. Money is rotating into equity strength while trimming exposure to the most economically sensitive corners of credit.

For markets, that tells us sentiment remains constructive — but not reckless. When large caps attract steady inflows while junk bonds see pressure, it suggests investors still believe in growth, just with a preference for quality over speculation.

For those of you inside the Rich Habits Network, you know from my portfolio update last week I’ve been buying industrials, materials, infrastructure, and all of the boring names — I’m optimistic these sectors of the equity markets will bode well for 2026.

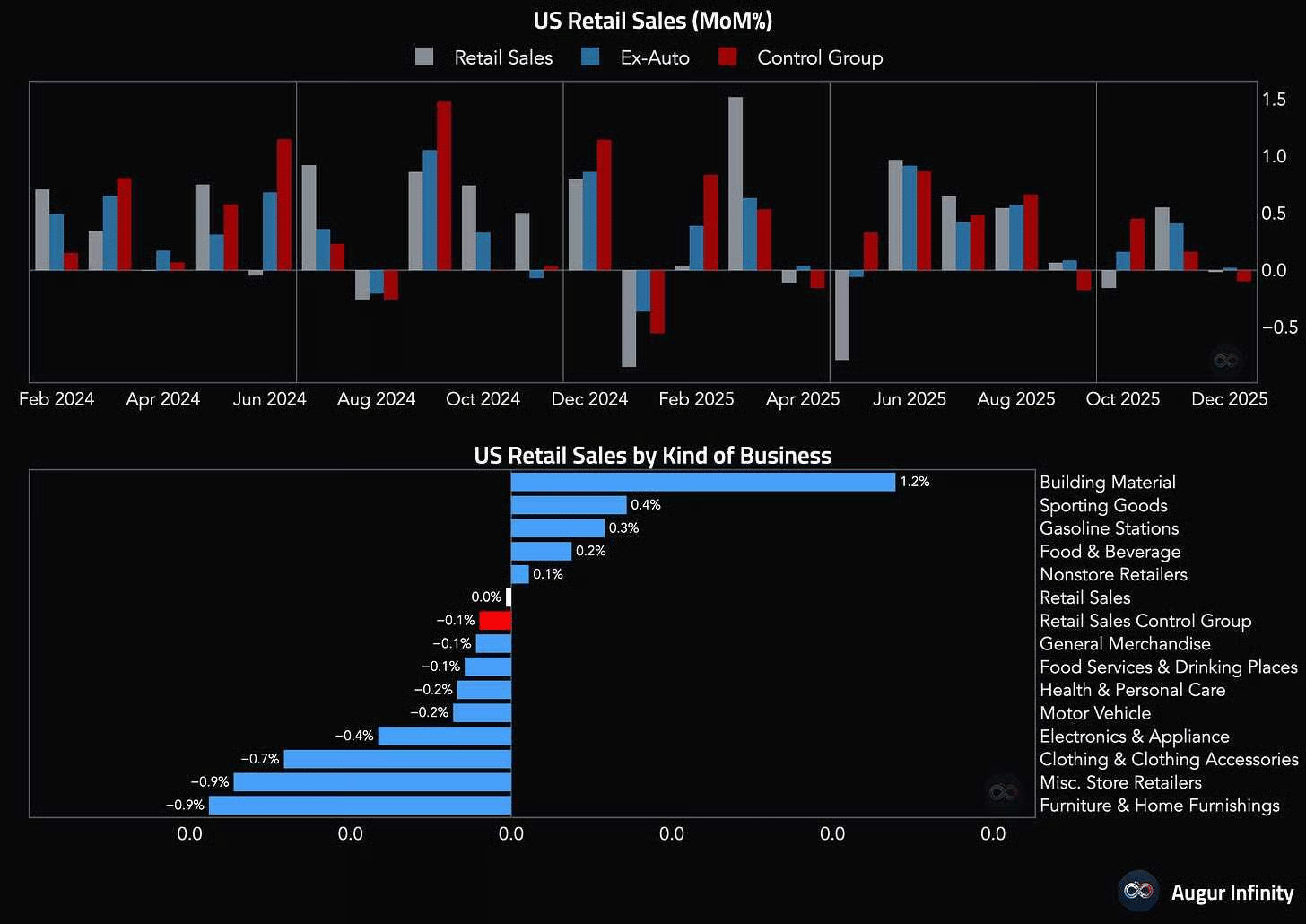

Robert’s Callout

Consumers hit ‘pause’ in December.

Headline retail sales were flat last month, missing expectations for a +0.4% increase. Sales excluding autos were also unchanged, while the control group — the measure used to calculate GDP — declined -0.1%, marking its first drop in three months.

The details suggest cooling momentum rather than collapse. After a strong holiday stretch and solid gains in prior months, December’s report points to a consumer that may be growing more cautious as rates remain elevated and excess savings continue to fade.

Markets care about the control group most, since it feeds directly into GDP calculations. A softer print here could modestly temper first-quarter growth expectations if the trend continues.

For now, this looks more like moderation than weakness. The consumer isn’t accelerating — but they’re not rolling over either. And in this cycle, steady is still supportive for equities.

The Rich Habits Radar

👉 U.S. January budget deficit fell to $95B, revenue beat spending growth.

👉 Bill Ackman’s Pershing Square revealed a new position in Meta.

👉 Bitcoin whales bought 53K coins in a week, most buying since November.

👉 Warner Bros. buyout intensified & Paramount raised its bid.

👉 Lyft stock plunged after earnings disappointed and guidance came in light.

👉 Robinhood topped EPS but revenue fell shy on crypto slump.

👉 Oscar Health missed earnings but reported strong 2026 guidance.

Get Free Resources w/ Our Referral Program!

Share this newsletter with 1 person and you’ll be sent our Financial Planning Workbook. Share it with 2 people and you’ll also be sent our video module explaining how Austin and Robert Analyze New Stocks.

It just takes a few moments — enjoy the resources!

Check ‘Em Out

Below is a list of our featured partners that we’ve vetted — with whom we have a personal relationship. Browse these exclusive offers curated just for you:

Real Estate — Download our FREE Real Estate Hacks Template

Budgeting — Download our FREE Budgeting Template

High-Yield Cash Account — Earn 3.3% on your savings

Public — Trade stocks, options, and crypto

Grifin — Automatically buy stock where you shop

Blossom — Manage and analyze your portfolio

Suriance — Protect your family with term life insurance

Timeshare Exit — Exit an unwanted timeshare

Video Course — Use code “Newsletter” for 15% off

Seeking Alpha — Optimize your portfolio

Credit Card Matrix — Find your next favorite card to swipe

Disclaimer: This is not financial advice or a recommendation for any investment. The content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

Disclosure: This content is sponsored by NEOS Investments. The creator is compensated by NEOS to discuss NEOS ETFs. This content is for informational purposes only, and is not personalized investment, tax, or legal advice, and does not constitute an offer to buy or sell any security. Investing involves risk, including possible loss of principal. Before investing, carefully review the NEOS ETFs prospectus at neosfunds.com.